Appraisal and home inspection serve distinct purposes in real estate transactions: an appraisal determines the market value of a property, while a home inspection evaluates its physical condition. Appraisals are crucial for securing a mortgage, ensuring the lender that the property's value justifies the loan amount. Home inspections identify potential issues or repairs, providing buyers with a detailed understanding of the property's structural and system integrity before purchase.

Table of Comparison

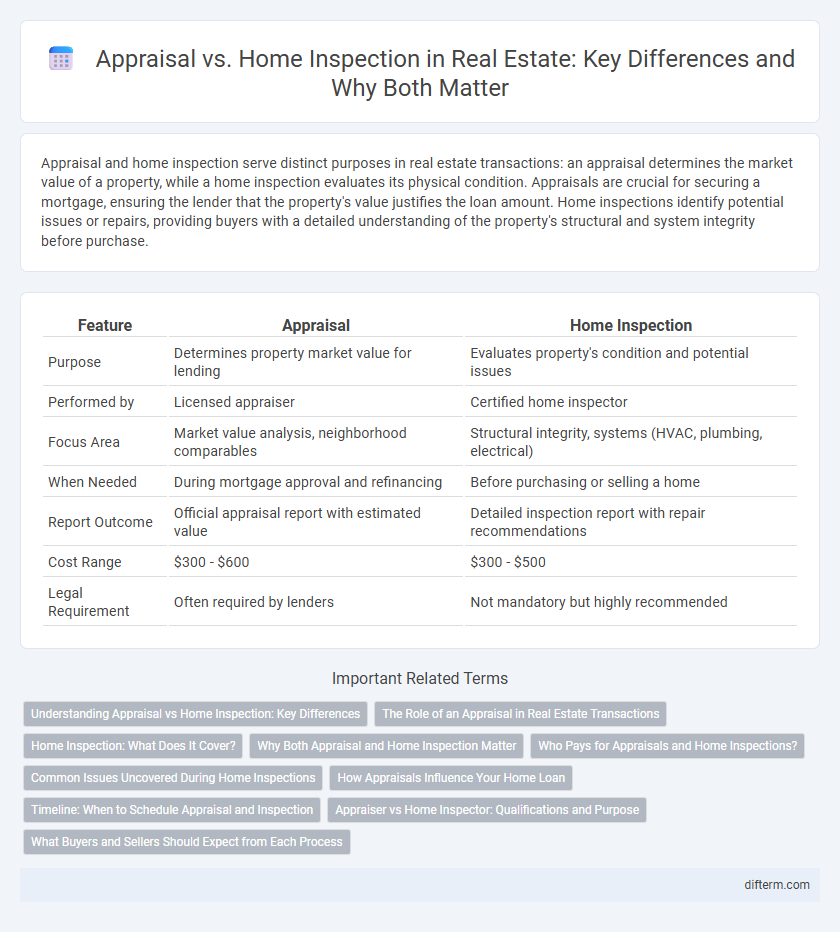

| Feature | Appraisal | Home Inspection |

|---|---|---|

| Purpose | Determines property market value for lending | Evaluates property's condition and potential issues |

| Performed by | Licensed appraiser | Certified home inspector |

| Focus Area | Market value analysis, neighborhood comparables | Structural integrity, systems (HVAC, plumbing, electrical) |

| When Needed | During mortgage approval and refinancing | Before purchasing or selling a home |

| Report Outcome | Official appraisal report with estimated value | Detailed inspection report with repair recommendations |

| Cost Range | $300 - $600 | $300 - $500 |

| Legal Requirement | Often required by lenders | Not mandatory but highly recommended |

Understanding Appraisal vs Home Inspection: Key Differences

Appraisal and home inspection serve distinct roles in real estate transactions, with appraisals assessing property value based on market conditions and home inspections evaluating the physical condition and safety of the property. Appraisers analyze comparable sales, location, and property features to determine market value, while home inspectors examine structural elements, electrical systems, plumbing, and potential hazards. Understanding these differences helps buyers and sellers make informed decisions and ensures accurate valuation alongside detailed property condition assessments.

