Fixed interest rates provide borrowers with predictable and stable payments, making budgeting easier over the loan term. Floating interest rates fluctuate with market conditions, which can result in lower initial costs but increased uncertainty and potential payment increases. Choosing between fixed and floating interest depends on risk tolerance, financial stability, and market outlook.

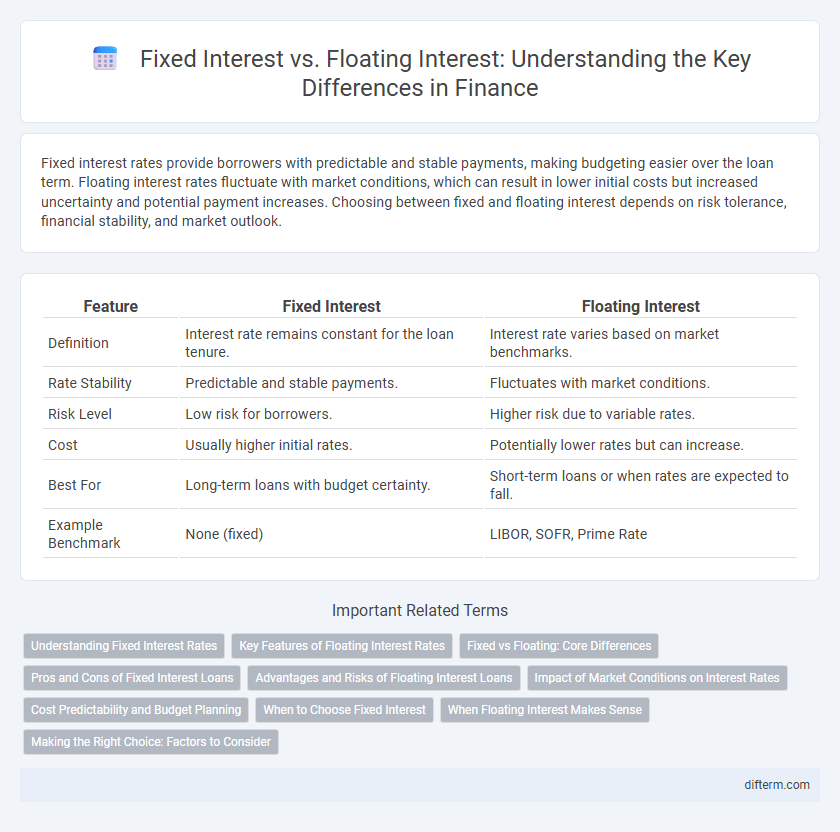

Table of Comparison

| Feature | Fixed Interest | Floating Interest |

|---|---|---|

| Definition | Interest rate remains constant for the loan tenure. | Interest rate varies based on market benchmarks. |

| Rate Stability | Predictable and stable payments. | Fluctuates with market conditions. |

| Risk Level | Low risk for borrowers. | Higher risk due to variable rates. |

| Cost | Usually higher initial rates. | Potentially lower rates but can increase. |

| Best For | Long-term loans with budget certainty. | Short-term loans or when rates are expected to fall. |

| Example Benchmark | None (fixed) | LIBOR, SOFR, Prime Rate |

Understanding Fixed Interest Rates

Fixed interest rates provide borrowers with predictability by locking in a constant rate over the loan term, shielding them from market fluctuations. This stability simplifies budgeting and financial planning, as monthly payments remain unchanged regardless of economic changes. Lenders often set fixed rates based on current economic conditions, credit risk, and loan duration, ensuring consistent repayment amounts throughout the agreement.

Key Features of Floating Interest Rates

Floating interest rates adjust periodically based on benchmark rates such as LIBOR or the federal funds rate, allowing borrowers to benefit from lower rates when market conditions change. These rates typically involve less predictability compared to fixed interest rates, resulting in variable monthly payments that reflect current economic factors. Floating rates often include a margin or spread added to the benchmark rate, influencing the overall cost of borrowing throughout the loan term.

Fixed vs Floating: Core Differences

Fixed interest rates remain constant throughout the loan tenure, ensuring predictable monthly payments and shielding borrowers from market fluctuations. Floating interest rates fluctuate based on benchmark rates like LIBOR or the prime rate, potentially offering lower initial costs but exposing borrowers to variable repayment amounts. The core difference lies in risk exposure: fixed rates provide stability, while floating rates introduce variability tied to economic conditions.

Pros and Cons of Fixed Interest Loans

Fixed interest loans offer predictable monthly payments, providing financial stability and easier budgeting as interest rates remain constant over the loan term. These loans protect borrowers from market fluctuations and rising interest rates but often come with higher initial rates compared to floating interest loans. However, fixed interest loans limit the potential benefit of falling rates, and early repayment penalties may apply, reducing flexibility for borrowers.

Advantages and Risks of Floating Interest Loans

Floating interest loans offer borrowers the advantage of lower initial rates compared to fixed interest loans, providing potential savings when market rates decline. These loans allow flexibility in repayments, adapting to changing economic conditions, which benefits businesses and individuals during periods of interest rate reductions. However, the primary risk lies in rate volatility, as rising interest rates can lead to significantly higher repayment amounts, increasing financial uncertainty and budgeting challenges.

Impact of Market Conditions on Interest Rates

Fixed interest rates remain stable regardless of market fluctuations, providing predictable loan repayments and budgeting certainty. Floating interest rates vary according to benchmark indices such as the LIBOR or SOFR, causing monthly payments to rise or fall with changes in economic conditions like inflation or central bank policies. Market volatility directly influences floating rates, making them more sensitive to shifts in supply and demand for credit compared to the constant nature of fixed rates.

Cost Predictability and Budget Planning

Fixed interest rates offer cost predictability by maintaining consistent payment amounts throughout the loan term, simplifying budget planning and minimizing financial uncertainty. Floating interest rates fluctuate with market benchmarks, potentially lowering initial costs but introducing variability that complicates long-term budgeting. Choosing between fixed and floating interest depends on prioritizing stable expenses versus potential savings in changing market conditions.

When to Choose Fixed Interest

Choose fixed interest rates when market volatility is high and budget certainty is essential, as fixed rates remain stable over the loan term. Locking in a fixed rate protects against rising interest costs, making it ideal for long-term loans or financial planning with predictable payments. Fixed interest is advantageous during periods of expected rate hikes or inflationary pressure to minimize repayment fluctuations.

When Floating Interest Makes Sense

Floating interest rates make sense when borrowers anticipate declining market rates, enabling them to benefit from lower payments over time. This approach suits businesses with cash flow flexibility, as payments can vary with benchmark rates like LIBOR or SOFR. Borrowers in low-interest environments or those seeking to hedge against rate volatility often prefer floating rates for potential cost savings.

Making the Right Choice: Factors to Consider

Choosing between fixed interest and floating interest rates depends on factors such as risk tolerance, market interest rate trends, and loan duration. Fixed interest offers stability and predictable payments, ideal in a rising interest rate environment or for long-term budgeting. Floating interest rates may benefit borrowers expecting rates to fall or with shorter loan terms, but they carry the risk of fluctuating monthly payments based on market conditions.

Fixed interest vs Floating interest Infographic

difterm.com

difterm.com