Pre-tax income refers to earnings before any taxes are deducted, providing a clear view of gross profitability and the potential tax liability. After-tax income represents the net amount remaining once all applicable taxes have been subtracted, reflecting the actual take-home earnings available for spending or investment. Understanding the distinction between pre-tax and after-tax amounts is essential for accurate financial planning and evaluating real income growth.

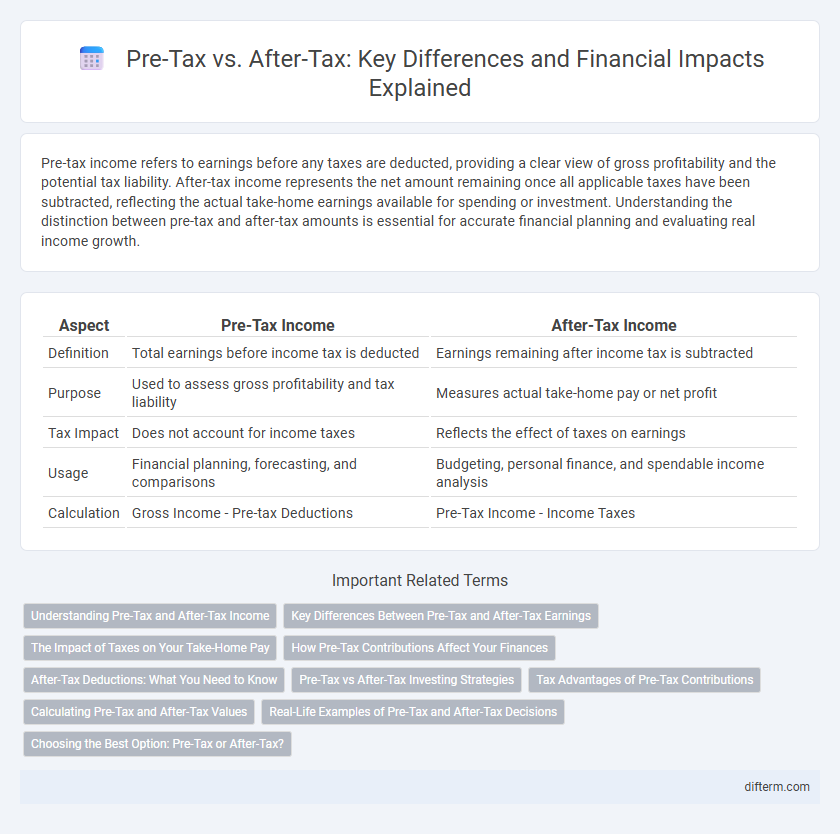

Table of Comparison

| Aspect | Pre-Tax Income | After-Tax Income |

|---|---|---|

| Definition | Total earnings before income tax is deducted | Earnings remaining after income tax is subtracted |

| Purpose | Used to assess gross profitability and tax liability | Measures actual take-home pay or net profit |

| Tax Impact | Does not account for income taxes | Reflects the effect of taxes on earnings |

| Usage | Financial planning, forecasting, and comparisons | Budgeting, personal finance, and spendable income analysis |

| Calculation | Gross Income - Pre-tax Deductions | Pre-Tax Income - Income Taxes |

Understanding Pre-Tax and After-Tax Income

Pre-tax income refers to earnings before any taxes are deducted, representing the total revenue available for obligations and investments, while after-tax income is the amount remaining after all applicable taxes have been subtracted, indicating the net earnings available for personal use or reinvestment. Understanding the distinction between pre-tax and after-tax income is crucial for accurate budgeting, tax planning, and evaluating true profitability or cash flow. Financial analysts and individuals use after-tax income to assess disposable income, while pre-tax figures help in comparing gross earnings and estimating tax liabilities.

