Cooperatives involve ownership of shares in a corporation that owns the entire building, granting shareholders the right to occupy a unit, while condominiums offer direct ownership of individual units and a share of common areas. Cooperative ownership often requires board approval for buyers and may impose stricter rules, making it less flexible compared to condominiums, which typically allow easier resale and more autonomy. In real estate, choosing between a cooperative and a condominium depends on the buyer's preference for control, financing options, and lifestyle considerations.

Table of Comparison

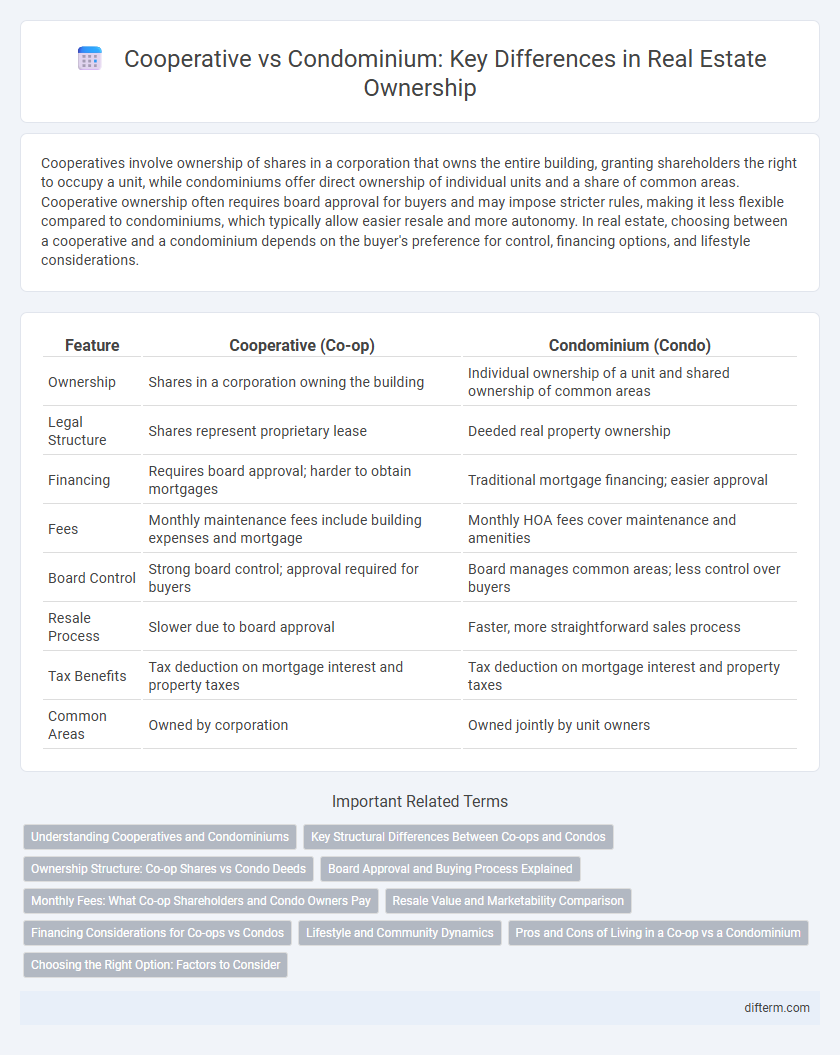

| Feature | Cooperative (Co-op) | Condominium (Condo) |

|---|---|---|

| Ownership | Shares in a corporation owning the building | Individual ownership of a unit and shared ownership of common areas |

| Legal Structure | Shares represent proprietary lease | Deeded real property ownership |

| Financing | Requires board approval; harder to obtain mortgages | Traditional mortgage financing; easier approval |

| Fees | Monthly maintenance fees include building expenses and mortgage | Monthly HOA fees cover maintenance and amenities |

| Board Control | Strong board control; approval required for buyers | Board manages common areas; less control over buyers |

| Resale Process | Slower due to board approval | Faster, more straightforward sales process |

| Tax Benefits | Tax deduction on mortgage interest and property taxes | Tax deduction on mortgage interest and property taxes |

| Common Areas | Owned by corporation | Owned jointly by unit owners |

Understanding Cooperatives and Condominiums

Cooperatives are investment entities where residents own shares representing their units, giving them voting rights in building management, while condominiums offer direct ownership of individual units with shared interest in common areas. In cooperatives, board approval is required for sales and sublets, often limiting flexibility, whereas condominiums allow free transfer of ownership similar to single-family homes. Understanding these differences is crucial for real estate buyers seeking control, financing options, and long-term residency stability.

