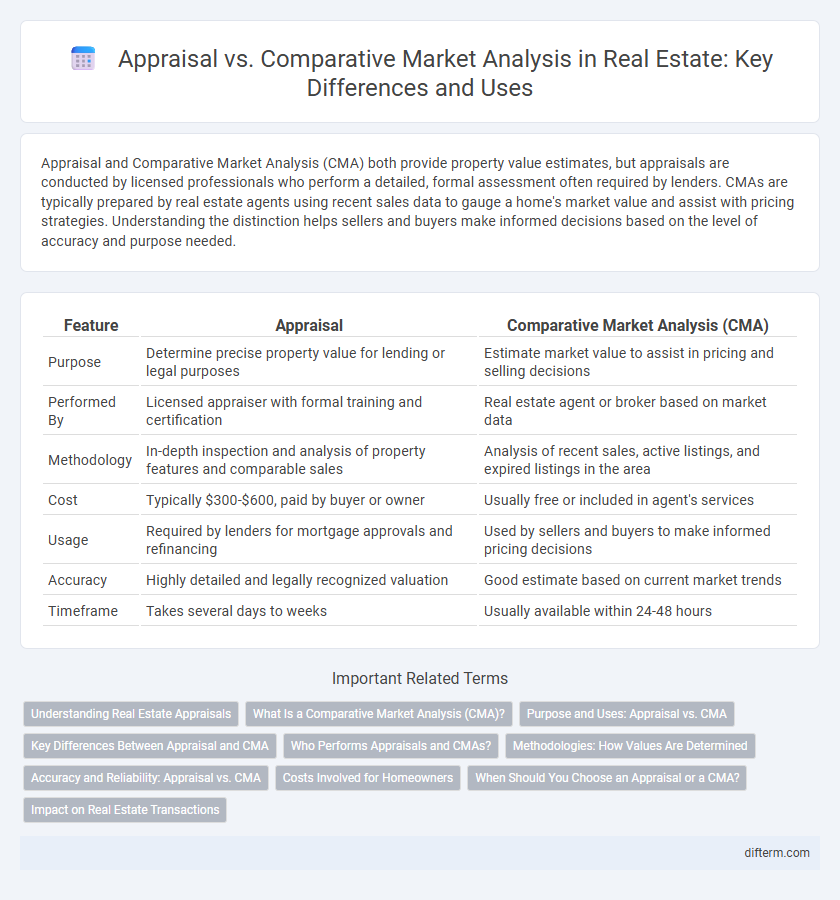

Appraisal and Comparative Market Analysis (CMA) both provide property value estimates, but appraisals are conducted by licensed professionals who perform a detailed, formal assessment often required by lenders. CMAs are typically prepared by real estate agents using recent sales data to gauge a home's market value and assist with pricing strategies. Understanding the distinction helps sellers and buyers make informed decisions based on the level of accuracy and purpose needed.

Table of Comparison

| Feature | Appraisal | Comparative Market Analysis (CMA) |

|---|---|---|

| Purpose | Determine precise property value for lending or legal purposes | Estimate market value to assist in pricing and selling decisions |

| Performed By | Licensed appraiser with formal training and certification | Real estate agent or broker based on market data |

| Methodology | In-depth inspection and analysis of property features and comparable sales | Analysis of recent sales, active listings, and expired listings in the area |

| Cost | Typically $300-$600, paid by buyer or owner | Usually free or included in agent's services |

| Usage | Required by lenders for mortgage approvals and refinancing | Used by sellers and buyers to make informed pricing decisions |

| Accuracy | Highly detailed and legally recognized valuation | Good estimate based on current market trends |

| Timeframe | Takes several days to weeks | Usually available within 24-48 hours |

Understanding Real Estate Appraisals

Real estate appraisals provide an objective, licensed professional's valuation of a property based on factors such as location, condition, and recent sales data to determine market value. Unlike a Comparative Market Analysis (CMA), which is an informal estimate often prepared by real estate agents using similar nearby property sales, appraisals involve rigorous inspection and standardized methodology. Accurate appraisals are crucial for lenders to mitigate risk during mortgage approval and ensure fair property pricing.

