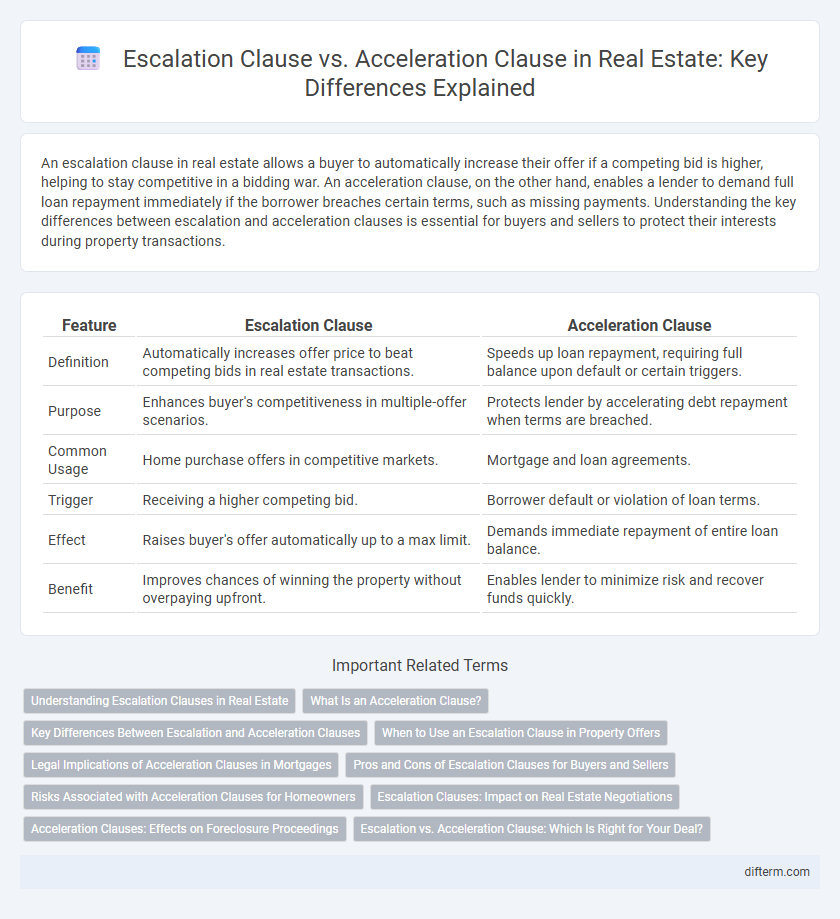

An escalation clause in real estate allows a buyer to automatically increase their offer if a competing bid is higher, helping to stay competitive in a bidding war. An acceleration clause, on the other hand, enables a lender to demand full loan repayment immediately if the borrower breaches certain terms, such as missing payments. Understanding the key differences between escalation and acceleration clauses is essential for buyers and sellers to protect their interests during property transactions.

Table of Comparison

| Feature | Escalation Clause | Acceleration Clause |

|---|---|---|

| Definition | Automatically increases offer price to beat competing bids in real estate transactions. | Speeds up loan repayment, requiring full balance upon default or certain triggers. |

| Purpose | Enhances buyer's competitiveness in multiple-offer scenarios. | Protects lender by accelerating debt repayment when terms are breached. |

| Common Usage | Home purchase offers in competitive markets. | Mortgage and loan agreements. |

| Trigger | Receiving a higher competing bid. | Borrower default or violation of loan terms. |

| Effect | Raises buyer's offer automatically up to a max limit. | Demands immediate repayment of entire loan balance. |

| Benefit | Improves chances of winning the property without overpaying upfront. | Enables lender to minimize risk and recover funds quickly. |

Understanding Escalation Clauses in Real Estate

Escalation clauses in real estate contracts automatically increase an offer price when competing bids surpass the initial offer, helping buyers remain competitive in hot housing markets. These clauses specify a maximum price cap and incremental increases, providing a clear mechanism for bid adjustment without renegotiation. Understanding escalation clauses is crucial for both buyers and sellers to ensure transparency and fairness during multiple-offer scenarios.

What Is an Acceleration Clause?