Key Structural Differences Between Co-ops and Condos

Cooperative buildings are owned by a corporation where residents purchase shares representing their unit, while condominiums involve individual ownership of units with shared common areas. Co-op boards typically have more control over residents and approval processes, whereas condo associations mainly enforce community rules. Financing options also differ, as co-ops often require board approval for loans, whereas condos generally allow traditional mortgage financing.

Ownership Structure: Co-op Shares vs Condo Deeds

Cooperative ownership involves purchasing shares in a corporation that owns the entire building, granting shareholders the right to occupy a specific unit through a proprietary lease. Condominium ownership provides an individual deed to a specific unit, along with a proportional interest in common elements, allowing for direct property ownership. The key distinction lies in the legal title structure, where co-op shareholders hold shares representing ownership, while condo owners hold real property titles.

Board Approval and Buying Process Explained

In real estate transactions, cooperative apartments require board approval where the board evaluates the buyer's financial stability and interview performance, making the purchase process more rigorous and time-consuming. Condominium purchases typically involve fewer restrictions, with buyers primarily undergoing a standard credit and background check, expediting closing timelines. Understanding these differences in board involvement and approval criteria is crucial for prospective buyers when choosing between cooperatives and condominiums.

Monthly Fees: What Co-op Shareholders and Condo Owners Pay

Co-op shareholders typically pay monthly maintenance fees that cover building mortgage, property taxes, and underlying expenses, which can result in higher costs compared to condo fees. Condo owners pay monthly HOA (Homeowners Association) fees primarily for common area maintenance, amenities, and reserve funds, often lower than co-op fees but variable based on the building's services. The difference in fee structure reflects ownership type, with co-op fees including building-level financial obligations and condo fees focusing on communal upkeep.

Resale Value and Marketability Comparison

Condominiums typically offer higher resale value and greater marketability than cooperatives due to clearer ownership structures and easier financing options. Cooperative units involve purchasing shares in a corporation, which can complicate sales and deter buyers, impacting liquidity and pricing. Market trends show condominiums attract a broader pool of buyers, making them more competitive and potentially commanding premium prices over cooperatives.

Financing Considerations for Co-ops vs Condos

Financing a cooperative (co-op) often requires a larger down payment, typically 20-30%, and involves board approval, which can lengthen the loan process compared to condominiums (condos). Condo buyers can access a wider range of mortgage options, including FHA and VA loans, due to individual unit ownership, whereas co-ops are structured as shares in a corporation, limiting some financing opportunities. Lenders view condos as lower risk because owners hold title to their units, while co-op financing depends on the building's financial health and shareholder agreements, impacting loan terms and availability.

Lifestyle and Community Dynamics

Cooperatives foster a tight-knit community through shared ownership, promoting collective decision-making and long-term stability among residents. Condominiums offer more individual ownership freedom, attracting diverse lifestyles with varied investment potential and greater autonomy over property modifications. The choice between cooperative and condominium living often hinges on preference for communal involvement versus personal control within urban real estate markets.

Pros and Cons of Living in a Co-op vs a Condominium

Living in a co-op typically offers lower purchase prices and a stronger sense of community control through board approvals, but it often comes with strict residency rules and limited financing options. Condominiums provide more autonomy and easier access to mortgages, while allowing owners to freely sell or rent their units, though maintenance fees can be higher and decision-making may be less centralized. Evaluating factors like financial flexibility, governance structure, and lifestyle preferences is crucial when choosing between a co-op and a condo.

Choosing the Right Option: Factors to Consider

When choosing between a cooperative and a condominium, consider factors such as ownership structure, monthly fees, and approval processes. Cooperatives often require board approval and have stricter resale rules, while condominiums provide individual ownership with more flexibility. Evaluate your financial situation, lifestyle preferences, and long-term investment goals to determine the most suitable housing option.

Cooperative vs Condominium Infographic

difterm.com

difterm.com