Underwriting in real estate involves evaluating the risk and financial viability of a loan application to determine approval, focusing on creditworthiness, collateral, and income verification. Processing centers on gathering, organizing, and verifying all necessary documentation to ensure the loan file is complete and ready for underwriting review. Efficient collaboration between underwriting and processing teams accelerates loan approval times and enhances transaction accuracy.

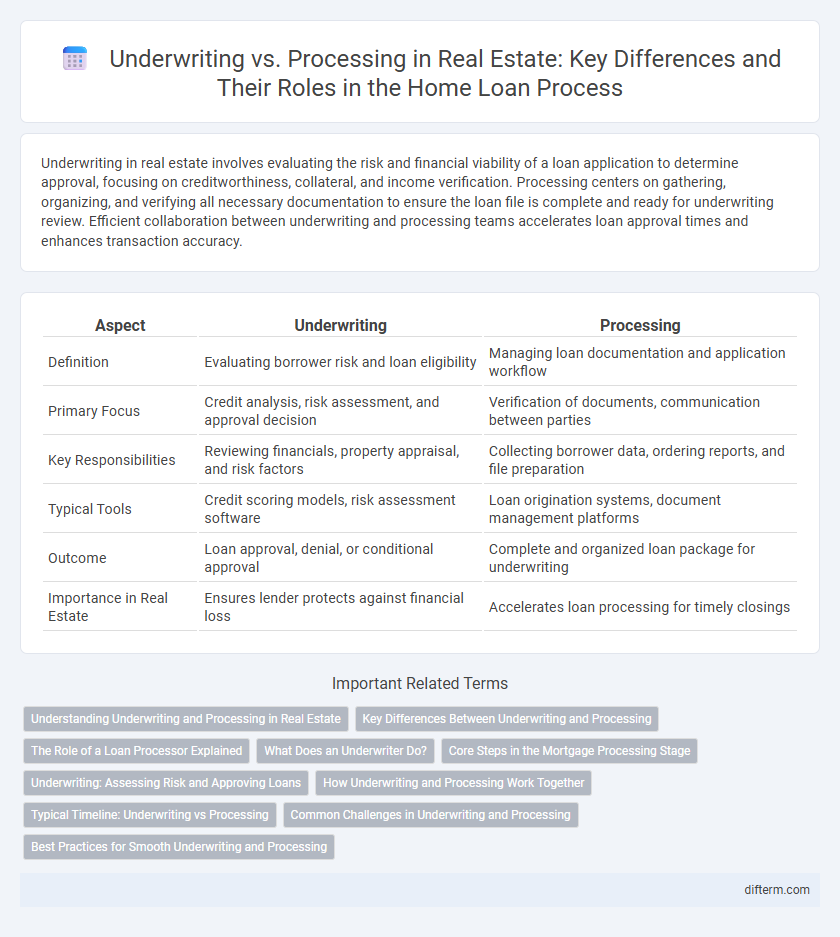

Table of Comparison

| Aspect | Underwriting | Processing |

|---|---|---|

| Definition | Evaluating borrower risk and loan eligibility | Managing loan documentation and application workflow |

| Primary Focus | Credit analysis, risk assessment, and approval decision | Verification of documents, communication between parties |

| Key Responsibilities | Reviewing financials, property appraisal, and risk factors | Collecting borrower data, ordering reports, and file preparation |

| Typical Tools | Credit scoring models, risk assessment software | Loan origination systems, document management platforms |

| Outcome | Loan approval, denial, or conditional approval | Complete and organized loan package for underwriting |

| Importance in Real Estate | Ensures lender protects against financial loss | Accelerates loan processing for timely closings |

Understanding Underwriting and Processing in Real Estate

Underwriting in real estate involves evaluating the financial risk and verifying the borrower's creditworthiness, income, and property value to approve or deny a mortgage loan. Processing focuses on gathering, organizing, and submitting all necessary documentation, such as tax returns, employment verification, and property appraisals, to ensure the loan application meets lender requirements. Understanding these distinct phases is crucial for efficient loan approval and risk assessment in real estate transactions.

Key Differences Between Underwriting and Processing

Underwriting involves the detailed assessment of a borrower's financial risk, creditworthiness, and property value to approve or deny a mortgage loan, while processing focuses on gathering and organizing necessary documentation for loan approval. Underwriters analyze income verification, credit reports, and property appraisals, whereas processors ensure all paperwork, such as loan applications and disclosures, is complete and accurate. The key difference lies in underwriting making final risk decisions and processors managing the administrative workflow to support underwriting.

The Role of a Loan Processor Explained

A loan processor plays a crucial role in real estate financing by gathering and organizing all necessary documentation to ensure loan applications meet underwriting standards. They verify financial information, coordinate between borrowers, lenders, and underwriters, and prepare files for thorough underwriting assessment. This meticulous process helps streamline loan approval and closing timelines, enhancing overall transaction efficiency.

What Does an Underwriter Do?

An underwriter in real estate evaluates loan applications by assessing the borrower's creditworthiness, property value, and risk factors to determine loan approval eligibility. They analyze credit reports, employment history, and appraisals to ensure the loan meets lender guidelines and regulatory requirements. The underwriter's decision plays a critical role in mitigating financial risk for the lender and ensuring a smooth loan approval process.

Core Steps in the Mortgage Processing Stage

Mortgage processing involves key steps such as verifying borrower documentation, ordering property appraisals, and coordinating credit reports to ensure loan eligibility. Accurate data collection and validation are critical to prepare the file for underwriting review and to prevent delays. This stage directly impacts underwriting efficiency by providing a comprehensive and organized loan application package.

Underwriting: Assessing Risk and Approving Loans

Underwriting in real estate involves evaluating a borrower's creditworthiness, income, and property value to assess loan risk and ensure compliance with lending guidelines. This critical process determines whether a mortgage loan is approved or denied based on risk analysis and financial documentation verification. Effective underwriting minimizes the risk of default and ensures that loan terms align with both borrower capacity and market conditions.

How Underwriting and Processing Work Together

Underwriting and processing work together by ensuring comprehensive evaluation and management of mortgage applications, where processing gathers and organizes all necessary documentation while underwriting assesses risk and creditworthiness based on this information. The processor compiles income statements, credit reports, and property details to create a complete file for the underwriter, who then analyzes the data to approve, suspend, or deny the loan. This collaboration streamlines loan approval, reduces errors, and accelerates the home financing timeline.

Typical Timeline: Underwriting vs Processing

Underwriting in real estate typically takes 24 to 72 hours, focusing on risk assessment, credit evaluation, and loan approval decisions. Processing generally spans 7 to 10 days, involving document collection, verification, and preparation for underwriting. Efficient coordination between underwriting and processing accelerates overall loan closure timelines.

Common Challenges in Underwriting and Processing

Common challenges in underwriting include accurately assessing borrower creditworthiness, verifying income documentation, and analyzing property value fluctuations, which impact risk evaluation. Processing faces obstacles such as managing document collection efficiently, ensuring compliance with lender requirements, and maintaining clear communication between buyers, lenders, and agents. Both stages demand precise coordination to minimize delays and prevent errors in the mortgage approval workflow.

Best Practices for Smooth Underwriting and Processing

Streamline underwriting and processing by ensuring thorough documentation verification and clear communication between loan officers and underwriters to reduce errors and delays. Implement automated systems for data entry and status tracking to enhance accuracy and transparency throughout the mortgage approval process. Prioritize early identification of potential risks and discrepancies to facilitate prompt resolution and maintain loan pipeline efficiency.

Underwriting vs Processing Infographic

difterm.com

difterm.com