The Role of an Appraisal in Real Estate Transactions

An appraisal provides an objective estimate of a property's market value, crucial for mortgage approval and ensuring the buyer does not overpay. Appraisers analyze comparable sales, property condition, location, and market trends to deliver a reliable valuation. This valuation influences loan amounts and supports lenders in mitigating financial risk during real estate transactions.

Home Inspection: What Does It Cover?

A home inspection covers a thorough evaluation of a property's structural components, including the foundation, roof, walls, and plumbing systems, as well as electrical wiring and HVAC functionality. Inspectors identify potential safety hazards, signs of damage, or maintenance issues that could impact the home's value or livability. This detailed assessment provides buyers with crucial insights into the condition of the property before purchase, helping them make informed decisions.

Why Both Appraisal and Home Inspection Matter

Appraisal and home inspection serve distinct yet complementary roles in real estate transactions, ensuring both financial value and structural soundness are accurately assessed. An appraisal determines the market value of the property, which is crucial for securing a mortgage and negotiating price, while a home inspection identifies potential issues or repairs needed, protecting buyers from unforeseen costs. Together, they provide comprehensive insight that safeguards investment, supports informed decision-making, and promotes confidence throughout the buying or selling process.

Who Pays for Appraisals and Home Inspections?

Homebuyers typically pay for both appraisals and home inspections, though the responsibility can vary based on local customs and negotiated terms. Lenders usually require and order the appraisal to confirm the property's value, with the borrower covering this cost upfront. Home inspections, paid by the buyer, provide a thorough condition assessment and are optional but highly recommended to uncover potential issues before purchase.

Common Issues Uncovered During Home Inspections

Home inspections frequently reveal common issues such as faulty electrical wiring, roof damage, plumbing leaks, and HVAC system malfunctions, which can significantly impact a property's safety and functionality. Unlike appraisals that primarily assess market value based on comparable sales and property features, inspections provide a detailed assessment of structural integrity and potential repair costs. Understanding these distinctions helps buyers make informed decisions by addressing hidden defects that appraisals may overlook.

How Appraisals Influence Your Home Loan

Appraisals provide a professional assessment of a property's market value, directly influencing the loan amount a lender is willing to approve for a home purchase. Lenders rely on appraisals to minimize risk by ensuring the home's value supports the mortgage amount requested by the buyer. Unlike home inspections, which focus on the condition and safety of the property, appraisals primarily affect loan terms and approval decisions in the real estate financing process.

Timeline: When to Schedule Appraisal and Inspection

Home inspections are typically scheduled immediately after an offer is accepted to identify potential issues early in the buying process, allowing buyers to negotiate repairs or price adjustments. Appraisals are usually scheduled after the inspection, often within two weeks of the contract acceptance, to determine the property's market value for mortgage approval. Coordinating both timelines efficiently ensures a smoother transaction and helps prevent delays in closing.

Appraiser vs Home Inspector: Qualifications and Purpose

Appraisers are licensed professionals with specialized training in property valuation, using market data and comparables to determine a home's fair market value for lending purposes. Home inspectors hold certifications focused on evaluating the physical condition of a property, identifying structural issues, safety hazards, and maintenance needs. While appraisers provide a financial assessment crucial for mortgage approval, home inspectors deliver a detailed report on the property's condition to inform buyers before purchase.

What Buyers and Sellers Should Expect from Each Process

Appraisal in real estate provides an unbiased estimate of a property's market value, crucial for mortgage approval and price negotiations. Home inspection offers a detailed assessment of the property's condition, identifying potential repairs or safety issues that may influence buying decisions. Buyers and sellers should expect appraisal to focus on value analysis based on comparable sales, while home inspection emphasizes physical condition and maintenance requirements.

Appraisal vs Home Inspection Infographic

difterm.com

difterm.com