Comparable sales provide a market-driven estimate of a property's value based on recent transactions of similar homes nearby, reflecting current buyer demand and market trends. Appraised value is determined by a licensed appraiser who assesses the property's condition, location, and comparable sales to provide an unbiased valuation for lending or negotiation purposes. Understanding the difference between comparable sales and appraised value helps buyers and sellers make informed decisions in real estate transactions involving pets, such as evaluating pet-friendly amenities or property modifications.

Table of Comparison

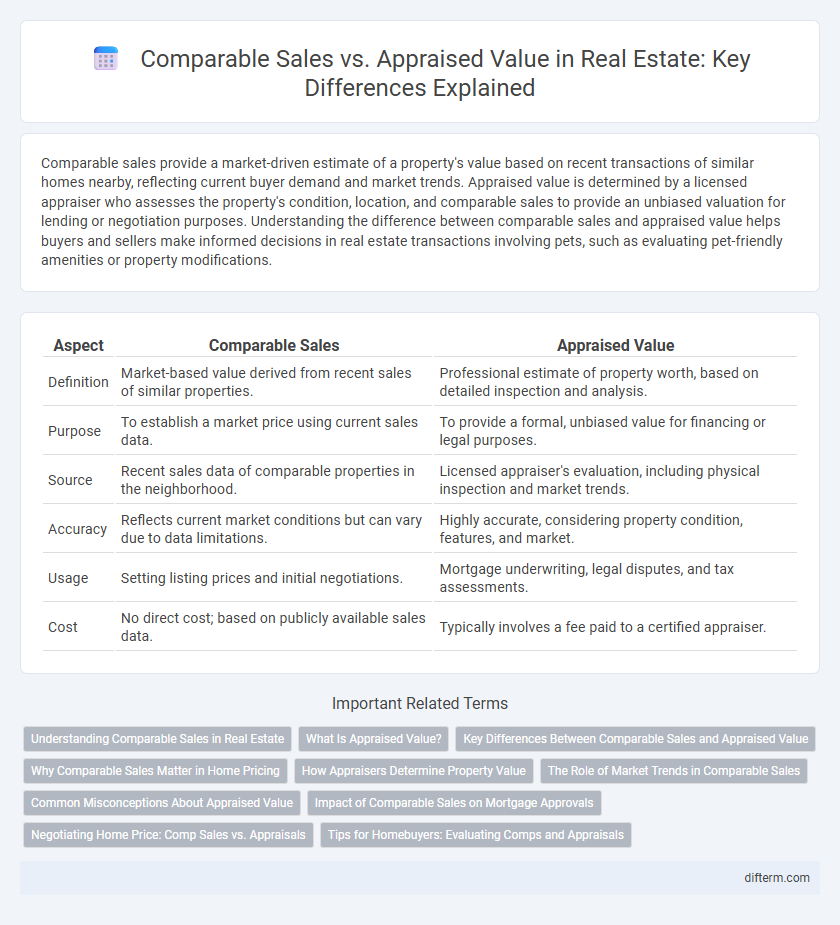

| Aspect | Comparable Sales | Appraised Value |

|---|---|---|

| Definition | Market-based value derived from recent sales of similar properties. | Professional estimate of property worth, based on detailed inspection and analysis. |

| Purpose | To establish a market price using current sales data. | To provide a formal, unbiased value for financing or legal purposes. |

| Source | Recent sales data of comparable properties in the neighborhood. | Licensed appraiser's evaluation, including physical inspection and market trends. |

| Accuracy | Reflects current market conditions but can vary due to data limitations. | Highly accurate, considering property condition, features, and market. |

| Usage | Setting listing prices and initial negotiations. | Mortgage underwriting, legal disputes, and tax assessments. |

| Cost | No direct cost; based on publicly available sales data. | Typically involves a fee paid to a certified appraiser. |

Understanding Comparable Sales in Real Estate

Understanding comparable sales in real estate involves analyzing recently sold properties with similar characteristics, such as location, size, and condition, to estimate a property's market value. This method provides a data-driven foundation for pricing decisions and is crucial for real estate agents, buyers, and sellers seeking accurate market insights. Unlike appraised value, which integrates professional judgment and property condition assessment, comparable sales rely primarily on objective sales data to reflect current market trends.

