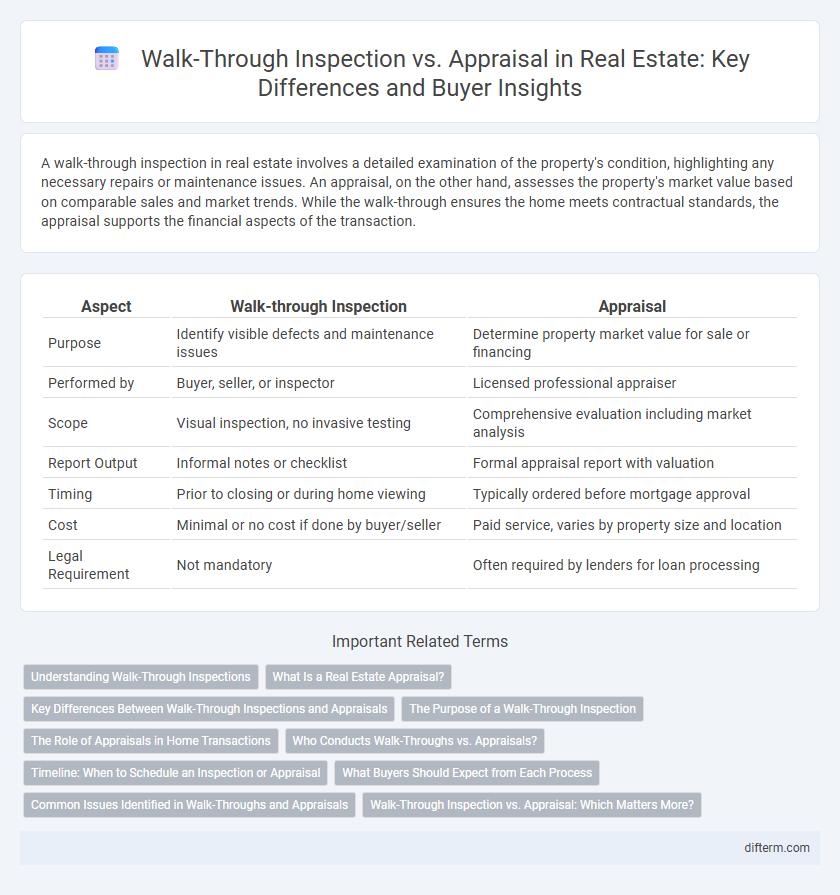

A walk-through inspection in real estate involves a detailed examination of the property's condition, highlighting any necessary repairs or maintenance issues. An appraisal, on the other hand, assesses the property's market value based on comparable sales and market trends. While the walk-through ensures the home meets contractual standards, the appraisal supports the financial aspects of the transaction.

Table of Comparison

| Aspect | Walk-through Inspection | Appraisal |

|---|---|---|

| Purpose | Identify visible defects and maintenance issues | Determine property market value for sale or financing |

| Performed by | Buyer, seller, or inspector | Licensed professional appraiser |

| Scope | Visual inspection, no invasive testing | Comprehensive evaluation including market analysis |

| Report Output | Informal notes or checklist | Formal appraisal report with valuation |

| Timing | Prior to closing or during home viewing | Typically ordered before mortgage approval |

| Cost | Minimal or no cost if done by buyer/seller | Paid service, varies by property size and location |

| Legal Requirement | Not mandatory | Often required by lenders for loan processing |

Understanding Walk-Through Inspections

Walk-through inspections enable buyers and sellers to verify the property's condition before closing, ensuring all agreed repairs are completed and no new damage has occurred. Unlike appraisals that assess property value based on market trends, walk-throughs focus on the physical state, including fixtures, appliances, and overall cleanliness. A thorough walk-through inspection minimizes post-sale disputes by confirming the home meets contractual standards.

What Is a Real Estate Appraisal?

A real estate appraisal is a professional assessment that determines the market value of a property based on factors such as location, condition, comparable sales, and current market trends. Unlike a walk-through inspection, which primarily evaluates the physical condition and identifies potential maintenance issues, an appraisal provides an objective monetary value crucial for mortgage approval, refinancing, or sale negotiations. Licensed appraisers use standardized methods and industry guidelines to ensure the valuation reflects accurate and fair market pricing.

Key Differences Between Walk-Through Inspections and Appraisals

Walk-through inspections primarily assess the physical condition and functionality of a property, identifying any immediate repairs or safety issues. Appraisals focus on determining the property's market value by analyzing comparable sales, location, and overall real estate trends. While both are crucial in real estate transactions, inspections detail property condition and appraisals establish financial worth.

The Purpose of a Walk-Through Inspection

The purpose of a walk-through inspection in real estate is to verify the property's condition before closing, ensuring all agreed-upon repairs are completed and no new damages have occurred. This final check helps buyers confirm that the home matches the contract specifications and is ready for occupancy. Walk-through inspections focus on identifying any physical issues, whereas appraisals primarily assess the property's market value.

The Role of Appraisals in Home Transactions

Appraisals play a critical role in home transactions by providing an unbiased, professional evaluation of a property's market value, ensuring buyers and lenders make informed financial decisions. Unlike walk-through inspections that primarily assess the physical condition of the home, appraisals analyze comparable sales, market trends, and property features to determine fair market price. Lenders rely heavily on appraisals to mitigate risk and confirm that the home's value supports the loan amount, making appraisals essential for mortgage approval and closing processes.

Who Conducts Walk-Throughs vs. Appraisals?

Walk-through inspections are typically conducted by buyers or their real estate agents to verify the property's condition before closing, ensuring all repairs and agreed-upon terms are met. Appraisals are performed by licensed appraisers who assess the property's market value based on factors like location, comparable sales, and property condition. Understanding the distinct roles helps buyers and sellers navigate the transaction process with clarity and confidence.

Timeline: When to Schedule an Inspection or Appraisal

Walk-through inspections are typically scheduled just before closing to ensure the property's condition matches the contract terms, usually within days of finalizing the sale. Appraisals should be arranged early in the mortgage process, often immediately after the offer is accepted, to provide a timely property valuation that supports financing approval. Coordinating these timelines ensures both the buyer's protection and lender requirements are met efficiently.

What Buyers Should Expect from Each Process

During a walk-through inspection, buyers should expect a detailed evaluation of the property's condition, identifying any needed repairs or maintenance issues before closing. An appraisal focuses on determining the property's market value through a professional assessment of comparable sales and neighborhood trends. Understanding these distinctions helps buyers make informed decisions about negotiations and financing.

Common Issues Identified in Walk-Throughs and Appraisals

Walk-through inspections commonly reveal immediate physical issues such as water damage, broken fixtures, and cleanliness, allowing buyers to address these before closing. Appraisals typically identify value-impacting factors including structural problems, outdated systems, and neighborhood market conditions that influence property worth. Both processes highlight discrepancies that can affect transaction decisions, yet walk-throughs emphasize condition verification while appraisals focus on valuation accuracy.

Walk-Through Inspection vs. Appraisal: Which Matters More?

Walk-through inspections provide a hands-on evaluation of a property's current condition, identifying immediate repair needs and safety concerns before closing. Appraisals determine a property's market value based on comparable sales, location, and overall features to ensure fair financing terms. For homebuyers, the walk-through inspection matters more to verify property condition, while lenders prioritize appraisals for accurate valuation.

Walk-through inspection vs appraisal Infographic

difterm.com

difterm.com