An escalation clause automatically increases a buyer's offer if competing bids arise, ensuring they remain competitive in a bidding war, while an appraisal gap clause addresses situations where a property appraises for less than the purchase price by requiring the buyer to cover the difference. Both clauses protect buyers and sellers during negotiations but serve distinct purposes--escalation clauses focus on outbidding rivals, whereas appraisal gap clauses manage financing risks related to property valuation. Understanding the differences helps buyers craft stronger offers and sellers avoid appraisal-related contingencies that could jeopardize the sale.

Table of Comparison

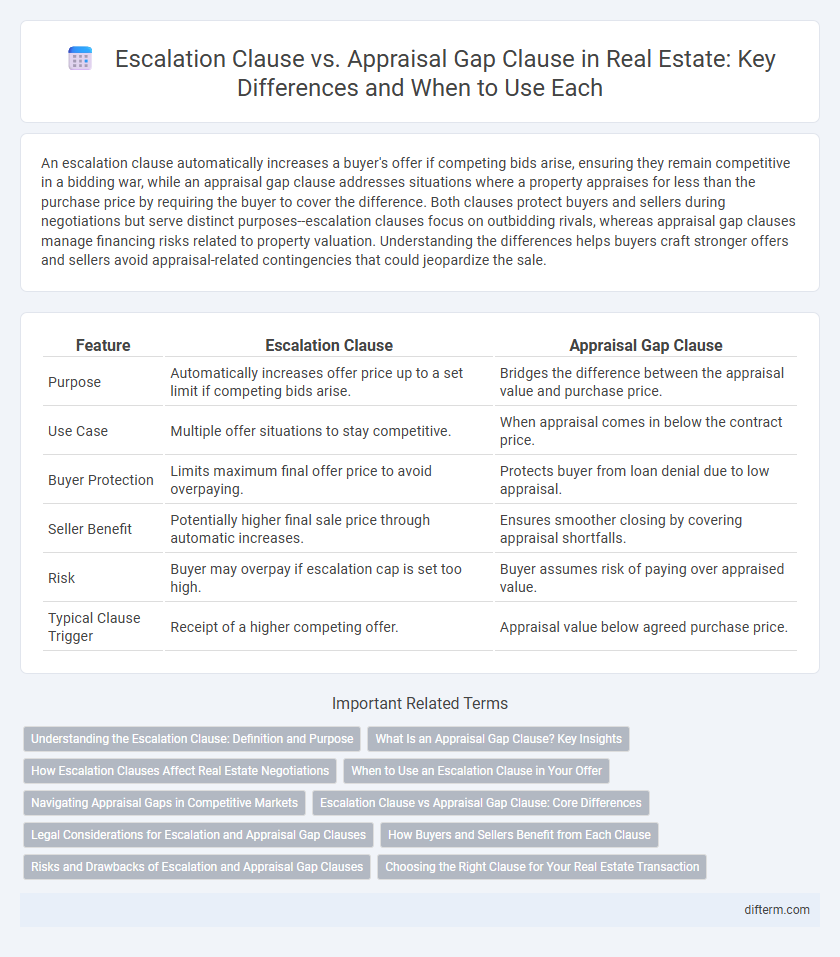

| Feature | Escalation Clause | Appraisal Gap Clause |

|---|---|---|

| Purpose | Automatically increases offer price up to a set limit if competing bids arise. | Bridges the difference between the appraisal value and purchase price. |

| Use Case | Multiple offer situations to stay competitive. | When appraisal comes in below the contract price. |

| Buyer Protection | Limits maximum final offer price to avoid overpaying. | Protects buyer from loan denial due to low appraisal. |

| Seller Benefit | Potentially higher final sale price through automatic increases. | Ensures smoother closing by covering appraisal shortfalls. |

| Risk | Buyer may overpay if escalation cap is set too high. | Buyer assumes risk of paying over appraised value. |

| Typical Clause Trigger | Receipt of a higher competing offer. | Appraisal value below agreed purchase price. |

Understanding the Escalation Clause: Definition and Purpose

An escalation clause in real estate is a contractual provision that automatically increases a buyer's offer if competing bids exceed the initial amount, ensuring the buyer remains competitive without overpaying from the start. Its primary purpose is to surpass higher offers up to a predetermined cap, streamlining negotiations and minimizing bidding wars. This tool is especially valuable in hot housing markets where multiple offers are common, providing clarity and confidence to both buyers and sellers.

