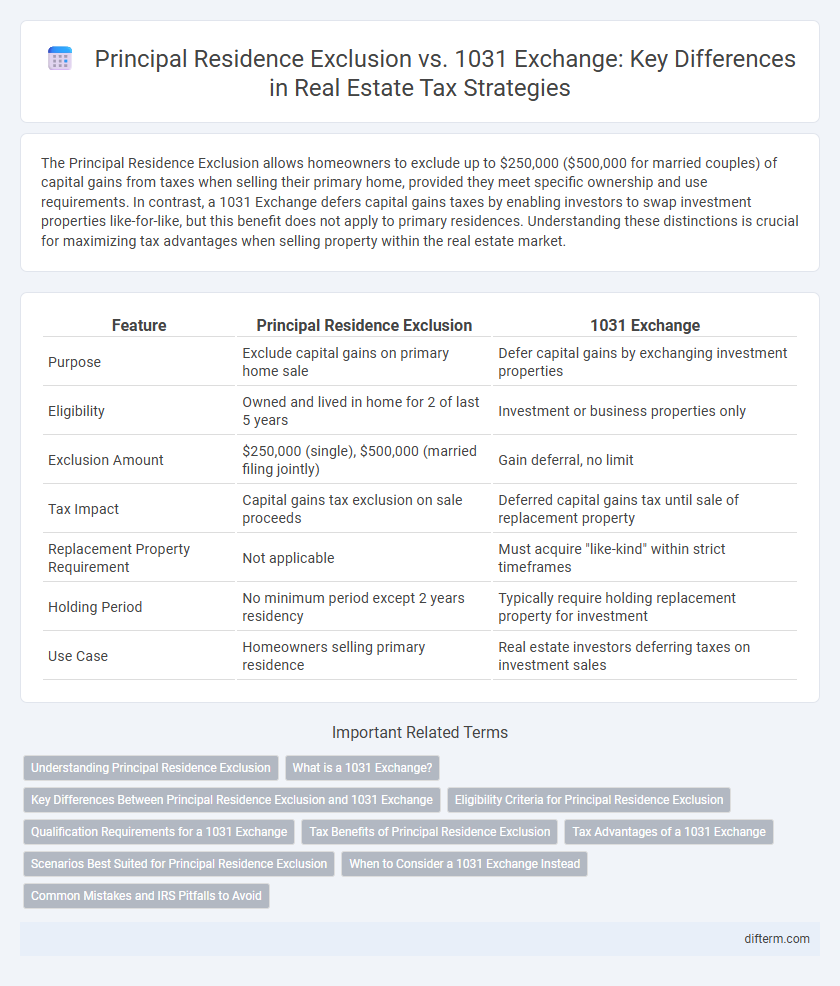

The Principal Residence Exclusion allows homeowners to exclude up to $250,000 ($500,000 for married couples) of capital gains from taxes when selling their primary home, provided they meet specific ownership and use requirements. In contrast, a 1031 Exchange defers capital gains taxes by enabling investors to swap investment properties like-for-like, but this benefit does not apply to primary residences. Understanding these distinctions is crucial for maximizing tax advantages when selling property within the real estate market.

Table of Comparison

| Feature | Principal Residence Exclusion | 1031 Exchange |

|---|---|---|

| Purpose | Exclude capital gains on primary home sale | Defer capital gains by exchanging investment properties |

| Eligibility | Owned and lived in home for 2 of last 5 years | Investment or business properties only |

| Exclusion Amount | $250,000 (single), $500,000 (married filing jointly) | Gain deferral, no limit |

| Tax Impact | Capital gains tax exclusion on sale proceeds | Deferred capital gains tax until sale of replacement property |

| Replacement Property Requirement | Not applicable | Must acquire "like-kind" within strict timeframes |

| Holding Period | No minimum period except 2 years residency | Typically require holding replacement property for investment |

| Use Case | Homeowners selling primary residence | Real estate investors deferring taxes on investment sales |

Understanding Principal Residence Exclusion

The Principal Residence Exclusion allows homeowners to exclude up to $250,000 ($500,000 for married couples) of capital gains from the sale of their primary home, provided they have lived in the property for at least two of the last five years. This exclusion offers substantial tax savings by reducing the taxable amount upon sale, encouraging long-term homeownership. Unlike the 1031 Exchange, which defers taxes by reinvesting proceeds into similar investment properties, the Principal Residence Exclusion applies solely to personal residences and provides a direct exclusion rather than a deferral.

What is a 1031 Exchange?

