A blanket mortgage consolidates multiple properties into one loan, simplifying payments and often reducing interest rates, making it ideal for investors managing several real estate assets. Bridge loans provide short-term financing to cover gaps between buying a new property and selling an existing one, offering quick access to capital but typically at higher interest rates. Choosing between a blanket mortgage and a bridge loan depends on your investment strategy, timeline, and the number of properties involved.

Table of Comparison

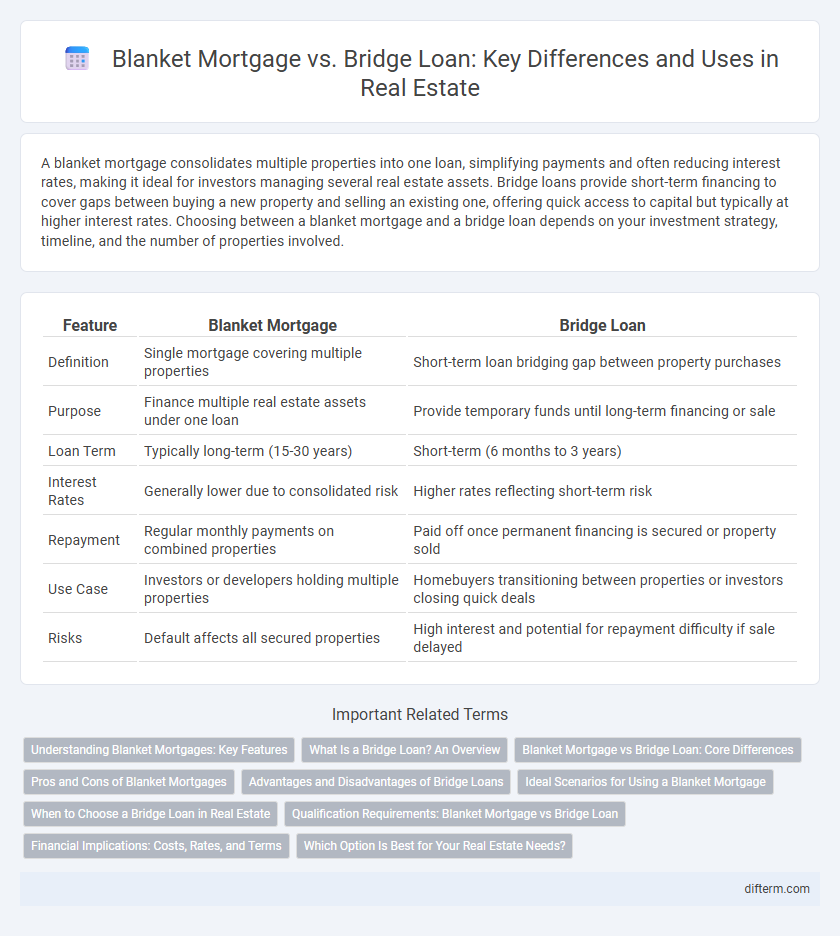

| Feature | Blanket Mortgage | Bridge Loan |

|---|---|---|

| Definition | Single mortgage covering multiple properties | Short-term loan bridging gap between property purchases |

| Purpose | Finance multiple real estate assets under one loan | Provide temporary funds until long-term financing or sale |

| Loan Term | Typically long-term (15-30 years) | Short-term (6 months to 3 years) |

| Interest Rates | Generally lower due to consolidated risk | Higher rates reflecting short-term risk |

| Repayment | Regular monthly payments on combined properties | Paid off once permanent financing is secured or property sold |

| Use Case | Investors or developers holding multiple properties | Homebuyers transitioning between properties or investors closing quick deals |

| Risks | Default affects all secured properties | High interest and potential for repayment difficulty if sale delayed |

Understanding Blanket Mortgages: Key Features

Blanket mortgages bundle multiple properties under a single loan, simplifying management and potentially lowering overall interest rates compared to individual loans. These loans feature a release clause, allowing borrowers to sell one property and pay off its portion of the mortgage without affecting the others. Ideal for real estate investors and developers, blanket mortgages provide financial flexibility when acquiring or reselling multiple properties simultaneously.

