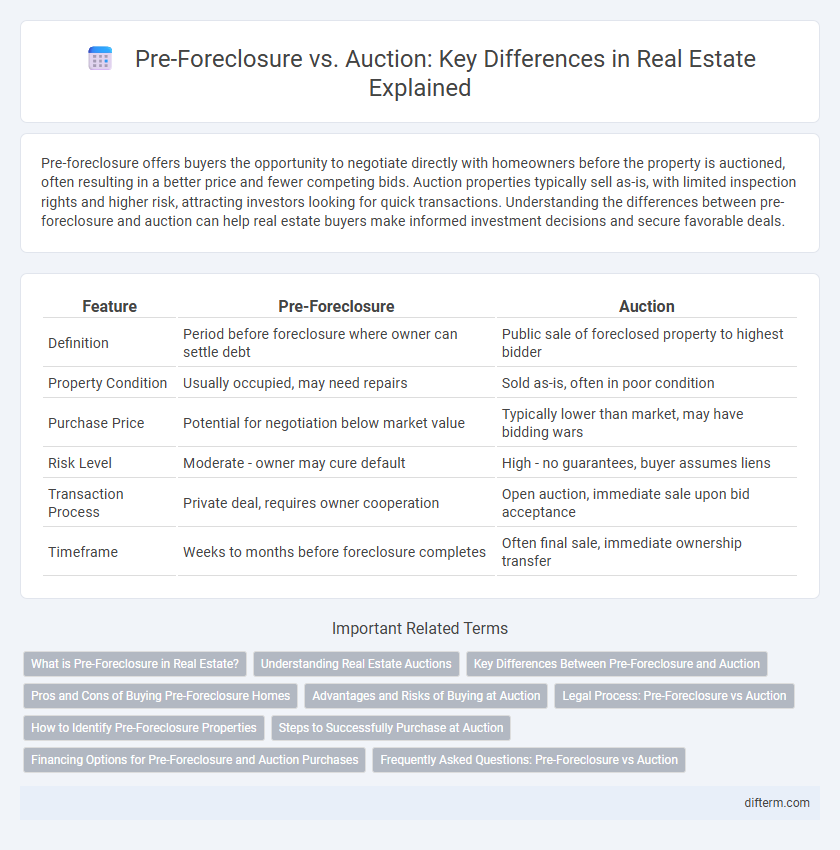

Pre-foreclosure offers buyers the opportunity to negotiate directly with homeowners before the property is auctioned, often resulting in a better price and fewer competing bids. Auction properties typically sell as-is, with limited inspection rights and higher risk, attracting investors looking for quick transactions. Understanding the differences between pre-foreclosure and auction can help real estate buyers make informed investment decisions and secure favorable deals.

Table of Comparison

| Feature | Pre-Foreclosure | Auction |

|---|---|---|

| Definition | Period before foreclosure where owner can settle debt | Public sale of foreclosed property to highest bidder |

| Property Condition | Usually occupied, may need repairs | Sold as-is, often in poor condition |

| Purchase Price | Potential for negotiation below market value | Typically lower than market, may have bidding wars |

| Risk Level | Moderate - owner may cure default | High - no guarantees, buyer assumes liens |

| Transaction Process | Private deal, requires owner cooperation | Open auction, immediate sale upon bid acceptance |

| Timeframe | Weeks to months before foreclosure completes | Often final sale, immediate ownership transfer |

What is Pre-Foreclosure in Real Estate?

Pre-foreclosure in real estate refers to the period after a homeowner misses mortgage payments but before the lender officially repossesses the property. During this time, the owner has the opportunity to negotiate with the lender, sell the home, or catch up on payments to avoid foreclosure. Pre-foreclosure properties often present potential investment opportunities due to pricing below market value compared to auction sales, which occur after foreclosure is finalized.

