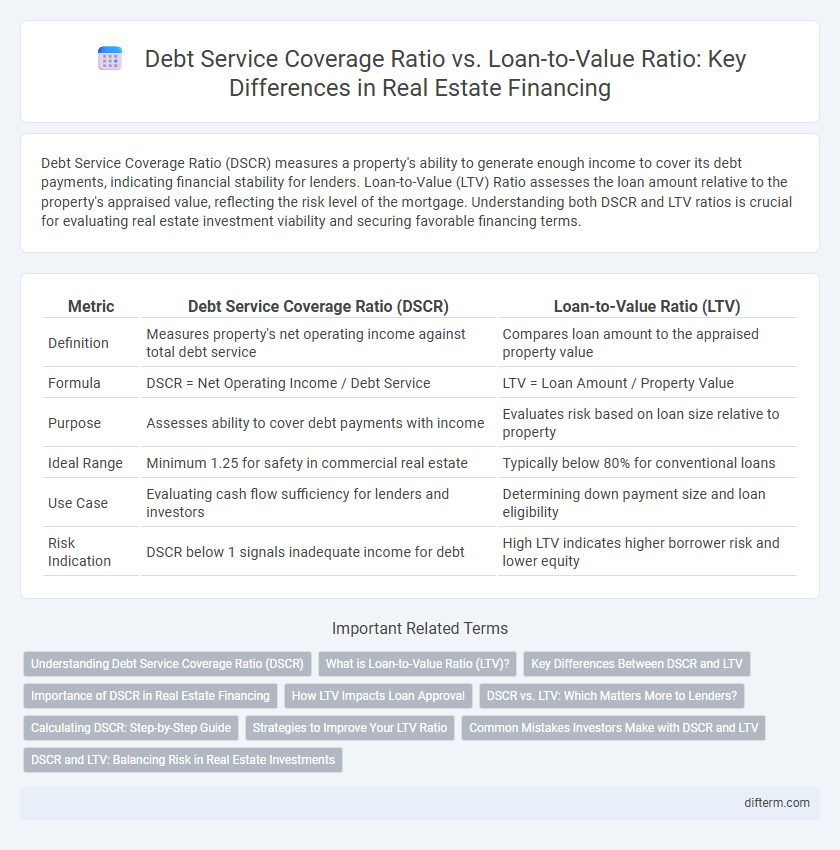

Debt Service Coverage Ratio (DSCR) measures a property's ability to generate enough income to cover its debt payments, indicating financial stability for lenders. Loan-to-Value (LTV) Ratio assesses the loan amount relative to the property's appraised value, reflecting the risk level of the mortgage. Understanding both DSCR and LTV ratios is crucial for evaluating real estate investment viability and securing favorable financing terms.

Table of Comparison

| Metric | Debt Service Coverage Ratio (DSCR) | Loan-to-Value Ratio (LTV) |

|---|---|---|

| Definition | Measures property's net operating income against total debt service | Compares loan amount to the appraised property value |

| Formula | DSCR = Net Operating Income / Debt Service | LTV = Loan Amount / Property Value |

| Purpose | Assesses ability to cover debt payments with income | Evaluates risk based on loan size relative to property |

| Ideal Range | Minimum 1.25 for safety in commercial real estate | Typically below 80% for conventional loans |

| Use Case | Evaluating cash flow sufficiency for lenders and investors | Determining down payment size and loan eligibility |

| Risk Indication | DSCR below 1 signals inadequate income for debt | High LTV indicates higher borrower risk and lower equity |

Understanding Debt Service Coverage Ratio (DSCR)

Debt Service Coverage Ratio (DSCR) measures a property's ability to generate enough income to cover its debt obligations by comparing net operating income (NOI) to total debt service. A DSCR greater than 1 indicates sufficient income to cover debt payments, essential for lenders assessing loan risk in real estate financing. Understanding DSCR helps investors evaluate property cash flow stability and ensures loan terms align with income generation capacity.

What is Loan-to-Value Ratio (LTV)?

