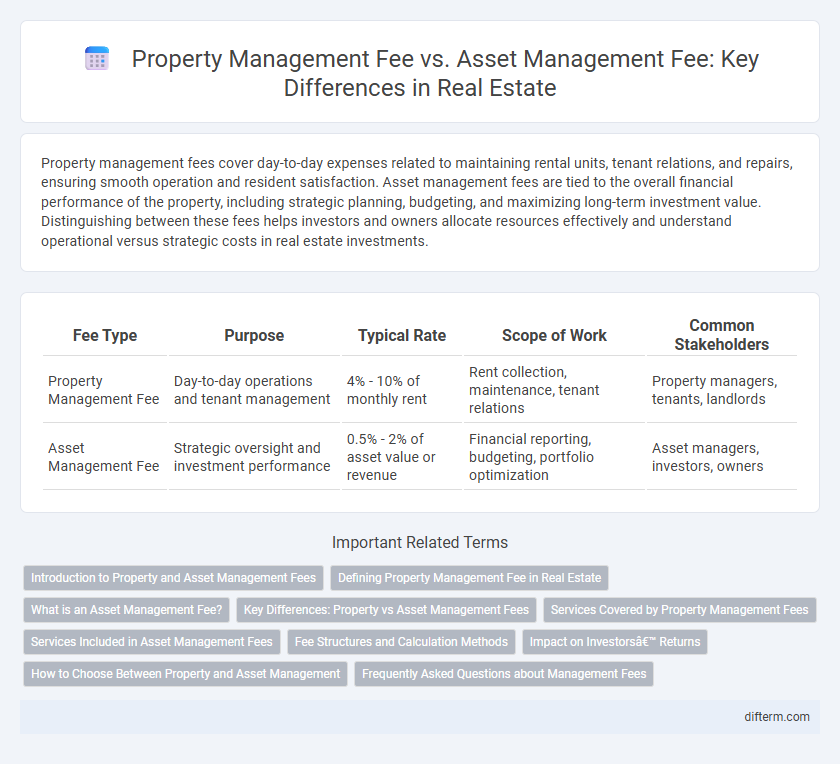

Property management fees cover day-to-day expenses related to maintaining rental units, tenant relations, and repairs, ensuring smooth operation and resident satisfaction. Asset management fees are tied to the overall financial performance of the property, including strategic planning, budgeting, and maximizing long-term investment value. Distinguishing between these fees helps investors and owners allocate resources effectively and understand operational versus strategic costs in real estate investments.

Table of Comparison

| Fee Type | Purpose | Typical Rate | Scope of Work | Common Stakeholders |

|---|---|---|---|---|

| Property Management Fee | Day-to-day operations and tenant management | 4% - 10% of monthly rent | Rent collection, maintenance, tenant relations | Property managers, tenants, landlords |

| Asset Management Fee | Strategic oversight and investment performance | 0.5% - 2% of asset value or revenue | Financial reporting, budgeting, portfolio optimization | Asset managers, investors, owners |

Introduction to Property and Asset Management Fees

Property management fees cover the day-to-day operational costs of maintaining rental properties, including tenant communication, repairs, and rent collection, typically ranging between 4% to 12% of collected rents. Asset management fees focus on strategic oversight and performance optimization of real estate investments, often charged as a percentage of the asset's value or net operating income, typically between 0.5% and 2%. Understanding the distinction between these fees is essential for investors aiming to maximize returns and efficiently manage real estate portfolios.

Defining Property Management Fee in Real Estate

Property management fee in real estate refers to the cost charged by a property management company or individual for overseeing the day-to-day operations of rental properties, including tenant relations, maintenance, rent collection, and lease enforcement. This fee is typically a percentage of the monthly rental income, averaging between 4% to 10%, depending on the property's location and size. Clear understanding of property management fees helps investors accurately assess operational expenses and net income potential from rental properties.

What is an Asset Management Fee?

An asset management fee is a charge paid to a professional or firm responsible for overseeing and optimizing the overall investment performance of a real estate portfolio. This fee typically covers strategic planning, financial reporting, budgeting, and maximizing the return on investment across multiple properties. Unlike property management fees that focus on day-to-day operations, asset management fees concentrate on long-term value growth and financial outcomes.

Key Differences: Property vs Asset Management Fees

Property management fees cover the day-to-day operations and maintenance of rental properties, including tenant relations, rent collection, and repairs, typically charged as a percentage of monthly rental income. Asset management fees focus on overseeing the overall investment performance, strategic planning, and financial reporting, usually calculated as a percentage of the total asset value or gross revenue. The primary difference lies in operational management versus investment strategy, with property management handling physical property care and asset management driving long-term portfolio growth.

Services Covered by Property Management Fees

Property management fees primarily cover day-to-day operational services such as tenant screening, rent collection, maintenance coordination, and handling tenant inquiries or complaints. These fees also include routine property inspections, lease enforcement, and managing vendor contracts to ensure property upkeep. Unlike asset management fees, which focus on financial performance and investment strategy, property management fees are directly tied to maintaining and operating the physical property.

Services Included in Asset Management Fees

Asset management fees in real estate primarily cover strategic oversight such as financial reporting, investment analysis, and portfolio optimization to maximize property value. These fees encompass services like market research, budgeting, capital improvement planning, and tenant relationship management, which extend beyond routine property maintenance. Unlike property management fees that focus on daily operations, asset management fees ensure long-term profitability and asset growth through proactive decision-making and performance monitoring.

Fee Structures and Calculation Methods

Property management fees are typically calculated as a fixed percentage of the monthly rental income, often ranging from 4% to 12%, covering day-to-day operational tasks like tenant screening, maintenance, and rent collection. Asset management fees, conversely, are structured as a percentage of the overall asset value or gross revenue, commonly between 0.5% and 2%, reflecting broader responsibilities such as investment strategy, financial reporting, and portfolio performance optimization. Understanding these distinctions in fee structures and calculation methods is crucial for investors aiming to balance operational costs with strategic asset growth in real estate portfolios.

Impact on Investors’ Returns

Property management fees typically range from 4% to 10% of collected rents and directly affect net operating income by covering day-to-day operational costs, thereby reducing immediate cash flow to investors. Asset management fees, often charged as 1% to 2% of the asset's gross value or revenue, impact investor returns by influencing long-term investment performance through strategic decisions and financial oversight. Understanding the distinction and scale of these fees is crucial for investors to accurately forecast net returns and evaluate overall investment viability in real estate portfolios.

How to Choose Between Property and Asset Management

Choosing between property management fees and asset management fees depends on the level of involvement and scope of services required for your real estate investment. Property management fees generally cover day-to-day operations such as tenant relations, maintenance, and rent collection, making them ideal for hands-on landlords seeking operational efficiency. Asset management fees include strategic oversight, financial analysis, and portfolio optimization, suited for investors prioritizing long-term value growth and comprehensive asset performance.

Frequently Asked Questions about Management Fees

Property Management Fees typically cover day-to-day operations such as tenant relations, rent collection, and maintenance coordination, often calculated as a percentage of collected rent, usually between 4% and 10%. Asset Management Fees are charged for overseeing the investment strategy, financial performance, and long-term value of the property, generally ranging from 0.5% to 2% of the asset's total value or gross income. Frequently asked questions focus on the distinction between these fees, their impact on net revenue, and how each fee supports different aspects of real estate portfolio management.

Property Management Fee vs Asset Management Fee Infographic

difterm.com

difterm.com