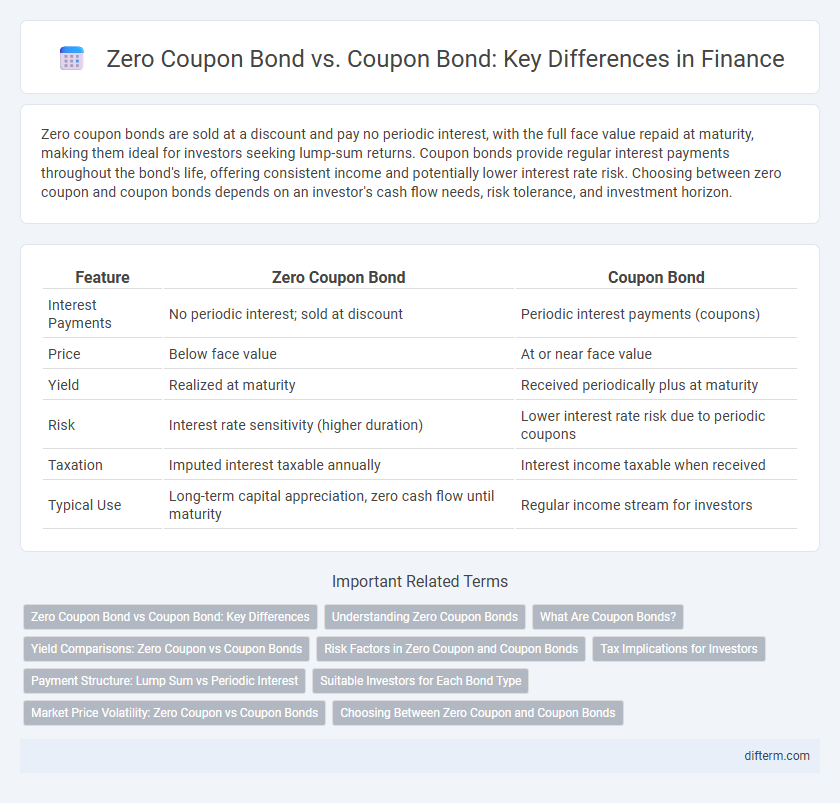

Zero coupon bonds are sold at a discount and pay no periodic interest, with the full face value repaid at maturity, making them ideal for investors seeking lump-sum returns. Coupon bonds provide regular interest payments throughout the bond's life, offering consistent income and potentially lower interest rate risk. Choosing between zero coupon and coupon bonds depends on an investor's cash flow needs, risk tolerance, and investment horizon.

Table of Comparison

| Feature | Zero Coupon Bond | Coupon Bond |

|---|---|---|

| Interest Payments | No periodic interest; sold at discount | Periodic interest payments (coupons) |

| Price | Below face value | At or near face value |

| Yield | Realized at maturity | Received periodically plus at maturity |

| Risk | Interest rate sensitivity (higher duration) | Lower interest rate risk due to periodic coupons |

| Taxation | Imputed interest taxable annually | Interest income taxable when received |

| Typical Use | Long-term capital appreciation, zero cash flow until maturity | Regular income stream for investors |

Zero Coupon Bond vs Coupon Bond: Key Differences

Zero coupon bonds differ from coupon bonds primarily in their payment structure, as zero coupon bonds are issued at a discount and pay no periodic interest, while coupon bonds provide regular interest payments over the bond's life. The yield of zero coupon bonds is realized entirely at maturity, making them sensitive to interest rate changes and suitable for long-term financial planning. Coupon bonds, conversely, offer periodic income, appealing to investors seeking steady cash flow and potentially lower price volatility.

Understanding Zero Coupon Bonds

Zero coupon bonds are debt securities that do not pay periodic interest, instead being issued at a significant discount to their face value and maturing at par. Investors benefit from the bond's appreciation, realizing return through the difference between the purchase price and the amount received at maturity. Unlike coupon bonds, which provide regular interest payments, zero coupon bonds are more sensitive to interest rate changes and ideal for investors seeking lump-sum payment at a future date.

What Are Coupon Bonds?

Coupon bonds are debt securities that pay periodic interest payments, known as coupons, to investors until maturity, when the principal amount is repaid. These bonds provide a steady income stream, making them attractive to income-focused investors and are commonly issued by governments and corporations to raise capital. The coupon rate is fixed or variable, influencing the bond's yield and pricing in the secondary market.

Yield Comparisons: Zero Coupon vs Coupon Bonds

Zero coupon bonds typically offer higher yields compared to coupon bonds when held to maturity, as they are sold at a significant discount and pay no periodic interest. Coupon bonds provide regular interest payments, which may result in lower yields but offer steady income and reduced reinvestment risk. The yield comparison between these bonds depends on factors such as interest rate environment, investor tax situation, and investment horizon.

Risk Factors in Zero Coupon and Coupon Bonds

Zero coupon bonds carry higher interest rate risk because their entire value is realized at maturity, making them more sensitive to market fluctuations, while coupon bonds provide periodic interest payments that can reduce this risk. Credit risk impacts both bond types, but coupon bonds offer regular income that can offset potential default losses, unlike zero coupon bonds, which expose investors to total principal risk at maturity. Liquidity risk tends to be greater in zero coupon bonds, as fewer investors trade them compared to coupon bonds, potentially making liquidation more difficult during market stress.

Tax Implications for Investors

Zero coupon bonds do not pay periodic interest, so investors are taxed annually on imputed interest, even though no cash is received until maturity, potentially creating a tax liability without income. Coupon bonds provide regular interest payments taxed as ordinary income in the year received, offering predictable tax treatment but higher current tax burdens. Understanding the tax implications helps investors optimize after-tax returns and manage cash flow requirements in portfolio planning.

Payment Structure: Lump Sum vs Periodic Interest

Zero coupon bonds pay investors a lump sum at maturity, consisting of the principal plus accrued interest, without periodic interest payments during the bond's life. Coupon bonds provide periodic interest payments, known as coupons, typically semiannually or annually, offering regular income streams before the principal is repaid at maturity. The lump sum payment of zero coupon bonds contrasts with the steady cash flow from coupon bonds, influencing investor cash flow preferences and tax considerations.

Suitable Investors for Each Bond Type

Zero coupon bonds are ideal for investors seeking long-term capital appreciation without periodic income, such as retirement planners or those with a low current income seeking tax deferral. Coupon bonds suit income-focused investors like retirees or conservative portfolios needing steady cash flow through regular interest payments. Institutional investors often diversify holdings by combining both bond types to balance growth potential and income stability.

Market Price Volatility: Zero Coupon vs Coupon Bonds

Zero coupon bonds exhibit higher market price volatility compared to coupon bonds due to their longer duration and absence of periodic interest payments, resulting in greater sensitivity to interest rate changes. Coupon bonds provide regular interest income, which cushions price fluctuations and thus reduces volatility relative to zero coupon bonds. Investors seeking lower interest rate risk often prefer coupon bonds, while those targeting capital appreciation may consider zero coupon bonds despite their increased price sensitivity.

Choosing Between Zero Coupon and Coupon Bonds

Choosing between zero coupon and coupon bonds depends on investment goals and cash flow preferences. Zero coupon bonds provide a lump sum payment at maturity, ideal for long-term savings and tax planning, while coupon bonds offer periodic interest payments, suitable for investors seeking steady income. Consider factors such as interest rate risk, tax implications, and investment horizon when selecting the appropriate bond type.

Zero coupon bond vs Coupon bond Infographic

difterm.com

difterm.com