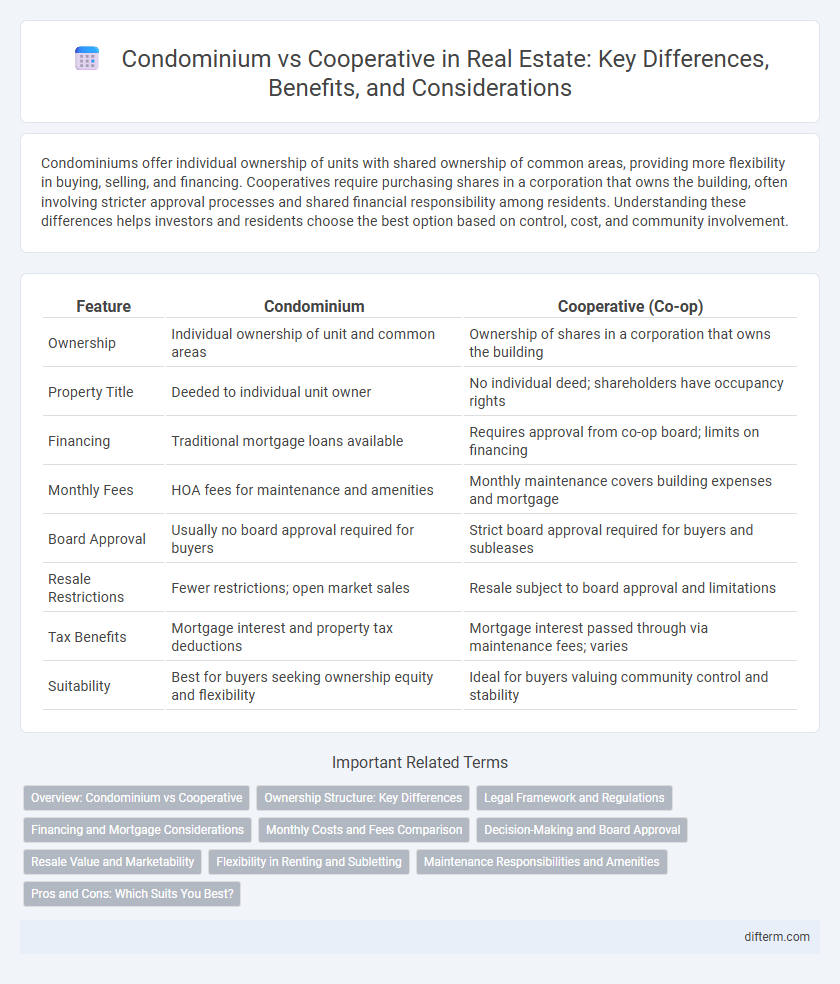

Condominiums offer individual ownership of units with shared ownership of common areas, providing more flexibility in buying, selling, and financing. Cooperatives require purchasing shares in a corporation that owns the building, often involving stricter approval processes and shared financial responsibility among residents. Understanding these differences helps investors and residents choose the best option based on control, cost, and community involvement.

Table of Comparison

| Feature | Condominium | Cooperative (Co-op) |

|---|---|---|

| Ownership | Individual ownership of unit and common areas | Ownership of shares in a corporation that owns the building |

| Property Title | Deeded to individual unit owner | No individual deed; shareholders have occupancy rights |

| Financing | Traditional mortgage loans available | Requires approval from co-op board; limits on financing |

| Monthly Fees | HOA fees for maintenance and amenities | Monthly maintenance covers building expenses and mortgage |

| Board Approval | Usually no board approval required for buyers | Strict board approval required for buyers and subleases |

| Resale Restrictions | Fewer restrictions; open market sales | Resale subject to board approval and limitations |

| Tax Benefits | Mortgage interest and property tax deductions | Mortgage interest passed through via maintenance fees; varies |

| Suitability | Best for buyers seeking ownership equity and flexibility | Ideal for buyers valuing community control and stability |

Overview: Condominium vs Cooperative

Condominiums offer individual ownership of units with shared ownership of common areas, providing greater autonomy in property decisions and financing options. Cooperatives involve owning shares in a corporation that owns the property, with residents holding long-term leases, often resulting in stricter approval processes and shared financial responsibilities. Both structures impact resale value, maintenance fees, and community governance, making buyer preferences and financial situations critical in choosing between condominium and cooperative ownership.

