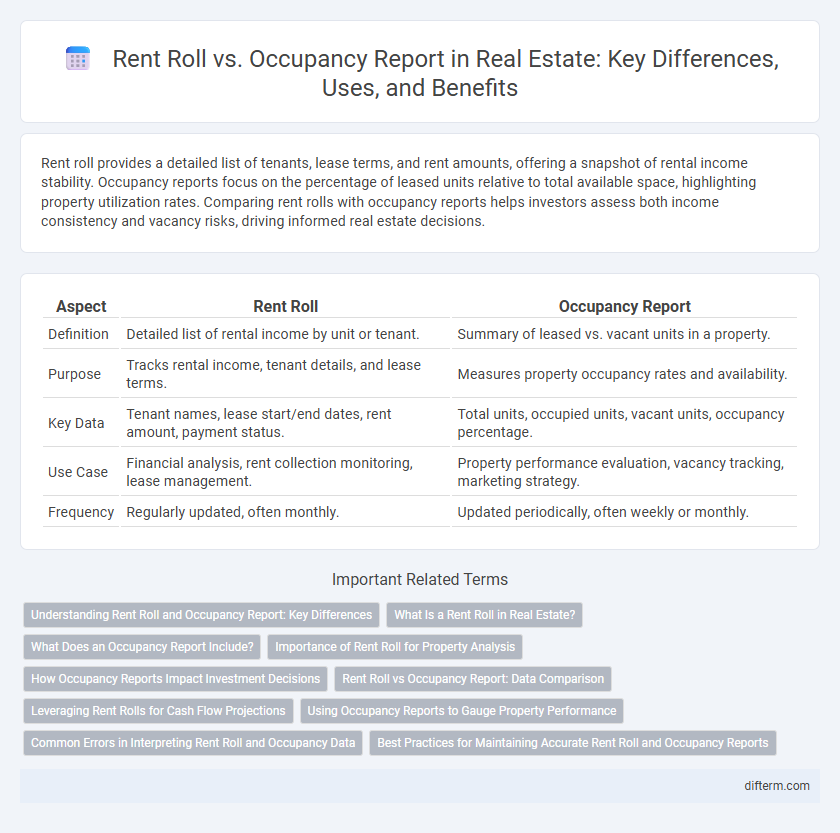

Rent roll provides a detailed list of tenants, lease terms, and rent amounts, offering a snapshot of rental income stability. Occupancy reports focus on the percentage of leased units relative to total available space, highlighting property utilization rates. Comparing rent rolls with occupancy reports helps investors assess both income consistency and vacancy risks, driving informed real estate decisions.

Table of Comparison

| Aspect | Rent Roll | Occupancy Report |

|---|---|---|

| Definition | Detailed list of rental income by unit or tenant. | Summary of leased vs. vacant units in a property. |

| Purpose | Tracks rental income, tenant details, and lease terms. | Measures property occupancy rates and availability. |

| Key Data | Tenant names, lease start/end dates, rent amount, payment status. | Total units, occupied units, vacant units, occupancy percentage. |

| Use Case | Financial analysis, rent collection monitoring, lease management. | Property performance evaluation, vacancy tracking, marketing strategy. |

| Frequency | Regularly updated, often monthly. | Updated periodically, often weekly or monthly. |

Understanding Rent Roll and Occupancy Report: Key Differences

A rent roll details all rental income generated by a property, including tenant names, lease terms, and payment status, providing a comprehensive snapshot of cash flow. An occupancy report tracks the percentage of leased versus vacant units, highlighting the property's current occupancy rate and lease expiration timelines. Understanding the distinction between these documents is crucial for assessing property performance and investment potential.

What Is a Rent Roll in Real Estate?

A rent roll in real estate is a detailed report listing all the rental income generated from each tenant in a property, including lease terms, rental rates, and payment status. It provides investors and property managers with comprehensive insights into cash flow, tenant occupancy, and lease expirations. This document is critical for evaluating the financial health and income potential of rental properties.

What Does an Occupancy Report Include?

An occupancy report includes detailed information about the current status of rental units within a property, such as the total number of units, the number of occupied units, and the percentage of occupancy. It often provides tenant details like lease start and end dates, unit types, and rent amounts to help assess property performance. This report is essential for real estate investors to evaluate cash flow stability and vacancy risks.

Importance of Rent Roll for Property Analysis

Rent roll provides detailed information on tenant leases, rental rates, and payment status, offering a granular view of a property's income stability and cash flow potential. This data is essential for accurately assessing net operating income (NOI) and forecasting future revenue streams. Unlike occupancy reports that primarily show space utilization, rent rolls reveal underlying financial performance critical for investment analysis and property valuation.

How Occupancy Reports Impact Investment Decisions

Occupancy reports provide real-time data on the percentage of leased units within a property, directly influencing cash flow projections and risk assessments for investors. Unlike rent rolls, which detail individual tenant leases and rental income, occupancy reports highlight property utilization trends, enabling investors to gauge market demand and vacancy rates effectively. Accurate occupancy analysis supports strategic decisions on property acquisition, pricing, and portfolio diversification in real estate investment.

Rent Roll vs Occupancy Report: Data Comparison

Rent Roll provides detailed tenant-level data including lease terms, rent amounts, and payment status, enabling precise revenue tracking for real estate investors. Occupancy Report summarizes property-wide vacancy rates and physical occupancy percentages, offering a snapshot of space utilization and leasing performance. The Rent Roll emphasizes financial metrics per unit, while the Occupancy Report focuses on overall property occupancy and tenant distribution.

Leveraging Rent Rolls for Cash Flow Projections

Rent rolls provide detailed tenant rent payment data essential for accurate cash flow projections in real estate investment analysis, outperforming occupancy reports that only indicate space utilization rates. Leveraging rent roll information enables investors to forecast income streams by capturing lease terms, rent escalations, and tenant turnover, creating a more precise financial model. This granular approach supports better decision-making for property management, budgeting, and identifying potential risks or growth opportunities.

Using Occupancy Reports to Gauge Property Performance

Occupancy reports provide real-time data on the percentage of leased versus available units, making them essential for assessing property performance in real estate. These reports help investors and property managers identify trends in tenant retention, vacancy rates, and seasonal demand fluctuations to optimize rental strategies. By comparing occupancy reports with rent rolls, stakeholders can better understand revenue potential and make informed decisions about property management and investment.

Common Errors in Interpreting Rent Roll and Occupancy Data

Misinterpreting rent roll data often arises from overlooking the distinction between leased and occupied units, leading to inflated income projections. Occupancy reports can be misleading if they fail to account for seasonal vacancies or short-term leases, which distort true occupancy rates. Accurate analysis requires cross-referencing rent rolls with occupancy reports to reconcile discrepancies and avoid errors in property valuation or cash flow forecasting.

Best Practices for Maintaining Accurate Rent Roll and Occupancy Reports

Maintaining accurate rent roll and occupancy reports requires regular updates that reflect current lease terms, tenant payment statuses, and unit availability, ensuring data integrity and facilitating effective property management. Utilizing property management software with automated tracking capabilities reduces human errors and enhances real-time accuracy in reporting. Consistent communication with tenants and periodic audits of both rent collections and occupancy data are essential best practices to validate information and support strategic decision-making in real estate operations.

Rent Roll vs Occupancy Report Infographic

difterm.com

difterm.com