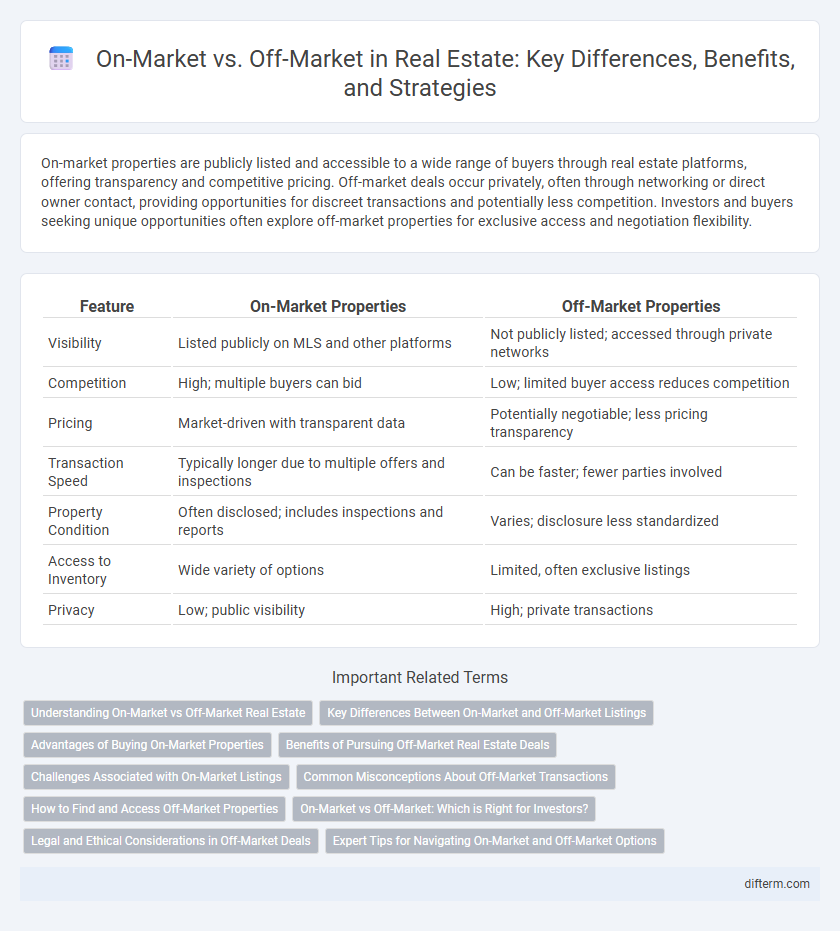

On-market properties are publicly listed and accessible to a wide range of buyers through real estate platforms, offering transparency and competitive pricing. Off-market deals occur privately, often through networking or direct owner contact, providing opportunities for discreet transactions and potentially less competition. Investors and buyers seeking unique opportunities often explore off-market properties for exclusive access and negotiation flexibility.

Table of Comparison

| Feature | On-Market Properties | Off-Market Properties |

|---|---|---|

| Visibility | Listed publicly on MLS and other platforms | Not publicly listed; accessed through private networks |

| Competition | High; multiple buyers can bid | Low; limited buyer access reduces competition |

| Pricing | Market-driven with transparent data | Potentially negotiable; less pricing transparency |

| Transaction Speed | Typically longer due to multiple offers and inspections | Can be faster; fewer parties involved |

| Property Condition | Often disclosed; includes inspections and reports | Varies; disclosure less standardized |

| Access to Inventory | Wide variety of options | Limited, often exclusive listings |

| Privacy | Low; public visibility | High; private transactions |

Understanding On-Market vs Off-Market Real Estate

On-market real estate listings are publicly advertised properties available for sale, maximizing exposure to potential buyers through multiple listing services (MLS) and real estate platforms. Off-market properties remain privately held and are not listed publicly, often sold through discreet channels such as direct outreach or agent networks, appealing to buyers seeking less competition. Understanding the distinctions between these approaches helps investors and homebuyers strategically navigate property acquisition and optimize negotiation leverage.

Key Differences Between On-Market and Off-Market Listings

On-market listings are publicly available properties advertised through multiple listing services (MLS), maximizing exposure to potential buyers and real estate agents. Off-market listings remain private, often marketed discreetly to select buyers or through exclusive networks, preserving seller confidentiality and reducing competition. Key differences include visibility, marketing strategy, and buyer access, with on-market listings offering transparency and broader reach, while off-market deals provide exclusivity and potentially faster negotiations.

Advantages of Buying On-Market Properties

Buying on-market properties offers increased transparency with access to multiple listings and public records, enabling buyers to make informed decisions. These properties often benefit from competitive pricing due to market competition among buyers, which can lead to fairer market value. Additionally, professional guidance from real estate agents and standardized transaction processes enhance the security and efficiency of on-market property purchases.

Benefits of Pursuing Off-Market Real Estate Deals

Pursuing off-market real estate deals offers the benefit of reduced competition, allowing buyers to negotiate better prices and terms without bidding wars. These transactions often provide access to unique or undervalued properties not listed on public platforms, enhancing investment potential. Sellers may also enjoy faster, more discreet sales processes, minimizing marketing expenses and privacy concerns.

Challenges Associated with On-Market Listings

On-market listings often face significant challenges such as heightened competition, which can drive prices down and extend time on the market. Public exposure increases scrutiny, limiting negotiation flexibility and revealing seller motivations to potential buyers. Moreover, on-market properties commonly attract speculative offers, complicating the sale process and requiring strategic pricing and marketing efforts.

Common Misconceptions About Off-Market Transactions

Off-market real estate transactions are often misunderstood as less transparent or risky, but they can offer privacy and reduced competition for buyers and sellers. Many believe off-market deals lack professional oversight, yet they frequently involve experienced brokers who manage confidential negotiations. Contrary to popular belief, off-market properties can sometimes yield better pricing and more flexible terms than on-market listings.

How to Find and Access Off-Market Properties

Finding off-market properties requires leveraging local real estate networks, including connections with agents, wholesalers, and property owners who may not list publicly. Utilizing specialized platforms, direct mail campaigns, and driving for dollars can uncover opportunities not available on the traditional MLS. Building relationships and focusing on motivated sellers often provides early access to exclusive off-market deals.

On-Market vs Off-Market: Which is Right for Investors?

On-market properties offer transparency and competitive pricing through public listings, making them ideal for investors seeking liquidity and market comparables. Off-market deals provide exclusivity and reduced competition, often resulting in better negotiation opportunities and potential discounts for investors prioritizing value acquisition. Evaluating investment goals, risk tolerance, and market conditions helps determine whether on-market or off-market properties align best with an investor's portfolio strategy.

Legal and Ethical Considerations in Off-Market Deals

Off-market real estate deals often bypass traditional listing platforms, raising critical legal considerations such as disclosure obligations and contract enforceability to protect all parties involved. Ethical concerns involve transparency and fair market access, ensuring that sellers do not receive manipulative offers and buyers are not misled about property conditions or pricing. Adherence to state real estate regulations and fiduciary duties remains paramount to avoid potential litigation and maintain industry integrity in off-market transactions.

Expert Tips for Navigating On-Market and Off-Market Options

Expert tips for navigating on-market and off-market real estate options emphasize the importance of thorough market research and leveraging professional networks. On-market properties provide public listings with transparent pricing, while off-market deals often offer exclusive opportunities but require strong relationships with brokers or insiders. Understanding buyer demand and assessing property potential are crucial to making informed investment decisions in both scenarios.

on-market vs off-market Infographic

difterm.com

difterm.com