What Is a Comparative Market Analysis (CMA)?

A Comparative Market Analysis (CMA) is a real estate tool used to estimate a property's value by comparing it to similar homes that have recently sold, are currently on the market, or were listed but did not sell. Real estate agents typically prepare CMAs to help sellers set competitive listing prices and buyers make informed offers. The CMA relies on key data points including location, size, condition, and features of comparable properties to provide an accurate market-driven valuation.

Purpose and Uses: Appraisal vs. CMA

An appraisal provides a professional, unbiased valuation of a property's market value, primarily used for mortgage lending, taxation, and legal purposes. A Comparative Market Analysis (CMA) estimates a home's value based on recent sales of similar properties in the area, helping sellers and real estate agents set competitive listing prices. While appraisals are conducted by licensed appraisers, CMAs are typically prepared by real estate agents to guide pricing strategies during a home sale.

Key Differences Between Appraisal and CMA

Appraisal is a formal, professional valuation conducted by a licensed appraiser to determine a property's precise market value, often required for mortgage approval. Comparative Market Analysis (CMA) is an informal estimate prepared by real estate agents, using recent sales data of similar properties to guide pricing strategies. Appraisals rely on standardized methodologies and regulatory guidelines, while CMAs offer flexible market insights tailored for listing decisions.

Who Performs Appraisals and CMAs?

Licensed appraisers perform appraisals by conducting thorough evaluations of a property's value based on factors like condition, location, and recent sales data. Real estate agents typically prepare Comparative Market Analyses (CMAs) using market trends, comparable property prices, and neighborhood insights to help sellers set competitive listing prices. Both appraisals and CMAs aim to estimate property value, but appraisals are more formal and legally recognized, while CMAs are informal pricing tools.

Methodologies: How Values Are Determined

Appraisal methodologies rely on licensed professionals conducting thorough inspections and using standardized approaches such as the cost, income, and sales comparison methods to determine a property's market value. Comparative Market Analysis (CMA) uses recent sales data of similar properties in the area, adjusting for differences in features, location, and condition, to estimate a competitive listing price. Both approaches consider market trends and property specifics, but appraisals provide a more detailed, formal valuation often required for financing, while CMAs offer quick, market-driven insights primarily for listing strategy.

Accuracy and Reliability: Appraisal vs. CMA

Appraisals provide a highly accurate property valuation performed by licensed professionals using standardized methods, ensuring reliability for legal and financial purposes. Comparative Market Analysis (CMA), conducted by real estate agents, offers an estimate based on recent sales of comparable properties but may lack the formal rigor and impartiality of appraisals. While appraisals are legally binding and crucial for mortgage approvals, CMAs serve as valuable market insights but can vary in precision depending on the agent's expertise and local market conditions.

Costs Involved for Homeowners

Appraisals typically cost between $300 and $600, providing a professional, unbiased property valuation required by lenders or legal proceedings. Comparative Market Analysis (CMA) is often offered free by real estate agents as part of their service, leveraging recent sales data to estimate home value without the expense of a formal appraisal. Homeowners should evaluate these cost differences when deciding between an appraisal and a CMA for pricing or refinancing decisions.

When Should You Choose an Appraisal or a CMA?

Choosing between an appraisal and a comparative market analysis (CMA) depends on the purpose and accuracy needed in property valuation. Appraisals, conducted by licensed professionals, provide legally binding property values essential for mortgage approvals, estate settlements, or disputes. CMAs, prepared by real estate agents, offer a quick, market-based estimate useful for pricing homes in a competitive market or making informed buying and selling decisions.

Impact on Real Estate Transactions

Appraisals provide a professional, unbiased property valuation essential for securing mortgages and ensuring accurate financial transactions in real estate. Comparative Market Analysis (CMA) offers real-time insights based on recent sales data, helping sellers and buyers gauge market trends and set competitive prices. Both tools influence negotiation power and transaction outcomes, with appraisals affecting loan approvals and CMAs guiding pricing strategies.

Appraisal vs Comparative Market Analysis Infographic

difterm.com

difterm.com