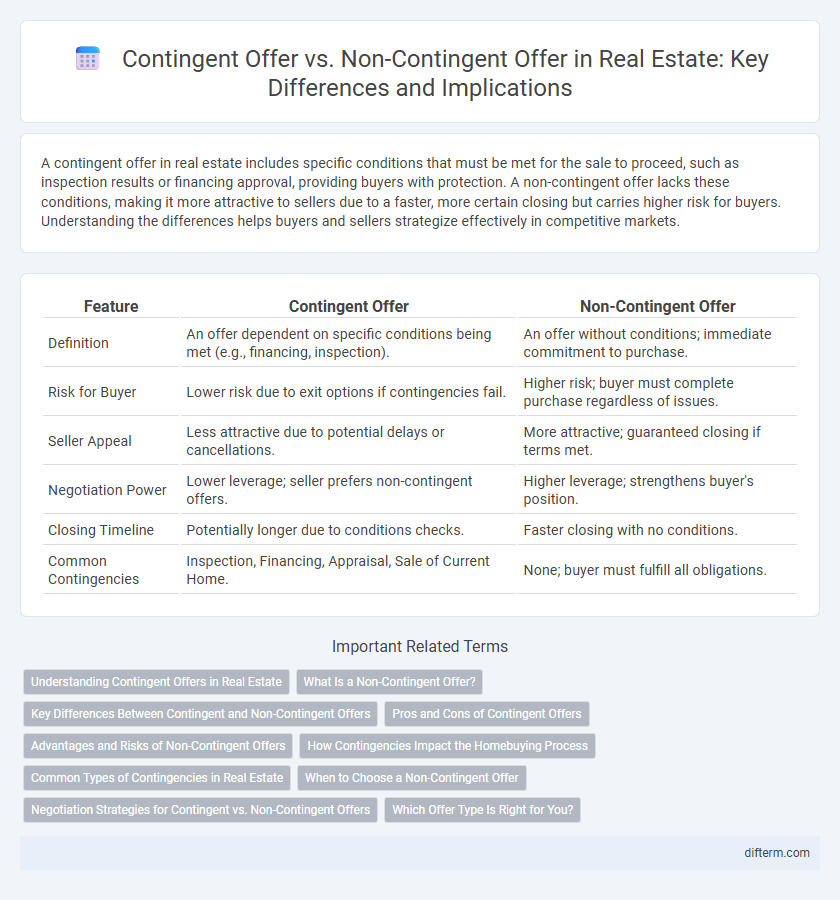

A contingent offer in real estate includes specific conditions that must be met for the sale to proceed, such as inspection results or financing approval, providing buyers with protection. A non-contingent offer lacks these conditions, making it more attractive to sellers due to a faster, more certain closing but carries higher risk for buyers. Understanding the differences helps buyers and sellers strategize effectively in competitive markets.

Table of Comparison

| Feature | Contingent Offer | Non-Contingent Offer |

|---|---|---|

| Definition | An offer dependent on specific conditions being met (e.g., financing, inspection). | An offer without conditions; immediate commitment to purchase. |

| Risk for Buyer | Lower risk due to exit options if contingencies fail. | Higher risk; buyer must complete purchase regardless of issues. |

| Seller Appeal | Less attractive due to potential delays or cancellations. | More attractive; guaranteed closing if terms met. |

| Negotiation Power | Lower leverage; seller prefers non-contingent offers. | Higher leverage; strengthens buyer's position. |

| Closing Timeline | Potentially longer due to conditions checks. | Faster closing with no conditions. |

| Common Contingencies | Inspection, Financing, Appraisal, Sale of Current Home. | None; buyer must fulfill all obligations. |

Understanding Contingent Offers in Real Estate

Contingent offers in real estate depend on specific conditions being met, such as securing financing, home inspections, or the sale of the buyer's current property, which can protect buyers from contractual obligations if contingencies fail. Non-contingent offers, however, are unconditional and signal a stronger commitment, often making them more attractive to sellers in competitive markets. Understanding these distinctions helps buyers and sellers navigate negotiations strategically to balance risk and advantage.

