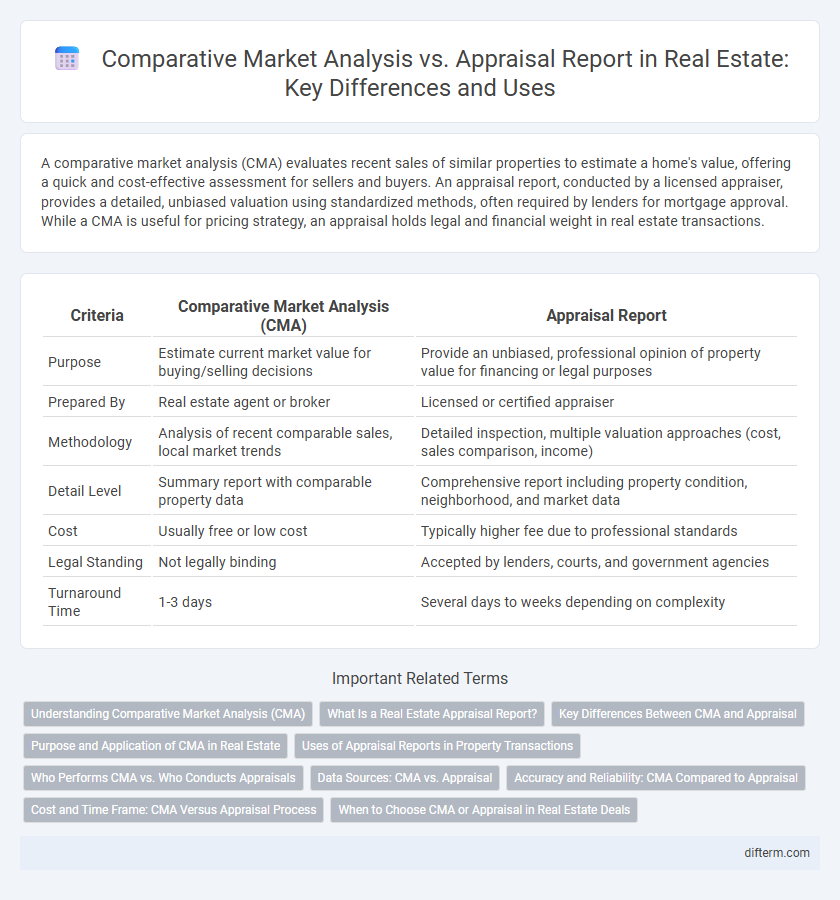

A comparative market analysis (CMA) evaluates recent sales of similar properties to estimate a home's value, offering a quick and cost-effective assessment for sellers and buyers. An appraisal report, conducted by a licensed appraiser, provides a detailed, unbiased valuation using standardized methods, often required by lenders for mortgage approval. While a CMA is useful for pricing strategy, an appraisal holds legal and financial weight in real estate transactions.

Table of Comparison

| Criteria | Comparative Market Analysis (CMA) | Appraisal Report |

|---|---|---|

| Purpose | Estimate current market value for buying/selling decisions | Provide an unbiased, professional opinion of property value for financing or legal purposes |

| Prepared By | Real estate agent or broker | Licensed or certified appraiser |

| Methodology | Analysis of recent comparable sales, local market trends | Detailed inspection, multiple valuation approaches (cost, sales comparison, income) |

| Detail Level | Summary report with comparable property data | Comprehensive report including property condition, neighborhood, and market data |

| Cost | Usually free or low cost | Typically higher fee due to professional standards |

| Legal Standing | Not legally binding | Accepted by lenders, courts, and government agencies |

| Turnaround Time | 1-3 days | Several days to weeks depending on complexity |

Understanding Comparative Market Analysis (CMA)

Understanding Comparative Market Analysis (CMA) involves evaluating recently sold properties similar in size, location, and features to estimate a home's market value. Unlike an appraisal report, which is conducted by a licensed appraiser and incorporates detailed property inspection and standardized methodologies, a CMA is typically prepared by real estate agents using current market data and trends. This analysis aids sellers and buyers in making informed pricing decisions by reflecting real-time market conditions and competitive property values.

What Is a Real Estate Appraisal Report?