Ownership Structure: Key Differences

Condominiums grant individual ownership of a unit along with shared ownership of common areas, allowing owners to sell or lease independently. Cooperatives involve collective ownership where residents hold shares in a corporation that owns the entire property, requiring board approval for sales or leases. This fundamental difference impacts financing options, legal rights, and transferability in the real estate market.

Legal Framework and Regulations

Condominiums operate under a legal framework where owners hold individual title to their units and share ownership of common areas, regulated by state condominium statutes and association bylaws. Cooperatives involve ownership of shares in a corporation that entitles residents to lease a specific unit, governed by corporate bylaws and cooperative housing laws. Legal regulations for condominiums typically allow more individual rights, whereas cooperative rules impose collective approval processes for ownership transfers and shareholder behavior.

Financing and Mortgage Considerations

Condominium financing typically allows for conventional mortgage loans, making it easier for buyers to secure standard financing with competitive interest rates and loan terms. Cooperative housing often requires buyers to obtain a share loan, which may involve stricter underwriting criteria, higher down payments, and board approval, complicating the mortgage process. Lenders assess financial stability, share liquidity, and proprietary lease terms in co-ops more rigorously than the fee-simple ownership structure of condominiums.

Monthly Costs and Fees Comparison

Monthly costs for condominiums typically include mortgage payments, property taxes, homeowner's insurance, and monthly HOA fees covering maintenance and amenities. Cooperative owners pay a monthly maintenance fee that covers building expenses, property taxes, underlying mortgage, and utilities, often resulting in higher monthly fees compared to condominiums. Understanding the breakdown of these fees is crucial for budgeting, as cooperative fees generally include more services while condominium owners may face separate bills for utilities and insurance.

Decision-Making and Board Approval

Condominiums grant individual owners full decision-making authority over their units, with a homeowners association managing common areas and rules subject to majority board approval. Cooperatives require prospective residents to obtain board approval for purchase and significant decisions, as the cooperative corporation holds the property title collectively. Board approval in cooperatives tends to be more rigorous, influencing residents' freedom over unit modifications and transfers compared to condominiums.

Resale Value and Marketability

Condominiums typically offer higher resale value and greater marketability due to individual ownership, allowing easier financing and broader buyer appeal. Cooperative units often face restrictions on sales, requiring board approval, which can limit potential buyers and reduce resale value. Market trends favor condos for their flexibility and liquidity in competitive real estate markets.

Flexibility in Renting and Subletting

Condos offer greater flexibility in renting and subletting, allowing owners to lease their units with fewer restrictions imposed by the homeowners' association. Cooperatives typically require board approval and impose strict rules on subletting, limiting owners' ability to rent out their shares. These differences make condominiums more appealing to investors and tenants seeking short-term rental options.

Maintenance Responsibilities and Amenities

Condominium owners are responsible for maintenance and repairs within their individual units while the condominium association manages common areas and shared amenities like pools and gyms. In cooperatives, the corporation owns the entire building, and shareholders pay monthly fees covering maintenance, building upkeep, and shared amenities, but individual unit maintenance is subject to cooperative rules. Both structures offer access to amenities, but condos often provide more autonomy over unit-specific repairs compared to the collective management style of cooperatives.

Pros and Cons: Which Suits You Best?

Condominiums offer individual ownership of units with shared ownership of common areas, providing more control over your property and simpler financing options, but typically come with higher monthly fees and maintenance responsibilities. Cooperatives involve owning shares in a corporation that holds the property, offering lower purchase prices and stricter approval processes, which can limit resale flexibility and financing options. Choosing between a condo and a cooperative depends on your budget, desire for property control, and willingness to navigate board approvals and shared responsibilities.

condominium vs cooperative Infographic

difterm.com

difterm.com