What Is a Non-Contingent Offer?

A non-contingent offer in real estate is a purchase proposal made without any conditions that must be met for the deal to proceed, such as financing approval, home inspection, or sale of another property. This type of offer provides sellers with greater certainty and is often favored in competitive markets because it reduces the risk of the transaction falling through. Buyers making non-contingent offers typically have secured their financing and are prepared to close quickly, enhancing their appeal to sellers.

Key Differences Between Contingent and Non-Contingent Offers

Contingent offers in real estate include specific conditions buyers must meet, such as securing financing, completing home inspections, or selling an existing property, which can delay or cancel the sale if unmet. Non-contingent offers present a stronger, more attractive proposal to sellers by removing these conditions, often resulting in quicker closings and higher chances of acceptance. Understanding these key differences helps buyers and sellers strategically navigate negotiations and market competitiveness.

Pros and Cons of Contingent Offers

Contingent offers in real estate allow buyers to secure a property while relying on specific conditions, such as financing approval or home inspection results, providing a safety net against unforeseen issues. These offers can delay the closing process and may be less attractive to sellers seeking a quick, guaranteed sale, potentially reducing the buyer's negotiating power. However, contingencies protect buyers from financial loss and ensure the property meets their expectations before finalizing the purchase.

Advantages and Risks of Non-Contingent Offers

Non-contingent offers in real estate provide sellers with a faster, more certain closing by eliminating conditions like financing or inspections, reducing the risk of deal fall-through. Buyers presenting non-contingent offers often stand out in competitive markets, increasing their chances of winning bidding wars. However, these offers carry higher risks for buyers, including potential financial loss if the property has undisclosed issues or if their financing falls through after commitment.

How Contingencies Impact the Homebuying Process

Contingencies in real estate contracts, such as inspection and financing conditions, protect buyers by allowing them to back out or renegotiate if specific criteria are not met, potentially causing delays in the homebuying process. Non-contingent offers, often favored by sellers for their certainty and speed, require buyers to proceed without these protections, increasing risk but enhancing competitiveness in a tight market. Understanding how contingencies affect timelines and negotiation power is crucial for buyers aiming to balance security and appeal in their purchase offers.

Common Types of Contingencies in Real Estate

Common types of contingencies in real estate include financing contingencies, inspection contingencies, and appraisal contingencies, each protecting buyers during the purchase process. Financing contingencies allow buyers to back out if they fail to secure a mortgage, while inspection contingencies enable renegotiation or cancellation based on property condition. Appraisal contingencies protect buyers from paying more than the home's appraised value, making these clauses critical in contingent offers compared to non-contingent offers that lack such protections.

When to Choose a Non-Contingent Offer

A non-contingent offer is ideal when competing in a seller's market or seeking to secure a property quickly without conditions that could delay closing. Buyers confident in their financing and inspection results choose non-contingent offers to strengthen their position and reduce the risk of deal fallout. This strategy is particularly effective for investment properties, foreclosure purchases, or when the buyer has completed prior due diligence.

Negotiation Strategies for Contingent vs. Non-Contingent Offers

Negotiation strategies for contingent offers often involve leveraging flexibility to address the seller's concerns about potential delays or uncertainties, such as financing or inspection contingencies. In contrast, non-contingent offers--free from conditions--can command stronger bargaining power by providing sellers with confidence in a quicker, more certain closing. Agents skilled in real estate negotiations tailor their approach by emphasizing risk mitigation in contingent offers while highlighting certainty and speed with non-contingent bids to optimize deal outcomes.

Which Offer Type Is Right for You?

A contingent offer includes specific conditions that must be met for the sale to proceed, such as inspections or financing approval, providing buyers with protections but potentially making the offer less competitive. A non-contingent offer removes these conditions, appealing to sellers seeking a faster, more secure transaction but increasing risk for the buyer. Choosing the right offer depends on your financial situation, risk tolerance, and market competitiveness to balance protection and attractiveness.

contingent offer vs non-contingent offer Infographic

difterm.com

difterm.com