Dilutive financing involves issuing new shares that reduce existing shareholders' ownership percentage, often used to raise capital without immediate debt obligations. Non-dilutive financing generates funds through means like loans or grants, preserving ownership stakes but typically increasing liabilities. Choosing between these options depends on balancing growth objectives with control and financial stability considerations.

Table of Comparison

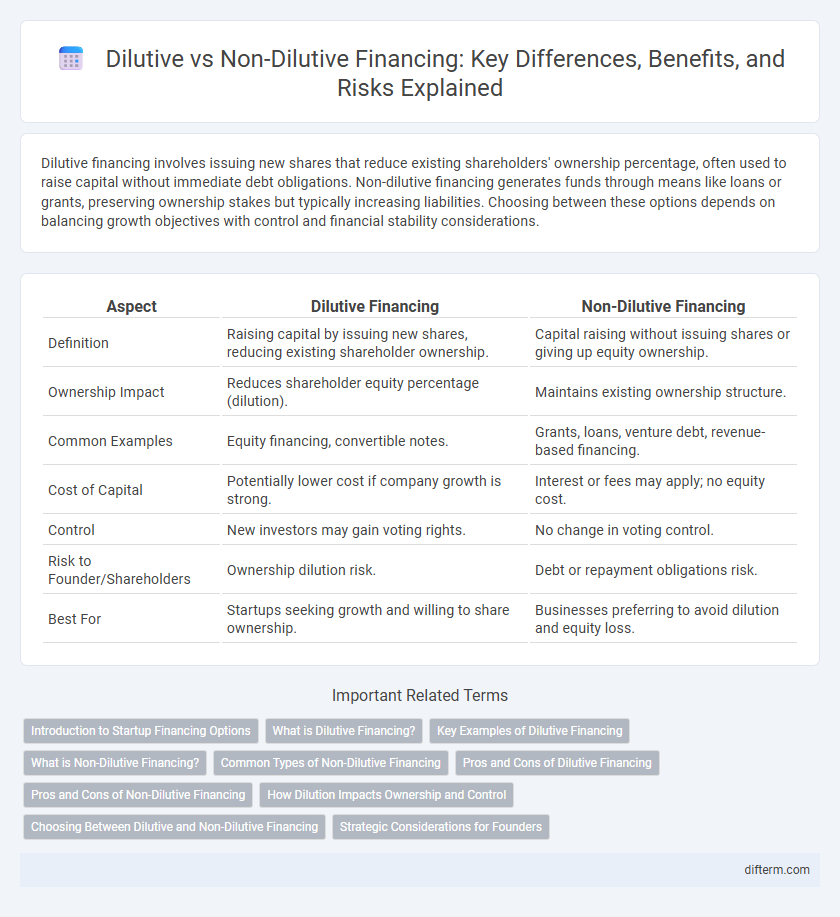

| Aspect | Dilutive Financing | Non-Dilutive Financing |

|---|---|---|

| Definition | Raising capital by issuing new shares, reducing existing shareholder ownership. | Capital raising without issuing shares or giving up equity ownership. |

| Ownership Impact | Reduces shareholder equity percentage (dilution). | Maintains existing ownership structure. |

| Common Examples | Equity financing, convertible notes. | Grants, loans, venture debt, revenue-based financing. |

| Cost of Capital | Potentially lower cost if company growth is strong. | Interest or fees may apply; no equity cost. |

| Control | New investors may gain voting rights. | No change in voting control. |

| Risk to Founder/Shareholders | Ownership dilution risk. | Debt or repayment obligations risk. |

| Best For | Startups seeking growth and willing to share ownership. | Businesses preferring to avoid dilution and equity loss. |

Introduction to Startup Financing Options

Dilutive financing involves raising capital by issuing equity, which decreases existing shareholders' ownership percentage, common in early-stage startup funding rounds like seed or Series A. Non-dilutive financing provides funds without equity loss, including grants, loans, or revenue-based financing, preserving founders' control and ownership stakes. Choosing between dilutive and non-dilutive options depends on the startup's growth stage, capital needs, and willingness to share future profits.

What is Dilutive Financing?

Dilutive financing involves raising capital by issuing new equity shares, which decreases existing shareholders' ownership percentage and potentially dilutes earnings per share. Common forms include convertible debt, warrants, and preferred stock that can convert into common equity, impacting control and future profit distribution. This financing method is often used by startups and growth companies to access funds without immediate debt repayment but can affect shareholder value over time.

Key Examples of Dilutive Financing

Key examples of dilutive financing include issuing new equity shares, convertible bonds, and stock options, which increase the total number of shares outstanding and dilute existing shareholders' ownership. Equity issuance raises capital by selling additional shares, while convertible bonds convert debt into equity under certain conditions, impacting share value. Stock options granted to employees or investors also lead to potential dilution when exercised and converted into shares.

What is Non-Dilutive Financing?

Non-dilutive financing refers to methods of raising capital that do not require giving up equity or ownership stakes in a company, preserving shareholders' control and vote power. Common sources include grants, revenue-based financing, and certain types of debt, which provide funds without diluting existing equity. This form of financing is crucial for startups and businesses aiming to maintain ownership structure while accessing necessary capital for growth.

Common Types of Non-Dilutive Financing

Non-dilutive financing includes grants, revenue-based financing, and customer prepayments, providing capital without equity loss. Government grants often support research and development without requiring repayment or ownership stakes. Revenue-based financing offers flexible repayments linked to business performance, preserving control for existing shareholders.

Pros and Cons of Dilutive Financing

Dilutive financing involves issuing new equity shares, which can provide substantial capital influx without increasing debt obligations, enhancing a company's cash flow flexibility. However, it reduces existing shareholders' ownership percentages and can lead to earnings per share dilution, potentially impacting stock valuation negatively. This method is beneficial for companies seeking growth without immediate repayment pressure but may signal to investors a lack of confidence in debt financing or internal cash generation.

Pros and Cons of Non-Dilutive Financing

Non-dilutive financing preserves existing shareholders' equity by avoiding issuance of new stock, which helps maintain control and prevent ownership dilution. It often involves loans, grants, or revenue-based financing, reducing pressure for immediate returns compared to dilutive options like equity funding. However, non-dilutive financing may include higher interest rates or strict repayment terms, potentially impacting short-term cash flow and financial flexibility.

How Dilution Impacts Ownership and Control

Dilutive financing, such as issuing new equity, decreases existing shareholders' ownership percentage by increasing the total shares outstanding, which can reduce their control and voting power in a company. Non-dilutive financing methods, like debt or grants, maintain existing ownership stakes because no new shares are issued. The impact of dilution on control is critical for founders and investors aiming to preserve decision-making authority while raising capital.

Choosing Between Dilutive and Non-Dilutive Financing

Choosing between dilutive and non-dilutive financing depends on a company's growth strategy and ownership preferences. Dilutive financing, such as issuing new equity, can provide substantial capital but reduces existing shareholders' ownership percentages, potentially impacting control and earnings per share. Non-dilutive financing options, including debt or grants, preserve ownership but may introduce repayment obligations or stringent conditions, influencing cash flow and financial stability.

Strategic Considerations for Founders

Founders must weigh the impact of dilutive financing on ownership percentages and control against the capital needs of growth and scalability. Non-dilutive financing preserves equity but often comes with strict eligibility criteria and limitations on use of funds, influencing strategic decisions on business flexibility. Assessing future funding rounds, investor relationships, and long-term company vision is critical in selecting the appropriate financing structure.

Dilutive Financing vs Non-Dilutive Financing Infographic

difterm.com

difterm.com