Understanding Real Estate Auctions

Real estate auctions offer a transparent and time-sensitive method for acquiring properties, often involving pre-foreclosure homes where sellers aim to avoid full foreclosure by negotiating repayment. Understanding the auction process is crucial, as properties are sold as-is with limited inspection opportunities, requiring buyers to conduct thorough due diligence on liens, title status, and market value. Auctions typically feature competitive bidding that can lead to below-market prices, but also carry risks like immediate payment requirements and minimal recourse post-sale.

Key Differences Between Pre-Foreclosure and Auction

Pre-foreclosure occurs when a homeowner defaults on mortgage payments but the property has not yet been repossessed by the lender, allowing potential buyers to negotiate directly with the owner for a sale. Auctions take place after the lender has initiated the foreclosure process, where the property is sold to the highest bidder, often at a public auction. Key differences include negotiation possibilities, timing in the foreclosure process, and the level of risk associated with property condition and title clarity.

Pros and Cons of Buying Pre-Foreclosure Homes

Buying pre-foreclosure homes offers the advantage of negotiating directly with homeowners, often resulting in lower prices compared to market value, but it requires thorough due diligence to uncover any liens or outstanding debts. Pre-foreclosure purchases generally provide more time to complete transactions than auction sales, yet the process can be lengthy and uncertain if lenders intervene or if the homeowner resolves the default. Opposite an auction's quick sale and clear title, pre-foreclosure deals carry risks such as potential hidden costs and the possibility of losing the property if the owner cures the default before closing.

Advantages and Risks of Buying at Auction

Buying Real Estate at Auction offers the advantage of potentially acquiring properties below market value, providing investors and homebuyers with opportunities for significant financial gains. Auction purchases involve risks such as limited property inspections, cash payment requirements, and the possibility of hidden liens or repairs needed, which can increase costs unexpectedly. Understanding the auction process, including bidder requirements and legal obligations, helps mitigate risks and maximize the benefits of purchasing pre-foreclosure or auction properties.

Legal Process: Pre-Foreclosure vs Auction

The legal process in pre-foreclosure involves the homeowner receiving a default notice and having a redemption period to cure the debt and avoid losing the property. In contrast, the auction stage occurs after foreclosure proceedings are complete, where the property is publicly sold to the highest bidder, often without further opportunity for the original owner to reclaim the home. Understanding these distinct legal timelines is crucial for buyers and sellers navigating distressed property transactions.

How to Identify Pre-Foreclosure Properties

Pre-foreclosure properties can be identified through public records indicating a Notice of Default or Lis Pendens filed by the lender, signaling the homeowner is behind on mortgage payments. Online real estate databases and county clerk's websites often provide access to these foreclosure notices, enabling investors to spot potential opportunities before the property reaches auction. Monitoring local courthouse postings and subscribing to foreclosure listing services also helps in tracking pre-foreclosure status early.

Steps to Successfully Purchase at Auction

Understanding the steps to successfully purchase real estate at auction involves thorough research of pre-foreclosure properties, verifying auction terms, and securing financing before bidding. Potential buyers must inspect the property beforehand, register with the auction house, and set a clear bidding limit to avoid overspending. Winning bidders are typically required to make a deposit immediately and complete the transaction within a specific timeframe to finalize ownership.

Financing Options for Pre-Foreclosure and Auction Purchases

Pre-foreclosure properties often allow buyers to secure traditional financing, including conventional loans, FHA loans, and VA loans, providing more flexibility in purchase terms. Auction purchases typically require cash or proof of immediate financing due to strict payment deadlines and minimal seller negotiations. Understanding these financing differences is crucial for buyers targeting investment opportunities or affordable homes in the distressed real estate market.

Frequently Asked Questions: Pre-Foreclosure vs Auction

Pre-foreclosure occurs when a homeowner defaults on mortgage payments but retains ownership while negotiating with lenders to avoid foreclosure. Auctions happen when the property is publicly sold, often at a courthouse or online, after the foreclosure process is complete, typically resulting in a new owner acquiring the property at a potentially reduced price. Buyers often ask about the risks, timelines, and potential for negotiating directly with owners during pre-foreclosure compared to the competitive nature and finality of auction sales.

Pre-Foreclosure vs Auction Infographic

difterm.com

difterm.com