Loan-to-Value Ratio (LTV) measures the loan amount against the property's appraised value or purchase price, serving as a key risk indicator in real estate financing. A lower LTV ratio suggests less risk for lenders, as it indicates higher borrower equity and greater property value relative to the loan. LTV is critical for determining mortgage eligibility, interest rates, and insurance requirements in property transactions.

Key Differences Between DSCR and LTV

Debt Service Coverage Ratio (DSCR) measures a property's ability to generate enough net operating income to cover its debt payments, with a ratio above 1 indicating positive cash flow. Loan-to-Value Ratio (LTV) compares the loan amount to the appraised property value, reflecting the risk level for lenders by quantifying equity versus debt. The key difference lies in DSCR assessing income sufficiency for debt servicing, while LTV evaluates collateral risk based on property value.

Importance of DSCR in Real Estate Financing

The Debt Service Coverage Ratio (DSCR) is crucial in real estate financing as it measures a property's ability to generate sufficient income to cover debt payments, ensuring lenders assess risk accurately. Unlike the Loan-to-Value (LTV) ratio, which evaluates loan size relative to property value, DSCR focuses on cash flow performance and the property's operating income stability. A high DSCR indicates strong financial health, making it a key metric for securing favorable loan terms and protecting investors from potential default.

How LTV Impacts Loan Approval

Loan-to-Value (LTV) ratio is a critical metric in real estate financing that compares the loan amount to the appraised property value, directly impacting loan approval chances. Lenders require a lower LTV to minimize risk, as high LTV ratios indicate higher borrower leverage and increased default probability. A favorable LTV enhances approval odds by demonstrating sufficient borrower equity and collateral value, aligning with lender risk thresholds.

DSCR vs. LTV: Which Matters More to Lenders?

Debt Service Coverage Ratio (DSCR) measures a property's ability to generate sufficient income to cover debt payments, making it a critical indicator of loan repayment safety for lenders. Loan-to-Value Ratio (LTV) evaluates the loan amount relative to the property's value, assessing the lender's risk exposure in case of default. Lenders typically prioritize DSCR over LTV because consistent cash flow directly impacts loan performance, while LTV primarily influences the loan's collateral risk.

Calculating DSCR: Step-by-Step Guide

Calculating the Debt Service Coverage Ratio (DSCR) involves dividing the net operating income (NOI) of a property by its total debt service. Begin by accurately determining the NOI, which is the property's gross income minus operating expenses, excluding debt payments. Then, sum all principal and interest payments on the loan over a year to find total debt service, and divide NOI by this amount to obtain the DSCR, a critical metric for assessing a property's ability to cover its debt obligations.

Strategies to Improve Your LTV Ratio

Improving your Loan-to-Value (LTV) ratio involves increasing property equity and reducing loan amounts by making larger down payments or paying down existing debt. Enhancing property value through strategic renovations and regular maintenance can also boost the appraised value, directly lowering the LTV ratio. Monitoring market trends and refinancing at favorable terms can optimize borrowing capacity while maintaining a strong Debt Service Coverage Ratio (DSCR) for lender confidence.

Common Mistakes Investors Make with DSCR and LTV

Investors often misinterpret the debt service coverage ratio (DSCR) by overlooking operating expenses, leading to an inflated ability to service debt. Common mistakes with the loan-to-value (LTV) ratio include neglecting market fluctuations that affect property values, which can result in overleveraging. Properly balancing DSCR and LTV is critical to avoid cash flow issues and ensure sustainable property financing.

DSCR and LTV: Balancing Risk in Real Estate Investments

Debt Service Coverage Ratio (DSCR) measures a property's ability to generate enough income to cover its debt payments, highlighting cash flow stability crucial for lenders. Loan-to-Value Ratio (LTV) indicates the loan amount relative to the property's appraised value, reflecting the equity cushion protecting against market fluctuations. Balancing DSCR and LTV helps investors manage risk by ensuring sufficient income coverage while maintaining prudent leverage levels in real estate financing.

Debt Service Coverage Ratio vs Loan-to-Value Ratio Infographic

difterm.com

difterm.com