Qualified dividends receive favorable tax treatment by being taxed at lower capital gains rates, whereas ordinary dividends are taxed at higher ordinary income tax rates. Investors benefit from holding stocks that pay qualified dividends, as this can reduce their overall tax liability. Understanding the distinction between these dividend types is crucial for effective tax planning and maximizing after-tax returns.

Table of Comparison

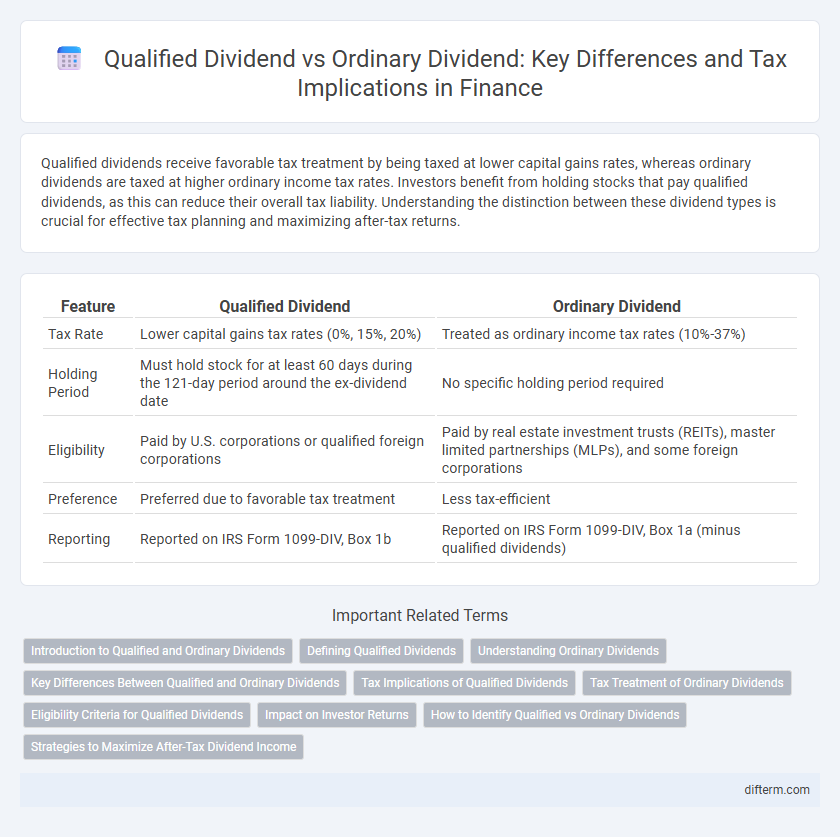

| Feature | Qualified Dividend | Ordinary Dividend |

|---|---|---|

| Tax Rate | Lower capital gains tax rates (0%, 15%, 20%) | Treated as ordinary income tax rates (10%-37%) |

| Holding Period | Must hold stock for at least 60 days during the 121-day period around the ex-dividend date | No specific holding period required |

| Eligibility | Paid by U.S. corporations or qualified foreign corporations | Paid by real estate investment trusts (REITs), master limited partnerships (MLPs), and some foreign corporations |

| Preference | Preferred due to favorable tax treatment | Less tax-efficient |

| Reporting | Reported on IRS Form 1099-DIV, Box 1b | Reported on IRS Form 1099-DIV, Box 1a (minus qualified dividends) |

Introduction to Qualified and Ordinary Dividends

Qualified dividends are taxed at the lower long-term capital gains rates, offering investors significant tax advantages compared to ordinary dividends, which are taxed as regular income at higher marginal rates. To be considered qualified, dividends must be paid by U.S. companies or qualified foreign corporations and meet specific holding period requirements, typically over 60 days within a 121-day period around the ex-dividend date. Ordinary dividends include all dividend income that does not meet these criteria and are subject to higher tax rates, impacting after-tax investment returns for shareholders.