A real estate appraisal report provides an unbiased professional opinion on a property's market value based on detailed analysis of comparable sales, market trends, and property conditions. Unlike a comparative market analysis (CMA), which is often prepared by real estate agents using recent sales data for pricing strategies, an appraisal is conducted by a licensed appraiser following standardized procedures required by lenders. This report plays a critical role in mortgage approvals, refinancing, and legal matters, ensuring the property's valuation is accurate and compliant with regulatory standards.

Key Differences Between CMA and Appraisal

A Comparative Market Analysis (CMA) provides an estimate of a property's value based on recent sales of similar homes in the area, primarily used by real estate agents to price listings competitively. An appraisal report, conducted by a licensed appraiser, offers a formal, detailed valuation including property condition, market trends, and legal factors, often required by lenders for mortgage approval. Key differences include CMA's informal nature aimed at marketing strategy versus appraisal's strict regulatory standards and comprehensive evaluation.

Purpose and Application of CMA in Real Estate

Comparative Market Analysis (CMA) is primarily used by real estate agents to estimate a property's market value based on recent sales of similar homes in the area, aiding sellers in pricing strategies and buyers in making competitive offers. Unlike an appraisal report conducted by licensed appraisers for mortgage lenders, CMA focuses on providing a quick, market-driven valuation to support marketing and negotiation decisions. CMA results help clients understand local market trends and position their properties effectively to attract buyers.

Uses of Appraisal Reports in Property Transactions

Appraisal reports provide an objective valuation of a property's market value, crucial for mortgage lending, tax assessments, and legal disputes. Lenders rely on appraisal reports to mitigate risk by confirming the property's worth aligns with the loan amount. These reports also assist buyers and sellers in making informed decisions during property transactions by offering a professional, unbiased estimate.

Who Performs CMA vs. Who Conducts Appraisals

Comparative Market Analysis (CMA) reports are typically performed by licensed real estate agents or brokers who use recent sales data and market trends to estimate a home's value. Appraisal reports are conducted by certified professional appraisers who follow standardized methodologies and regulatory guidelines to provide an unbiased property valuation. While CMAs serve as informal valuation tools for pricing decisions, appraisals are formal assessments often required by lenders for mortgage underwriting.

Data Sources: CMA vs. Appraisal

Comparative Market Analysis (CMA) primarily utilizes recent sales data of similar properties in the local market, relying heavily on Multiple Listing Service (MLS) databases and active listings for price comparisons. In contrast, an appraisal report incorporates a broader range of data sources, including public property records, tax information, physical property inspections, and market trends, to provide a detailed, standardized valuation. This comprehensive approach in appraisals aims to establish a more precise, lender-accepted property value compared to the CMA's market-driven price estimate used by real estate agents.

Accuracy and Reliability: CMA Compared to Appraisal

Comparative Market Analysis (CMA) leverages recent sales data from similar properties to provide a quick and cost-effective estimate of market value, making it reliable for agents and sellers in a competitive market. Appraisal reports, conducted by licensed appraisers, employ detailed inspections and standardized methodologies, ensuring higher accuracy and credibility for lenders and legal transactions. While CMAs offer practical market insights, appraisals deliver more precise and legally binding valuations essential for financing and contractual purposes.

Cost and Time Frame: CMA Versus Appraisal Process

Comparative Market Analysis (CMA) typically costs less and can be completed within a few days, providing a quick estimate of a property's value based on recent sales of similar homes in the area. An appraisal report, conducted by a licensed appraiser, involves a more thorough evaluation and usually takes one to two weeks, resulting in a higher cost due to the detailed inspection and formal documentation. Real estate agents use CMAs for listing price guidance, while lenders require appraisal reports for mortgage approval, reflecting the differences in purpose and precision between the two valuation methods.

When to Choose CMA or Appraisal in Real Estate Deals

Comparative Market Analysis (CMA) is ideal for sellers or buyers seeking a quick, cost-effective estimate of a property's market value based on recent sales of similar homes. An appraisal report, conducted by a licensed appraiser, is necessary when lenders require an unbiased, formal valuation to approve financing or during complex transactions like estate settlements. Choosing CMA suits preliminary pricing strategies, while appraisal reports are essential for legal, mortgage, or investment decisions demanding precise and regulated property valuations.

comparative market analysis vs appraisal report Infographic

difterm.com

difterm.com