An acceleration clause in real estate mortgage agreements allows the lender to demand full repayment of the loan immediately if the borrower defaults or violates specific terms. This clause protects lenders by enabling swift action to recover the outstanding balance without waiting for the scheduled payment plan. It differs from an escalation clause, which adjusts payment amounts based on market conditions or other factors.

Key Differences Between Escalation and Acceleration Clauses

An escalation clause in real estate automatically increases the offer price when competing bids exceed the original price, ensuring a buyer stays competitive up to a set limit. An acceleration clause, typically found in mortgage contracts, requires the borrower to pay the entire remaining loan balance immediately if they default on payments. The key difference lies in their function: escalation clauses adjust purchase price based on market competition, while acceleration clauses enforce loan repayment terms upon breach.

When to Use an Escalation Clause in Property Offers

An escalation clause is strategically used in competitive real estate markets to automatically increase a buyer's offer price when a higher competing bid is received, helping secure a property without overpaying excessively. This clause is ideal when multiple offers are expected, allowing buyers to stay ahead without constant renegotiation. Unlike acceleration clauses, which speed up loan payments upon default, escalation clauses specifically address offer competitiveness in property bidding.

Legal Implications of Acceleration Clauses in Mortgages

Acceleration clauses in mortgages grant lenders the legal right to demand full loan repayment upon a borrower's default, significantly impacting foreclosure proceedings and borrower obligations. These clauses legally accelerate the loan maturity date, enabling lenders to initiate foreclosure without waiting for the original payment schedule to conclude, thereby increasing the risk of rapid asset loss for the borrower. Understanding the enforceability and state-specific regulations governing acceleration clauses is critical for both mortgage holders and lenders to navigate potential legal disputes effectively.

Pros and Cons of Escalation Clauses for Buyers and Sellers

Escalation clauses benefit buyers by automatically increasing their offer to outbid competitors up to a set limit, enhancing the chance of securing a property without overpaying initially, though this can complicate negotiations if the seller receives multiple escalated bids. Sellers gain by potentially achieving a higher sale price with minimal effort, but they risk prolonged negotiations and possible buyer withdrawal if escalation terms cause confusion or distrust. Both parties must carefully draft and understand escalation clauses to balance competitive bidding with clear, fair transaction terms.

Risks Associated with Acceleration Clauses for Homeowners

Acceleration clauses in real estate loans can pose significant risks for homeowners, as they allow lenders to demand full repayment of the mortgage immediately upon default. This sudden financial burden increases the likelihood of foreclosure, severely impacting credit scores and homeownership stability. Unlike escalation clauses that adjust payments under specific conditions, acceleration clauses trigger instant repayment, often leaving homeowners with little time to resolve payment issues.

Escalation Clauses: Impact on Real Estate Negotiations

Escalation clauses in real estate contracts automatically increase a buyer's offer if competing bids surpass the initial price, enhancing the buyer's chances in competitive markets. These clauses expedite negotiations by setting predefined increments, minimizing bidding wars and promoting quicker agreement on price. Sellers benefit from potential higher sale prices while buyers gain an advantage without the need for constant renegotiation.

Acceleration Clauses: Effects on Foreclosure Proceedings

Acceleration clauses trigger the immediate repayment of the entire loan balance upon default, significantly impacting foreclosure proceedings by expediting the lender's ability to initiate legal action. This clause reduces the borrower's opportunity to cure the default and forces faster resolution, often leading to earlier foreclosure sales. Courts typically uphold acceleration clauses as enforceable, emphasizing their role in protecting the lender's interests and mitigating prolonged default risks.

Escalation vs. Acceleration Clause: Which Is Right for Your Deal?

Escalation clauses automatically increase a buyer's offer in competitive real estate markets by a predefined increment up to a maximum price, ensuring the bid remains competitive without overpaying initially. Acceleration clauses, commonly found in mortgage agreements, demand immediate payment of the remaining loan balance if the borrower defaults, protecting lenders from prolonged non-payment. Choosing between escalation and acceleration clauses depends on whether the priority is to secure a property in bidding wars or to manage risk and loan repayment terms effectively.

escalation clause vs acceleration clause Infographic

difterm.com

difterm.com