Defining Qualified Dividends

Qualified dividends are payments made by U.S. corporations or qualified foreign corporations that meet specific IRS criteria, allowing them to be taxed at the lower long-term capital gains tax rates rather than ordinary income tax rates. These dividends must be paid on common stock held for more than 60 days during the 121-day period surrounding the ex-dividend date. The preferential tax treatment of qualified dividends significantly reduces the tax burden for investors compared to ordinary dividends, which are taxed at standard income tax rates.

Understanding Ordinary Dividends

Ordinary dividends are payments made to shareholders from a corporation's earnings that do not meet the criteria for qualified dividend status, leading to taxation at the individual's ordinary income tax rates. These dividends are generally paid out of the company's current or accumulated earnings and profits and are subject to higher tax rates compared to qualified dividends. Understanding the distinction between ordinary and qualified dividends is crucial for effective tax planning and maximizing after-tax returns on investment portfolios.

Key Differences Between Qualified and Ordinary Dividends

Qualified dividends benefit from lower tax rates, typically taxed at long-term capital gains rates, while ordinary dividends are taxed at higher ordinary income tax rates. Qualified dividends must meet specific holding period requirements and be paid by U.S. corporations or qualified foreign corporations, unlike ordinary dividends which have no such restrictions. The distinction significantly impacts after-tax income for investors and is essential for effective portfolio tax planning.

Tax Implications of Qualified Dividends

Qualified dividends benefit from lower tax rates compared to ordinary dividends, often taxed at long-term capital gains rates ranging from 0% to 20% depending on the taxpayer's income bracket. Ordinary dividends are taxed as ordinary income, which can be as high as 37% under the current federal tax brackets. Understanding these distinctions is crucial for investment strategy and tax planning, as qualified dividends can significantly reduce tax liability on dividend income.

Tax Treatment of Ordinary Dividends

Ordinary dividends are taxed as ordinary income at the investor's marginal tax rate, which can be as high as 37% under current U.S. tax laws. These dividends do not benefit from the lower tax rates applied to qualified dividends, which range between 0% and 20% depending on the taxpayer's income bracket. The IRS requires that ordinary dividends be reported on Form 1099-DIV, and they contribute to the overall taxable income reported on the individual's tax return.

Eligibility Criteria for Qualified Dividends

Qualified dividends must be paid by U.S. corporations or qualified foreign corporations and held for a specific minimum period, typically more than 60 days during the 121-day period surrounding the ex-dividend date. Shareholders must meet the holding period requirement, ensuring shares are held long enough to receive favorable tax treatment. Dividends failing these criteria are taxed as ordinary dividends at the individual's regular income tax rate.

Impact on Investor Returns

Qualified dividends are taxed at lower capital gains rates, ranging from 0% to 20%, enhancing after-tax investor returns compared to ordinary dividends, which are taxed at higher ordinary income rates up to 37%. This tax advantage on qualified dividends can significantly increase net income for investors in higher tax brackets, improving portfolio performance over time. Understanding the distinction between these dividend types is essential for tax-efficient investment strategies and maximizing long-term wealth accumulation.

How to Identify Qualified vs Ordinary Dividends

Qualified dividends are identified by their source and holding period, originating from U.S. corporations or qualified foreign corporations, with stocks held for more than 60 days within the 121-day period surrounding the ex-dividend date. Ordinary dividends include all dividends that do not meet these criteria and are taxed at the standard income tax rates. Reviewing Form 1099-DIV and IRS guidelines helps taxpayers distinguish between qualified dividends, subject to lower long-term capital gains tax rates, and ordinary dividends, taxed as ordinary income.

Strategies to Maximize After-Tax Dividend Income

Maximizing after-tax dividend income involves prioritizing qualified dividends, which benefit from preferential tax rates up to 20%, compared to ordinary dividends taxed as regular income up to 37%. Strategies include holding dividend-paying stocks for the required minimum period, typically over 60 days around the ex-dividend date, to qualify for favorable tax treatment. Utilizing tax-advantaged accounts like IRAs or 401(k)s can further shield ordinary dividends from immediate taxation, enhancing overall after-tax returns.

Qualified dividend vs ordinary dividend Infographic

difterm.com

difterm.com