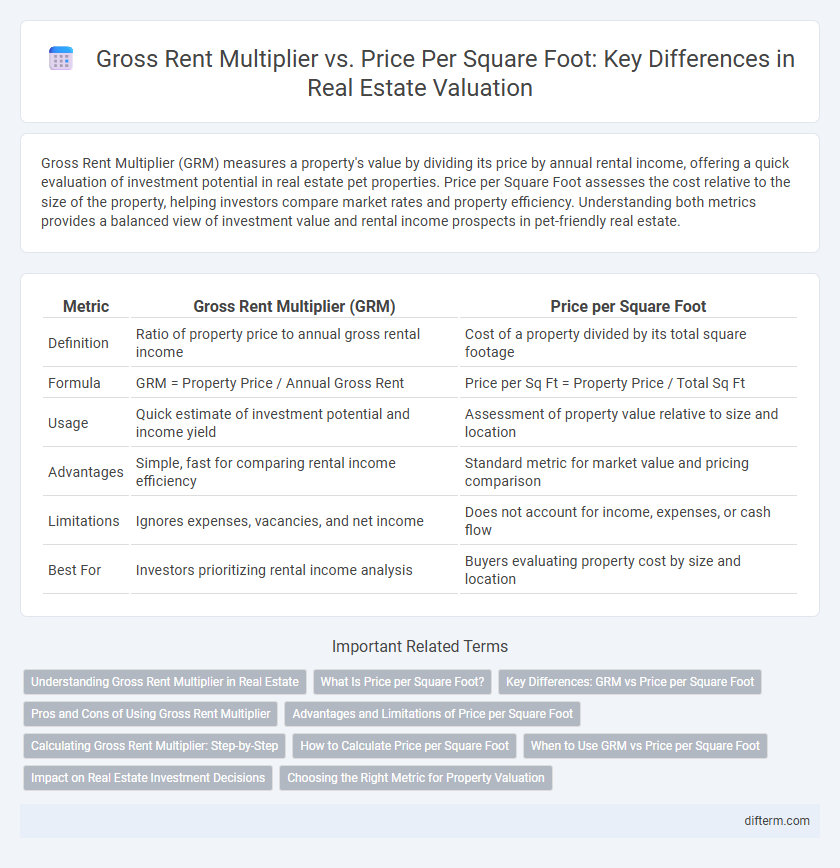

Gross Rent Multiplier (GRM) measures a property's value by dividing its price by annual rental income, offering a quick evaluation of investment potential in real estate pet properties. Price per Square Foot assesses the cost relative to the size of the property, helping investors compare market rates and property efficiency. Understanding both metrics provides a balanced view of investment value and rental income prospects in pet-friendly real estate.

Table of Comparison

| Metric | Gross Rent Multiplier (GRM) | Price per Square Foot |

|---|---|---|

| Definition | Ratio of property price to annual gross rental income | Cost of a property divided by its total square footage |

| Formula | GRM = Property Price / Annual Gross Rent | Price per Sq Ft = Property Price / Total Sq Ft |

| Usage | Quick estimate of investment potential and income yield | Assessment of property value relative to size and location |

| Advantages | Simple, fast for comparing rental income efficiency | Standard metric for market value and pricing comparison |

| Limitations | Ignores expenses, vacancies, and net income | Does not account for income, expenses, or cash flow |

| Best For | Investors prioritizing rental income analysis | Buyers evaluating property cost by size and location |

Understanding Gross Rent Multiplier in Real Estate

Gross Rent Multiplier (GRM) in real estate serves as a quick valuation metric, calculated by dividing a property's sale price by its annual gross rental income. Unlike Price per Square Foot, which emphasizes property size and market location, GRM focuses on rental income generating potential, providing investors with an efficiency insight. This metric helps investors assess the profitability of rental properties by highlighting the relationship between purchase price and rental income, facilitating more informed investment decisions.