Key Differences Between Pre-Tax and After-Tax Earnings

Pre-tax earnings represent a company's profit before income tax expenses are deducted, serving as a critical indicator of operational efficiency and profitability. After-tax earnings, also known as net income, reflect the remaining profit once all tax obligations have been paid, providing a realistic measure of financial health and liquidity. The key difference lies in tax impact, where pre-tax earnings exclude tax effects and after-tax earnings incorporate tax liabilities, influencing investment decisions and valuation metrics such as earnings per share (EPS) and return on equity (ROE).

The Impact of Taxes on Your Take-Home Pay

Pre-tax deductions reduce your taxable income, lowering the amount of income subject to federal and state taxes, which can increase your overall take-home pay by decreasing tax liability. After-tax deductions are subtracted from your net income, meaning taxes are calculated on your full salary before these deductions, reducing your take-home pay more directly. Understanding the distinction between pre-tax and after-tax contributions is essential for financial planning, as it affects disposable income and potential tax savings.

How Pre-Tax Contributions Affect Your Finances

Pre-tax contributions lower your taxable income, reducing the amount of income tax you owe in the current year and increasing your immediate take-home pay. These contributions grow tax-deferred, meaning you won't pay taxes on earnings until you withdraw the funds, typically during retirement when your tax rate may be lower. Understanding the impact of pre-tax contributions helps optimize tax savings and enhance long-term financial growth through retirement accounts like 401(k)s and traditional IRAs.

After-Tax Deductions: What You Need to Know

After-tax deductions are amounts withheld from your paycheck after taxes have been calculated, reducing your take-home pay but not your taxable income. These deductions typically include contributions to Roth retirement accounts, certain insurance premiums, and union dues, which can offer benefits like tax-free growth or stronger post-retirement income. Understanding after-tax deductions is crucial for effective financial planning, as they impact your net pay and potential tax advantages differently than pre-tax deductions.

Pre-Tax vs After-Tax Investing Strategies

Pre-tax investing strategies involve contributing funds to accounts like 401(k)s or traditional IRAs, allowing investments to grow tax-deferred until withdrawal, which can reduce current taxable income. After-tax investing relies on accounts such as Roth IRAs or taxable brokerage accounts, where contributions are made with taxed income but withdrawals or gains may be tax-free or taxed at capital gains rates. Choosing between pre-tax and after-tax investing depends on anticipated future tax brackets, retirement plans, and the need for tax diversification to optimize investment growth and tax efficiency.

Tax Advantages of Pre-Tax Contributions

Pre-tax contributions reduce taxable income in the year they are made, providing immediate tax savings and potentially lowering the overall tax bracket. These contributions grow tax-deferred, allowing investments to compound without being diminished by annual taxes. This tax deferral enhances long-term retirement savings compared to after-tax contributions, which are taxed upfront and only grow tax-free upon withdrawal.

Calculating Pre-Tax and After-Tax Values

Calculating pre-tax values involves determining the total income or investment amount before any taxes are deducted, which often requires assessing gross earnings, interest, or dividends. After-tax values are calculated by subtracting applicable federal, state, and local taxes from the pre-tax amount, using specific tax rates based on income brackets or investment types. Accurate after-tax calculations enable investors and individuals to understand their net returns and make informed financial decisions.

Real-Life Examples of Pre-Tax and After-Tax Decisions

Choosing between pre-tax and after-tax contributions impacts take-home pay and long-term savings growth, as seen in retirement plans like 401(k)s versus Roth IRAs. Pre-tax contributions reduce taxable income now, offering immediate tax savings but taxes are paid upon withdrawal, whereas after-tax contributions are taxed upfront, allowing for tax-free growth and withdrawals. Real-life decisions often depend on current versus expected future tax rates, income levels, and investment time horizons to optimize overall tax efficiency.

Choosing the Best Option: Pre-Tax or After-Tax?

Choosing between pre-tax and after-tax contributions depends on your current tax bracket and future income expectations. Pre-tax contributions reduce taxable income now, offering immediate tax savings, while after-tax contributions grow tax-free and provide tax-free withdrawals in retirement. Evaluating your projected tax rate at withdrawal helps optimize long-term tax efficiency and maximize retirement savings.

Pre-Tax vs After-Tax Infographic

difterm.com

difterm.com