Leased fee interest refers to the ownership interest held by a landlord who leases property to tenants, retaining the right to receive rent and regain possession after the lease term. Leasehold interest represents the tenant's rights to use and occupy the property for the duration of the lease, often including obligations and restrictions set forth in the lease agreement. Understanding the distinction between leased fee and leasehold interests is crucial for real estate investors and legal professionals managing property rights and rental agreements.

Table of Comparison

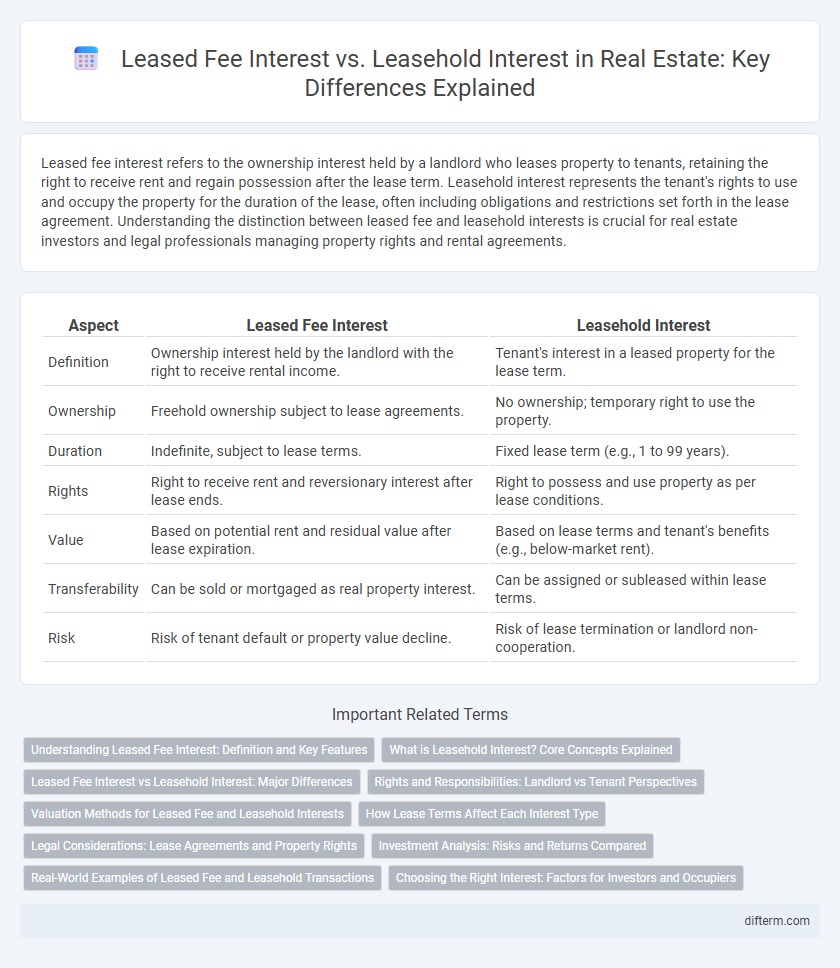

| Aspect | Leased Fee Interest | Leasehold Interest |

|---|---|---|

| Definition | Ownership interest held by the landlord with the right to receive rental income. | Tenant's interest in a leased property for the lease term. |

| Ownership | Freehold ownership subject to lease agreements. | No ownership; temporary right to use the property. |

| Duration | Indefinite, subject to lease terms. | Fixed lease term (e.g., 1 to 99 years). |

| Rights | Right to receive rent and reversionary interest after lease ends. | Right to possess and use property as per lease conditions. |

| Value | Based on potential rent and residual value after lease expiration. | Based on lease terms and tenant's benefits (e.g., below-market rent). |

| Transferability | Can be sold or mortgaged as real property interest. | Can be assigned or subleased within lease terms. |

| Risk | Risk of tenant default or property value decline. | Risk of lease termination or landlord non-cooperation. |

Understanding Leased Fee Interest: Definition and Key Features

Leased fee interest refers to the property owner's ownership rights in real estate leased to a tenant, encompassing the right to receive lease payments and the reversionary interest upon lease expiration. This interest retains control over the property while granting possession and use to the tenant under specified lease terms. Understanding leased fee interest is critical for investors valuing income-producing properties and assessing risk in lease agreements.