What Is a Bridge Loan? An Overview

A bridge loan is a short-term financing option that provides immediate capital to homebuyers or investors to cover the gap between purchasing a new property and selling an existing one. Typically lasting from six months to a year, this loan is secured by the borrower's current home and offers quick access to funds to facilitate a seamless property transition. Bridge loans usually have higher interest rates compared to traditional mortgages due to their short-term nature and increased risk for lenders.

Blanket Mortgage vs Bridge Loan: Core Differences

Blanket mortgages cover multiple properties under a single loan, providing flexibility for investors managing several real estate assets, while bridge loans serve as short-term financing to bridge the gap between purchasing a new property and selling an existing one. Blanket mortgages typically feature longer terms and are ideal for portfolio consolidation, whereas bridge loans have higher interest rates and shorter durations, often 6 to 12 months. Understanding the core differences in loan structure, purpose, and repayment timelines helps real estate investors choose the most suitable financing option for property acquisition or portfolio management.

Pros and Cons of Blanket Mortgages

Blanket mortgages allow borrowers to finance multiple properties under a single loan, offering simplified management and potential cost savings on interest. They provide flexibility in selling individual properties without paying off the entire loan, but typically come with higher risk due to cross-collateralization, which can complicate refinancing or selling. Borrowers must carefully assess potential challenges like balloon payments and lender restrictions before choosing a blanket mortgage.

Advantages and Disadvantages of Bridge Loans

Bridge loans offer quick financing to bridge the gap between buying a new property and selling an existing one, enabling homeowners to secure a new home without waiting for their current property sale. They provide flexibility and immediate cash flow but come with higher interest rates and short repayment terms, increasing financial risk if the existing home doesn't sell quickly. Borrowers should carefully consider these factors, as failure to sell within the loan period can lead to significant financial strain.

Ideal Scenarios for Using a Blanket Mortgage

Blanket mortgages are ideal for real estate investors or developers who own multiple properties and want to consolidate financing under a single loan, reducing complexity and potentially lowering interest rates. They are particularly suitable when purchasing multiple units simultaneously or when planning phased developments that require flexible repayment terms. This financing strategy allows for the release of individual properties from the mortgage as they are sold, providing liquidity while maintaining overall control of the portfolio.

When to Choose a Bridge Loan in Real Estate

A bridge loan is ideal for real estate buyers who need short-term financing to purchase a new property before selling their current home, providing quick access to funds and minimizing the risk of missing out on a desirable property. This type of loan is typically chosen when timing is critical, and the buyer expects to repay the loan promptly from the proceeds of the home sale. Bridge loans often have higher interest rates but offer the flexibility and speed necessary for seamless property transitions in competitive markets.

Qualification Requirements: Blanket Mortgage vs Bridge Loan

Qualification for a blanket mortgage typically requires strong creditworthiness, substantial property equity, and the ability to cover multiple properties under one loan, making it suitable for investors managing several assets. Bridge loans demand proof of imminent property sales, steady income, and sufficient equity in the current home to secure short-term financing for purchasing a new property before selling the existing one. Lenders evaluate debt-to-income ratios and asset liquidity rigorously for both loan types to ensure borrowers can manage complex financial obligations.

Financial Implications: Costs, Rates, and Terms

Blanket mortgages consolidate multiple properties under a single loan, often resulting in lower interest rates and extended repayment terms compared to bridge loans, which are short-term and typically carry higher rates due to their risk profile. Bridge loans require immediate repayment or refinancing within months, leading to increased costs such as origination fees and higher interest expenses, while blanket mortgages offer more predictable, long-term financial commitments. Borrowers should evaluate cash flow impacts, loan-to-value ratios, and potential prepayment penalties associated with both options to determine the most cost-effective financing strategy for their real estate portfolio.

Which Option Is Best for Your Real Estate Needs?

A blanket mortgage is ideal for investors seeking to finance multiple properties under a single loan, offering simplified management and often lower interest rates, whereas a bridge loan suits homeowners needing short-term financing to purchase a new home before selling their current property. Evaluating factors such as loan duration, interest rates, repayment terms, and the timing of real estate transactions helps determine the most suitable option. Prioritizing your financial goals and transaction timeline ensures choosing between a blanket mortgage and bridge loan aligns with your real estate investment or home buying strategy.

Blanket Mortgage vs Bridge Loan Infographic

difterm.com

difterm.com