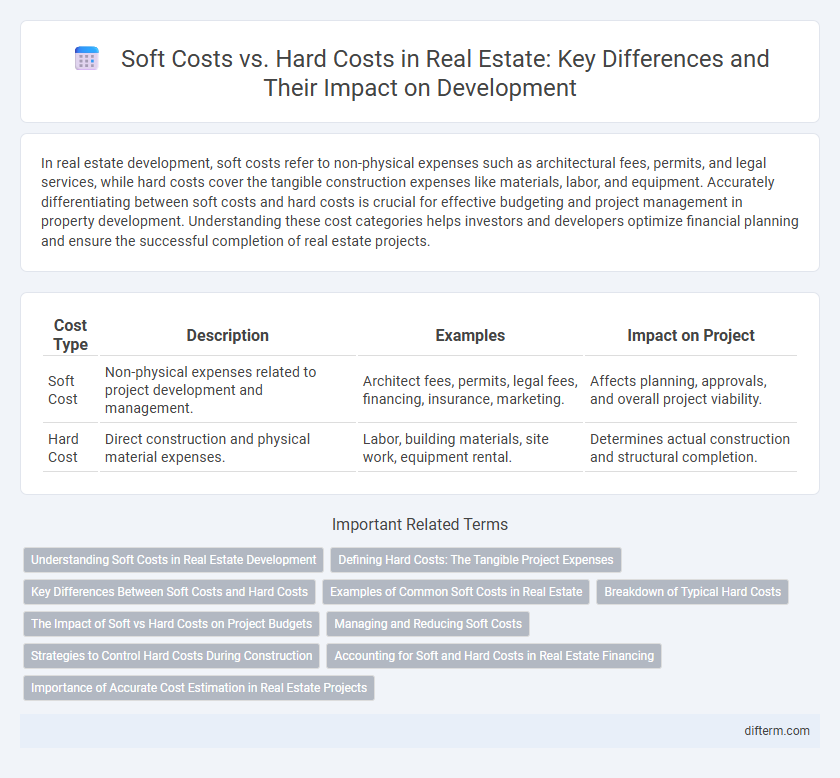

In real estate development, soft costs refer to non-physical expenses such as architectural fees, permits, and legal services, while hard costs cover the tangible construction expenses like materials, labor, and equipment. Accurately differentiating between soft costs and hard costs is crucial for effective budgeting and project management in property development. Understanding these cost categories helps investors and developers optimize financial planning and ensure the successful completion of real estate projects.

Table of Comparison

| Cost Type | Description | Examples | Impact on Project |

|---|---|---|---|

| Soft Cost | Non-physical expenses related to project development and management. | Architect fees, permits, legal fees, financing, insurance, marketing. | Affects planning, approvals, and overall project viability. |

| Hard Cost | Direct construction and physical material expenses. | Labor, building materials, site work, equipment rental. | Determines actual construction and structural completion. |

Understanding Soft Costs in Real Estate Development

Soft costs in real estate development include expenses not directly tied to physical construction, such as architectural fees, permits, legal services, and financing charges. These costs typically represent 20-30% of the total project budget and are crucial for planning, design, and regulatory compliance. Effectively managing soft costs ensures smoother project execution and more accurate financial forecasting.

Defining Hard Costs: The Tangible Project Expenses

Hard costs in real estate development refer to the tangible expenses directly related to the physical construction of a property, including materials, labor, and equipment. These costs encompass concrete, steel, roofing, electrical wiring, and plumbing installations, as well as contractor fees and site work. Accurately estimating hard costs is crucial for budgeting, project management, and securing financing in real estate projects.

Key Differences Between Soft Costs and Hard Costs

Hard costs in real estate development refer to the tangible, physical expenses such as construction materials, labor, and equipment needed to build a property. Soft costs encompass non-physical expenses like architectural fees, permits, legal services, and financing charges that support project completion without direct involvement in construction. Understanding the distinction between hard costs and soft costs is crucial for accurate budgeting and managing overall project financials.

Examples of Common Soft Costs in Real Estate

Common soft costs in real estate include architectural and engineering fees, permits and inspection charges, legal and consulting fees, financing and loan interest expenses, insurance premiums, and marketing or leasing costs. Unlike hard costs, which are directly tied to physical construction like materials and labor, soft costs cover indirect expenses essential for project planning, compliance, and completion. Accurately estimating these soft costs is critical for budgeting and financial planning in property development projects.

Breakdown of Typical Hard Costs

Typical hard costs in real estate development include concrete, steel, wood framing, roofing, plumbing, electrical systems, HVAC installations, and exterior finishes such as windows and siding. These expenses directly relate to the physical construction and are usually categorized under building materials, labor, and equipment rental. Hard costs typically account for 70% to 85% of the total project budget, reflecting their significant impact on overall development expenditures.

The Impact of Soft vs Hard Costs on Project Budgets

Soft costs, including architectural fees, permits, and project management, often represent 20-30% of a real estate development budget, significantly influencing financial planning and risk management. Hard costs, covering materials and labor for construction, typically account for 70-80% of total expenses and directly affect the project's timeline and quality. Balancing soft and hard costs is essential for accurate budget forecasting and ensuring project profitability in real estate development.

Managing and Reducing Soft Costs

Managing and reducing soft costs in real estate projects involves thorough budget analysis, streamlined project management, and negotiation with consultants to minimize expenses like legal fees, permits, and architectural services. Implementing efficient communication tools and adopting technology-driven solutions can reduce delays and lower overhead related to soft costs. Leveraging competitive bidding and maintaining transparent cost tracking ensures better control over soft cost expenditures, maximizing project profitability.

Strategies to Control Hard Costs During Construction

Effective strategies to control hard costs during construction include detailed budgeting, rigorous contractor selection, and regular on-site inspections to prevent cost overruns. Implementing value engineering optimizes material and labor expenses without compromising quality. Leveraging technology such as construction management software enhances tracking and accountability, ensuring projects stay within budget and schedule.

Accounting for Soft and Hard Costs in Real Estate Financing

Soft costs in real estate financing encompass non-physical expenses such as architectural fees, permits, legal services, and financing costs, which must be accurately categorized in accounting to ensure proper budgeting and tax treatment. Hard costs refer to tangible construction expenses like materials, labor, and equipment, requiring detailed tracking for cash flow management and loan disbursement compliance. Differentiating and systematically accounting for soft and hard costs improves financial reporting accuracy and aids lenders in evaluating project viability and risk.

Importance of Accurate Cost Estimation in Real Estate Projects

Accurate cost estimation in real estate projects is crucial for effectively managing both soft costs, such as architectural fees and permits, and hard costs like construction materials and labor. Precise estimation prevents budget overruns, ensures sufficient financing, and supports informed decision-making throughout the project lifecycle. Properly balancing these costs enhances project feasibility, timeline adherence, and overall investment profitability.

Soft Cost vs Hard Cost Infographic

difterm.com

difterm.com