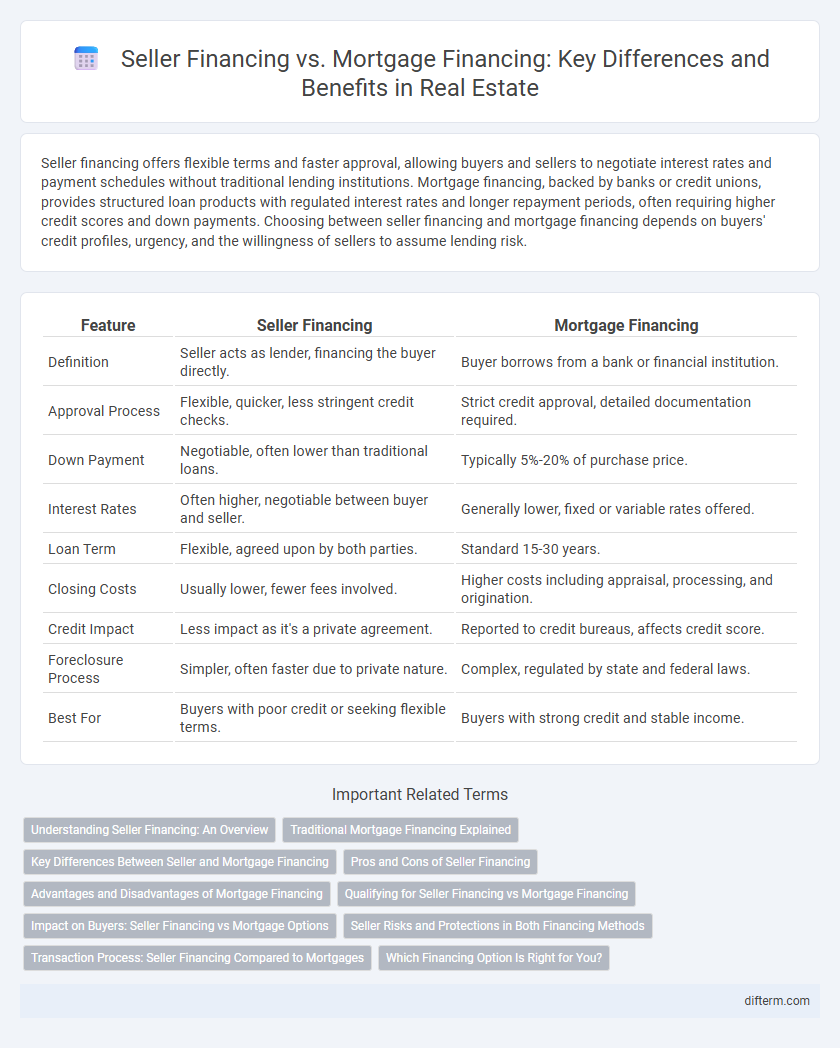

Seller financing offers flexible terms and faster approval, allowing buyers and sellers to negotiate interest rates and payment schedules without traditional lending institutions. Mortgage financing, backed by banks or credit unions, provides structured loan products with regulated interest rates and longer repayment periods, often requiring higher credit scores and down payments. Choosing between seller financing and mortgage financing depends on buyers' credit profiles, urgency, and the willingness of sellers to assume lending risk.

Table of Comparison

| Feature | Seller Financing | Mortgage Financing |

|---|---|---|

| Definition | Seller acts as lender, financing the buyer directly. | Buyer borrows from a bank or financial institution. |

| Approval Process | Flexible, quicker, less stringent credit checks. | Strict credit approval, detailed documentation required. |

| Down Payment | Negotiable, often lower than traditional loans. | Typically 5%-20% of purchase price. |

| Interest Rates | Often higher, negotiable between buyer and seller. | Generally lower, fixed or variable rates offered. |

| Loan Term | Flexible, agreed upon by both parties. | Standard 15-30 years. |

| Closing Costs | Usually lower, fewer fees involved. | Higher costs including appraisal, processing, and origination. |

| Credit Impact | Less impact as it's a private agreement. | Reported to credit bureaus, affects credit score. |

| Foreclosure Process | Simpler, often faster due to private nature. | Complex, regulated by state and federal laws. |

| Best For | Buyers with poor credit or seeking flexible terms. | Buyers with strong credit and stable income. |

Understanding Seller Financing: An Overview

Seller financing offers a flexible alternative to traditional mortgage financing by allowing buyers to make payments directly to the seller instead of a bank or lender. This method often benefits buyers with less-than-perfect credit or those seeking quicker closing processes, while sellers can attract more potential buyers and negotiate terms. Key features include adjustable interest rates, shorter loan durations, and customized payment schedules tailored to both parties' needs.