What Is an Appraisal Gap Clause? Key Insights

An Appraisal Gap Clause guarantees the buyer will cover the difference between the appraised value and the agreed purchase price, ensuring the deal progresses despite low appraisals. This clause is crucial in competitive real estate markets where appraisal values often lag behind rapidly rising prices. It protects sellers from losing offers due to appraisal shortfalls and offers buyers a strategic advantage in bidding wars.

How Escalation Clauses Affect Real Estate Negotiations

Escalation clauses significantly impact real estate negotiations by automatically increasing a buyer's offer when competing bids exceed the initial price, ensuring stronger positioning in multiple-offer situations. These clauses provide sellers with higher sale prices while giving buyers a systematic method to compete without overpaying initially. Unlike appraisal gap clauses, escalation clauses adjust bids based on market competition rather than appraised value shortfalls, influencing negotiation dynamics and contract terms.

When to Use an Escalation Clause in Your Offer

Use an escalation clause in your real estate offer when you anticipate multiple competitive bids and want to automatically increase your offer up to a predetermined limit without constant renegotiation. This strategy is ideal in highly sought-after markets where bidding wars are common, allowing buyers to stay ahead without overpaying. An escalation clause protects buyers by capping the maximum price they're willing to pay, providing a structured way to secure the property amid rising offers.

Navigating Appraisal Gaps in Competitive Markets

Escalation clauses automatically increase a buyer's offer incrementally to stay competitive when higher bids emerge, providing a clear ceiling for pricing adjustments. Appraisal gap clauses specifically address the difference between the appraised value and the purchase price, requiring buyers to cover the shortfall to satisfy the lender and complete the transaction. In competitive real estate markets, understanding these clauses helps buyers navigate appraisal gaps effectively, ensuring stronger offers while managing financial risks.

Escalation Clause vs Appraisal Gap Clause: Core Differences

An escalation clause automatically increases a buyer's offer incrementally above competing bids up to a predefined limit, securing competitive advantage in multiple-offer situations. In contrast, an appraisal gap clause requires the buyer to cover the difference if the appraisal comes in below the offer price, ensuring the deal proceeds despite low appraisals. The core difference lies in escalation clauses addressing competitive bid increases, while appraisal gap clauses address valuation shortfalls during the financing process.

Legal Considerations for Escalation and Appraisal Gap Clauses

Escalation clauses and appraisal gap clauses carry distinct legal considerations, primarily revolving around contract enforceability and risk allocation. Escalation clauses must clearly specify the maximum purchase price limit and incremental increases to avoid ambiguity and potential disputes, while appraisal gap clauses require careful drafting to define buyer obligations if the appraisal falls short of the purchase price, protecting both parties from unexpected financial burdens. Legal scrutiny often emphasizes transparency and fair negotiation to ensure these clauses comply with local real estate laws and are not perceived as unconscionable or predatory.

How Buyers and Sellers Benefit from Each Clause

Escalation clauses benefit buyers by automatically increasing their offer up to a specified limit in competitive markets, ensuring they remain the highest bidder without overpaying. Sellers gain from these clauses by receiving potentially higher offers, reducing the risk of accepting a low initial bid. Appraisal gap clauses protect sellers by guaranteeing they receive a minimum sale price despite appraisal shortfalls, while buyers benefit by making their offers more attractive without immediate financial risk of covering appraisal gaps.

Risks and Drawbacks of Escalation and Appraisal Gap Clauses

Escalation clauses can lead to overpaying for a property if the market value does not justify the increased offer, potentially resulting in buyer's remorse or appraisal issues. Appraisal gap clauses pose a risk when the appraisal comes in significantly lower than the offer price, forcing buyers to cover the difference out-of-pocket, which may strain finances or jeopardize loan approval. Both clauses introduce financial uncertainty and can complicate negotiations, contributing to potential deal failures or legal disputes if not carefully structured.

Choosing the Right Clause for Your Real Estate Transaction

Choosing the right clause for your real estate transaction depends on market conditions and your financial flexibility. An escalation clause automatically increases your offer up to a set limit when competing bids arise, ensuring you stay competitive without overpaying, while an appraisal gap clause covers the difference if the appraisal comes in below the purchase price, protecting your bid's viability. Understanding the local market trends and appraisal risks helps determine whether prioritizing escalation protection or appraisal coverage aligns best with your purchasing strategy.

Escalation Clause vs Appraisal Gap Clause Infographic

difterm.com

difterm.com