What is Leasehold Interest? Core Concepts Explained

Leasehold interest refers to the tenant's right to use and occupy a property for a specified lease term under a lease agreement, without owning the property itself. It grants the lessee possession and control of the property, including rights to sublease or transfer the lease, but ownership remains with the landlord, who holds the leased fee interest. Understanding leasehold interest is essential for evaluating lease terms, tenant rights, and the value of leasehold estates in commercial and residential real estate transactions.

Leased Fee Interest vs Leasehold Interest: Major Differences

Leased fee interest represents the ownership rights held by the landlord, including the right to receive lease payments and reversionary interest at lease expiration. Leasehold interest grants the tenant the right to possess and use the property for a specified lease term, subject to the terms agreed upon in the lease contract. The major difference lies in ownership versus possession: leased fee interest embodies landlord ownership, while leasehold interest embodies tenant possession and use rights.

Rights and Responsibilities: Landlord vs Tenant Perspectives

Leased fee interest grants the landlord ownership rights over the property while collecting rent, bearing responsibilities for structural maintenance and property taxes. Leasehold interest provides the tenant rights to use and occupy the property for a specified lease term, with responsibilities typically including rent payments and routine upkeep. The distinction centers on landlord's long-term ownership benefits versus tenant's temporary usage rights and associated obligations.

Valuation Methods for Leased Fee and Leasehold Interests

Valuation methods for leased fee interest primarily involve estimating the present value of the future lease payments plus the reversionary value of the property at lease expiration, often using discounted cash flow analysis or income capitalization. Leasehold interest valuation focuses on the economic benefits derived from the lease, such as the difference between market rent and contract rent, or surplus income generated by the tenant, applying methods like the discounted cash flow of net leasehold income or the market rent differential approach. Both interests require careful assessment of contract terms, market conditions, and risk factors to accurately determine their respective economic values.

How Lease Terms Affect Each Interest Type

Lease terms significantly influence leased fee interest by determining the property owner's rights and income stability throughout the lease duration. In leasehold interest, the tenant's rights and obligations depend on lease length, rent escalation clauses, and renewal options, which affect the tenant's control and use of the property. Clear stipulations regarding maintenance, subleasing, and termination conditions shape the financial and operational impact on both leased fee and leasehold interest holders.

Legal Considerations: Lease Agreements and Property Rights

Leased fee interest represents the property ownership held by a landlord who leases the property to a tenant, retaining the underlying ownership rights subject to the lease terms. Leasehold interest refers to the tenant's rights to occupy and use the property for the lease duration, governed by the specific lease agreement provisions. Legal considerations in real estate focus on clearly defining these interests within lease agreements to protect property rights, enforce obligations, and resolve disputes effectively.

Investment Analysis: Risks and Returns Compared

Leased fee interest represents the property owner's interest, encompassing the underlying land and improvements leased to a tenant, while leasehold interest pertains to the tenant's rights during the lease term. Investment analysis of leased fee interest involves assessing potential long-term income stability and reversion value, whereas leasehold interest analysis emphasizes tenant credit risk and lease term duration. Returns from leased fee investments typically offer more stability with moderate risk, contrasted with leasehold interests which may yield higher returns but carry heightened risk due to lease expiration and tenant default possibilities.

Real-World Examples of Leased Fee and Leasehold Transactions

Leased fee interest represents the ownership interest retained by the landlord, as seen in commercial properties where investors hold the leased fee while collecting rent from tenants. Leasehold interest refers to the tenant's rights to occupy and use the property for a specified term, such as a retail store leasing space in a shopping center. Real-world transactions include ground leases in urban development projects, where the landowner retains the leased fee, and the developer holds the leasehold interest to build and operate facilities.

Choosing the Right Interest: Factors for Investors and Occupiers

Leased fee interest represents the property ownership held by the landlord with the right to receive lease payments, while leasehold interest grants the tenant the right to use and occupy the property under lease terms. Investors prioritize leased fee interest for stable income streams and long-term capital appreciation, whereas occupiers focus on leasehold interest for operational flexibility and lower upfront costs. Key factors influencing the choice include investment horizon, risk tolerance, control requirements, and financial objectives aligned with property use or income generation.

leased fee interest vs leasehold interest Infographic

difterm.com

difterm.com