Retained earnings represent the accumulated net income of a company that is kept for reinvestment or to pay down debt rather than distributed as dividends. Reserves are portions of retained earnings set aside for specific purposes, such as contingencies or future investments, to enhance financial stability. Understanding the distinction between retained earnings and reserves helps businesses manage profitability and safeguard against financial uncertainties.

Table of Comparison

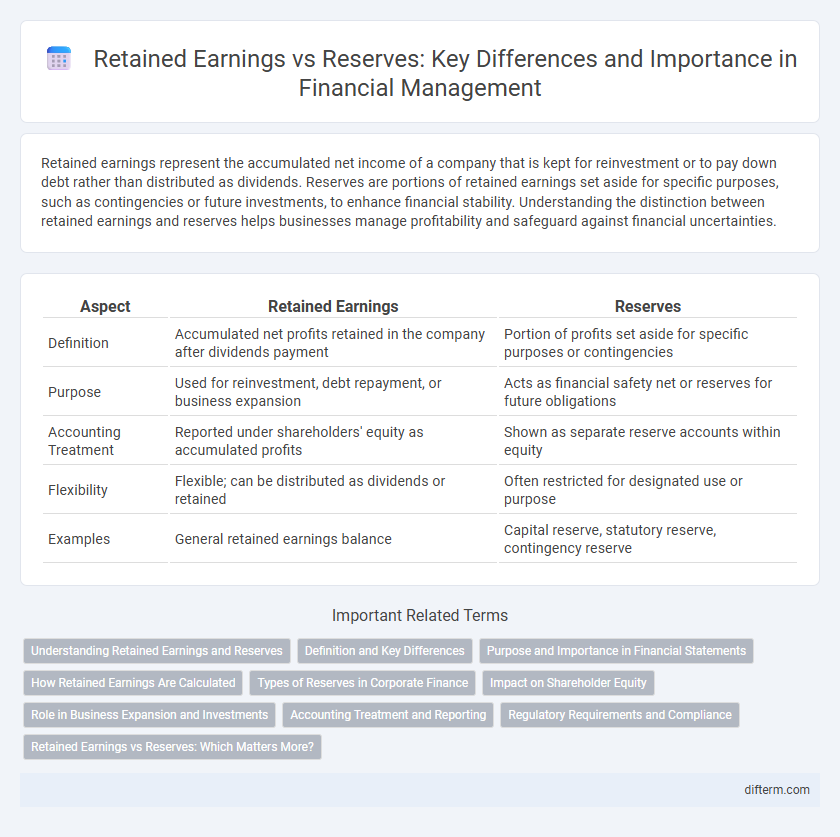

| Aspect | Retained Earnings | Reserves |

|---|---|---|

| Definition | Accumulated net profits retained in the company after dividends payment | Portion of profits set aside for specific purposes or contingencies |

| Purpose | Used for reinvestment, debt repayment, or business expansion | Acts as financial safety net or reserves for future obligations |

| Accounting Treatment | Reported under shareholders' equity as accumulated profits | Shown as separate reserve accounts within equity |

| Flexibility | Flexible; can be distributed as dividends or retained | Often restricted for designated use or purpose |

| Examples | General retained earnings balance | Capital reserve, statutory reserve, contingency reserve |

Understanding Retained Earnings and Reserves

Retained earnings represent the cumulative net income a company reinvests into its business rather than distributing as dividends, serving as a crucial source of internal financing. Reserves, on the other hand, are portions of retained earnings set aside for specific purposes such as contingencies, asset repairs, or legal requirements, enhancing financial stability and risk management. Understanding the distinction between retained earnings and reserves is essential for assessing a company's dividend policy, financial health, and capacity to fund future growth.

Definition and Key Differences

Retained earnings represent the accumulated net income a company retains for reinvestment or debt repayment, excluding dividend distribution. Reserves are specific portions of retained earnings set aside for particular purposes such as contingencies, capital expansion, or legal requirements. The key difference lies in the purpose: retained earnings reflect overall profitability kept within the business, while reserves are allocated subsets of retained earnings earmarked for designated financial objectives.

Purpose and Importance in Financial Statements

Retained earnings represent the accumulated net income reinvested in the business to fund growth, pay debts, or distribute dividends, reflecting a company's profitability over time. Reserves are portions of equity set aside for specific purposes like contingencies or asset replacement, enhancing financial stability and regulatory compliance. Both retained earnings and reserves are crucial in financial statements, as they provide insights into a company's financial health, risk management practices, and capacity for future investments.

How Retained Earnings Are Calculated

Retained earnings are calculated by subtracting total dividends paid to shareholders from net income earned during a specific period, then adding the result to the previous retained earnings balance. This figure reflects the cumulative profits that a company reinvests in its operations instead of distributing as dividends. Unlike reserves, which are specific allocations of retained earnings for contingencies or future investments, retained earnings provide a comprehensive measure of accumulated profitability available for growth or debt repayment.

Types of Reserves in Corporate Finance

In corporate finance, reserves are categorized primarily into revenue reserves and capital reserves, each serving distinct purposes within retained earnings management. Revenue reserves, such as general reserves and specific reserves, originate from operational profits and are utilized for business expansion or contingency purposes. Capital reserves arise from non-operational sources like asset revaluation or share premiums and are typically used for purposes like writing off capital losses or issuing bonus shares.

Impact on Shareholder Equity

Retained earnings represent accumulated net income reinvested in the business, directly increasing shareholder equity as a key component of owners' claims. Reserves, created by appropriating retained earnings for specific purposes such as contingencies or asset replacement, also contribute to shareholder equity but reflect internal allocations rather than additional profits. Both retained earnings and reserves strengthen the equity base, enhancing financial stability and influencing investment capacity without immediate distribution to shareholders.

Role in Business Expansion and Investments

Retained earnings represent the accumulated net income reinvested in the business, serving as a primary source of internal financing for expansion and new investments. Reserves, on the other hand, are portions of profits earmarked for specific purposes such as risk mitigation or future projects, providing financial stability without necessarily being used immediately for growth. Both retained earnings and reserves play crucial roles in supporting sustainable business expansion and funding strategic investments.

Accounting Treatment and Reporting

Retained earnings represent accumulated net profits retained in the business after dividends, recorded under shareholders' equity without any specific restrictions on use. Reserves are portions of profits consciously set aside for specific purposes, such as contingencies or expansions, often classified separately in equity to enhance financial stability and compliance. Accounting treatment requires retained earnings to be adjusted by net income and dividend payments, while reserves are created through formal appropriation entries and reported distinctly on the balance sheet.

Regulatory Requirements and Compliance

Regulatory requirements mandate that retained earnings reflect the accumulated net profits available for distribution after meeting legal obligations, whereas reserves are portions of profits set aside to comply with specific statutory or contractual obligations. Compliance with financial regulations ensures reserves fulfill purposes such as capital adequacy, risk mitigation, or future contingencies, distinct from the distributable nature of retained earnings. Transparent reporting of both retained earnings and reserves is essential to meet statutory compliance and maintain financial stability within regulated industries.

Retained Earnings vs Reserves: Which Matters More?

Retained earnings represent the accumulated net income that a company reinvests in its operations or uses to pay down debt, reflecting its profitability and growth potential. Reserves, often categorized as statutory or discretionary, serve as financial buffers to protect against future uncertainties and regulatory requirements, impacting a firm's financial stability and risk management. While retained earnings indicate long-term value creation for shareholders, reserves primarily enhance a company's resilience, making both crucial but their importance varies based on strategic priorities and industry context.

Retained Earnings vs Reserves Infographic

difterm.com

difterm.com