What Is Price per Square Foot?

Price per square foot is a key metric used in real estate to assess the value of a property by dividing its total price by the total livable or usable square footage. Unlike Gross Rent Multiplier, which calculates an investment's return potential based on rental income, price per square foot provides a straightforward measure to compare properties regardless of income. This metric helps buyers and investors quickly gauge market trends, identify overvalued or undervalued properties, and make informed purchasing decisions.

Key Differences: GRM vs Price per Square Foot

Gross Rent Multiplier (GRM) measures investment potential by comparing a property's price to its annual gross rental income, emphasizing cash flow analysis. Price per Square Foot calculates the cost relative to property size, highlighting valuation based on area rather than income. GRM is primarily used by investors prioritizing rental yield, while Price per Square Foot aids buyers and appraisers assessing market value and property size efficiency.

Pros and Cons of Using Gross Rent Multiplier

Gross Rent Multiplier (GRM) offers a quick evaluation metric in real estate by comparing property price to gross rental income, ideal for preliminary investment screening. However, GRM overlooks operating expenses, vacancy rates, and net income, limiting its accuracy in cash flow analysis. Price per square foot provides detailed property valuation by size but lacks income-based insights, making GRM essential for rental income-focused investors despite its simplified approach.

Advantages and Limitations of Price per Square Foot

Price per Square Foot offers a straightforward metric for comparing property values across different sizes and locations, enabling buyers and investors to evaluate cost efficiency quickly. This measure simplifies budgeting and market analysis by standardizing price relative to space, but it may overlook factors like property condition, amenities, and income potential. While useful for initial assessments, reliance solely on Price per Square Foot can lead to undervaluing properties with higher rental yields or unique features.

Calculating Gross Rent Multiplier: Step-by-Step

Calculating Gross Rent Multiplier (GRM) involves dividing the property's purchase price by its gross rental income, offering a quick assessment of investment potential. For example, a property priced at $500,000 generating $50,000 in annual gross rent results in a GRM of 10, indicating the number of years it takes to recoup the investment without expenses accounted. Comparing GRM with Price per Square Foot helps investors balance rental income efficiency against property size and market value, refining investment decisions.

How to Calculate Price per Square Foot

Price per square foot is calculated by dividing the property's total purchase price by its total square footage, providing a clear metric for real estate valuation. This method allows investors to compare properties of varying sizes by standardizing cost on a per unit basis. Unlike Gross Rent Multiplier which relates price to rental income, price per square foot focuses purely on property size and price efficiency for market analysis.

When to Use GRM vs Price per Square Foot

Gross Rent Multiplier (GRM) is most effective when evaluating rental properties because it focuses on the relationship between the property's price and its gross rental income, making it ideal for investors analyzing income potential. Price per Square Foot is better suited for comparing properties of similar size and location, providing a straightforward metric for assessing market value and cost efficiency. Use GRM for income-driven investment decisions and Price per Square Foot for property valuation and market comparison.

Impact on Real Estate Investment Decisions

Gross Rent Multiplier (GRM) provides a straightforward measure to evaluate property profitability by comparing purchase price to gross rental income, while Price per Square Foot offers granular insight into property value relative to size. Investors often use GRM for quick cash flow analysis, but Price per Square Foot helps to assess market trends and property quality in specific locations. Balancing both metrics allows investors to make informed decisions by integrating income potential with property valuation efficiency.

Choosing the Right Metric for Property Valuation

Gross Rent Multiplier (GRM) offers a quick snapshot of rental income relative to property price, making it useful for investors prioritizing cash flow analysis. Price per Square Foot provides a more granular view of property value based on size, essential for comparing properties in similar locations or conditions. Selecting the right metric depends on investment goals: GRM suits income-focused evaluations, while Price per Square Foot better supports market value assessments and property comparisons.

Gross Rent Multiplier vs Price per Square Foot Infographic

difterm.com

difterm.com