What Is Appraised Value?

Appraised value is a professional estimate of a property's market worth determined by a certified appraiser who evaluates factors such as location, condition, size, and recent comparable sales. This valuation plays a crucial role in mortgage approval, helping lenders assess risk and ensure the loan amount aligns with the property's true value. Unlike comparable sales that reflect market trends through recent transactions, appraised value provides an objective, detailed analysis tailored to the specific property.

Key Differences Between Comparable Sales and Appraised Value

Comparable sales represent recent transaction prices of similar properties in the same area, providing a market-based benchmark for property valuation. Appraised value is determined by a licensed appraiser who assesses the property's condition, location, and comparable sales to establish a professional opinion of its market worth. Key differences include that comparable sales reflect actual market activity, while appraised value incorporates expert analysis and adjustments for unique property features.

Why Comparable Sales Matter in Home Pricing

Comparable sales provide critical market data by reflecting actual transaction prices of similar properties in the same area, offering a realistic benchmark for home pricing. They help establish a competitive and accurate listing price that aligns with current market demand and conditions. Relying on comparable sales ensures sellers and buyers make informed decisions based on recent, local sales trends rather than speculative appraisals.

How Appraisers Determine Property Value

Appraisers determine property value by analyzing recent comparable sales within the same neighborhood, adjusting for differences in size, condition, and features to ensure accuracy. They also inspect the property thoroughly, considering factors such as location, structural integrity, and market trends. This method contrasts with relying solely on comparable sales, as appraisers incorporate detailed assessments and standardized valuation techniques to establish a precise appraised value.

The Role of Market Trends in Comparable Sales

Market trends significantly influence comparable sales by reflecting current demand, inventory levels, and pricing patterns in the real estate sector. These trends help adjust the value of recently sold properties to match the current market conditions, ensuring that the comparable sales provide an accurate basis for appraisals. Incorporating factors such as interest rates, economic indicators, and local development projects enhances the precision of value estimations derived from comparable sales.

Common Misconceptions About Appraised Value

Appraised value often differs from comparable sales due to variations in appraisal methods, property conditions, and market trends at the time of assessment. Many mistakenly assume appraised value directly matches recent comparable sales, but appraisals incorporate adjustments for unique property features, repairs, and neighborhood changes. Understanding that appraised value reflects a professional estimate based on current market data and property specifics helps clarify this common misconception in real estate transactions.

Impact of Comparable Sales on Mortgage Approvals

Comparable sales significantly influence mortgage approvals by providing lenders with a market-based benchmark to assess a property's value, ensuring the loan amount aligns with recent sales of similar homes in the area. This data helps mitigate risk by validating that the appraised value is supported by actual transaction prices, enhancing lender confidence in the property's marketability and resale potential. When comparable sales are strong and recent, they typically lead to smoother mortgage approvals and more favorable loan terms for buyers.

Negotiating Home Price: Comp Sales vs. Appraisals

Negotiating a home price often hinges on understanding comparable sales and appraised value, where comparable sales represent actual market transactions of similar properties providing a realistic price benchmark. Appraised value, determined by licensed appraisers, factors in property condition, location, and market trends to establish a fair market value for financing purposes. Leveraging comparable sales data can empower buyers and sellers to negotiate confidently, while recognizing appraisals protect lenders and ensure the sale price aligns with true market value.

Tips for Homebuyers: Evaluating Comps and Appraisals

When evaluating comparable sales (comps) and appraised value, homebuyers should analyze recent sales of similar properties within the same neighborhood to understand market trends accurately. It's crucial to compare key features such as square footage, condition, and upgrades to ensure comps reflect the true market value. Relying on a professional appraiser's detailed report alongside reviewed comps helps buyers make informed decisions and negotiate effectively.

Comparable Sales vs Appraised Value Infographic

difterm.com

difterm.com