Traditional Mortgage Financing Explained

Traditional mortgage financing involves a borrower obtaining a loan from a financial institution to purchase property, typically requiring a credit check, steady income verification, and a down payment ranging from 3% to 20%. Mortgage loans usually feature fixed or adjustable interest rates, with repayment terms commonly spanning 15 to 30 years, allowing buyers to spread out the cost of a home over time. Lenders retain legal claim to the property through a mortgage lien until the loan is fully repaid, providing security and benefits such as competitive interest rates and access to larger loan amounts.

Key Differences Between Seller and Mortgage Financing

Seller financing allows buyers to purchase property directly from the seller through a private loan agreement, bypassing traditional banks and easing qualification requirements. Mortgage financing involves obtaining a loan from a financial institution, usually with stricter credit checks, standard interest rates, and longer repayment terms. Key differences include down payment flexibility, negotiation options, and the potential for faster transaction closing with seller financing compared to the structured process of mortgage loans.

Pros and Cons of Seller Financing

Seller financing offers flexible qualification criteria and faster closing times, making it ideal for buyers with credit challenges or those seeking a streamlined purchase process. However, it typically comes with higher interest rates and shorter repayment terms, posing potential financial strain for borrowers. Sellers also assume the risk of buyer default and may face challenges in managing the loan or reselling the property if issues arise.

Advantages and Disadvantages of Mortgage Financing

Mortgage financing offers the advantage of lower interest rates compared to seller financing, making it more cost-effective for buyers over the loan term. It provides structured repayment plans and the opportunity to build credit history, which can improve future borrowing potential. However, strict qualification criteria and lengthy approval processes may limit access, and failure to meet payments can lead to foreclosure.

Qualifying for Seller Financing vs Mortgage Financing

Qualifying for seller financing typically involves fewer credit requirements and more flexible approval processes compared to mortgage financing, which heavily relies on credit scores, income verification, and debt-to-income ratios. Seller financing allows buyers to negotiate terms directly with the property owner, often benefiting those with lower creditworthiness or unique financial situations. Mortgage financing requires strict documentation and underwriting from lenders, making it more challenging for buyers without traditional financial profiles to secure approval.

Impact on Buyers: Seller Financing vs Mortgage Options

Seller financing offers buyers flexible qualification criteria and faster closing times, making it ideal for those with less-than-perfect credit or limited access to traditional loans. Mortgage financing provides lower interest rates and longer repayment terms, resulting in more affordable monthly payments and greater financial stability over time. Buyers must weigh immediate accessibility against long-term cost efficiency when choosing between seller financing and conventional mortgage options.

Seller Risks and Protections in Both Financing Methods

Seller financing exposes the seller to greater risk due to the buyer's potential default and limited legal protections compared to mortgage financing, where a lender holds a lien on the property. In mortgage financing, sellers receive full payment upfront, reducing financial risk, while seller financing relies on installment payments that can be disrupted by buyer insolvency. Implementing thorough credit checks, promissory notes, and security agreements strengthens seller protections in seller financing arrangements.

Transaction Process: Seller Financing Compared to Mortgages

Seller financing streamlines the transaction process by enabling direct negotiation between buyer and seller, eliminating the need for traditional bank underwriting and lengthy approval times. Mortgage financing requires extensive documentation, credit checks, and lender approval, often extending the closing timeline significantly. Seller financing offers greater flexibility in terms and faster closing, appealing to buyers with credit challenges or those seeking a quicker purchase.

Which Financing Option Is Right for You?

Seller financing offers flexible terms and faster closings, ideal for buyers with less-than-perfect credit or those seeking personalized payment plans. Mortgage financing typically provides lower interest rates and tax benefits, best suited for buyers with strong credit profiles and stable incomes. Evaluating your financial situation, credit score, and long-term goals will help determine the most suitable financing option for your real estate purchase.

Seller Financing vs Mortgage Financing Infographic

difterm.com

difterm.com