A 1031 Exchange is a tax-deferment strategy that allows real estate investors to sell an investment property and reinvest the proceeds into a like-kind property, deferring capital gains taxes. This exchange is governed by Section 1031 of the Internal Revenue Code and requires strict adherence to timelines and property identification rules. Unlike the Principal Residence Exclusion, which applies to primary homes, a 1031 Exchange is exclusively designed for investment properties to optimize tax savings.

Key Differences Between Principal Residence Exclusion and 1031 Exchange

The Principal Residence Exclusion allows homeowners to exclude up to $250,000 ($500,000 for married couples) of capital gains on the sale of their primary residence, provided they meet specific residency requirements. In contrast, a 1031 Exchange defers capital gains taxes by reinvesting proceeds from an investment property sale into a like-kind property, targeting investors rather than primary homeowners. Key differences include eligibility criteria, the type of property involved, and the tax treatment--exclusion versus deferral--impacting the timing and strategy for tax benefits in real estate transactions.

Eligibility Criteria for Principal Residence Exclusion

To qualify for the Principal Residence Exclusion, taxpayers must have owned and used the home as their primary residence for at least two of the five years preceding the sale. This exclusion allows exclusion of up to $250,000 of capital gains ($500,000 for married couples filing jointly) from taxable income. Unlike the 1031 Exchange, which requires investment properties and property swaps, the Principal Residence Exclusion specifically applies only to personal residences meeting strict ownership and use criteria.

Qualification Requirements for a 1031 Exchange

A 1031 Exchange requires the property to be held for investment or business purposes, not as a primary residence. To qualify, the investor must identify a replacement property within 45 days and complete the purchase within 180 days of selling the original property. Proper documentation and the use of a qualified intermediary are essential to meet IRS regulations and maintain tax-deferred status.

Tax Benefits of Principal Residence Exclusion

The Principal Residence Exclusion allows homeowners to exclude up to $250,000 ($500,000 for married couples) of capital gains from the sale of their primary residence, significantly reducing taxable income. This tax benefit applies if the property has been owned and lived in for at least two of the last five years, providing substantial savings without the reinvestment requirements of a 1031 Exchange. Unlike the 1031 Exchange, which defers taxes by rolling gains into a new investment property, the Principal Residence Exclusion offers immediate, permanent exclusion of gains, making it highly advantageous for personal real estate transactions.

Tax Advantages of a 1031 Exchange

A 1031 Exchange offers significant tax advantages by allowing investors to defer capital gains taxes on the sale of an investment property when reinvesting the proceeds into a like-kind property. Unlike the Principal Residence Exclusion, which provides a limited capital gains exclusion up to $250,000 ($500,000 for married couples) only on primary residences, a 1031 Exchange applies specifically to investment and business properties. This deferral strategy helps real estate investors maximize equity growth and leverage without immediate tax liability, making it a powerful tool for portfolio expansion.

Scenarios Best Suited for Principal Residence Exclusion

The Principal Residence Exclusion is best suited for homeowners who sell their primary residence and have lived there for at least two of the last five years, allowing exclusion of up to $250,000 ($500,000 for married couples) in capital gains from taxable income. This exclusion applies specifically to personal residences rather than investment properties, making it ideal for individuals seeking to reduce tax liability on their main home sale. Taxpayers who do not intend to reinvest in other real estate or who sell due to personal reasons such as relocation or downsizing benefit most from utilizing the Principal Residence Exclusion.

When to Consider a 1031 Exchange Instead

Investors should consider a 1031 exchange when deferring capital gains taxes by reinvesting proceeds into a like-kind property aligns with their long-term investment goals, especially for rental or investment properties rather than primary residences. Unlike the Principal Residence Exclusion, which allows homeowners to exclude up to $250,000 ($500,000 for married couples) in capital gains from the sale of a primary residence, a 1031 exchange enables tax deferral on investment property sales by meeting strict timeline and property identification rules. Property owners seeking to build wealth through portfolio diversification or upgrade investment properties without immediate tax consequences benefit most from utilizing the 1031 exchange strategy.

Common Mistakes and IRS Pitfalls to Avoid

Many homeowners mistakenly apply the Principal Residence Exclusion to investment or rental properties, which disqualifies them from the capital gains tax exemption. Misunderstanding the timelines and usage requirements for the 1031 Exchange often leads to disqualification, triggering immediate tax liability. Ignoring IRS documentation mandates and failing to reinvest proceeds within the 45- and 180-day windows can cause loss of tax-deferral benefits in property transactions.

Principal Residence Exclusion vs 1031 Exchange Infographic

difterm.com

difterm.com