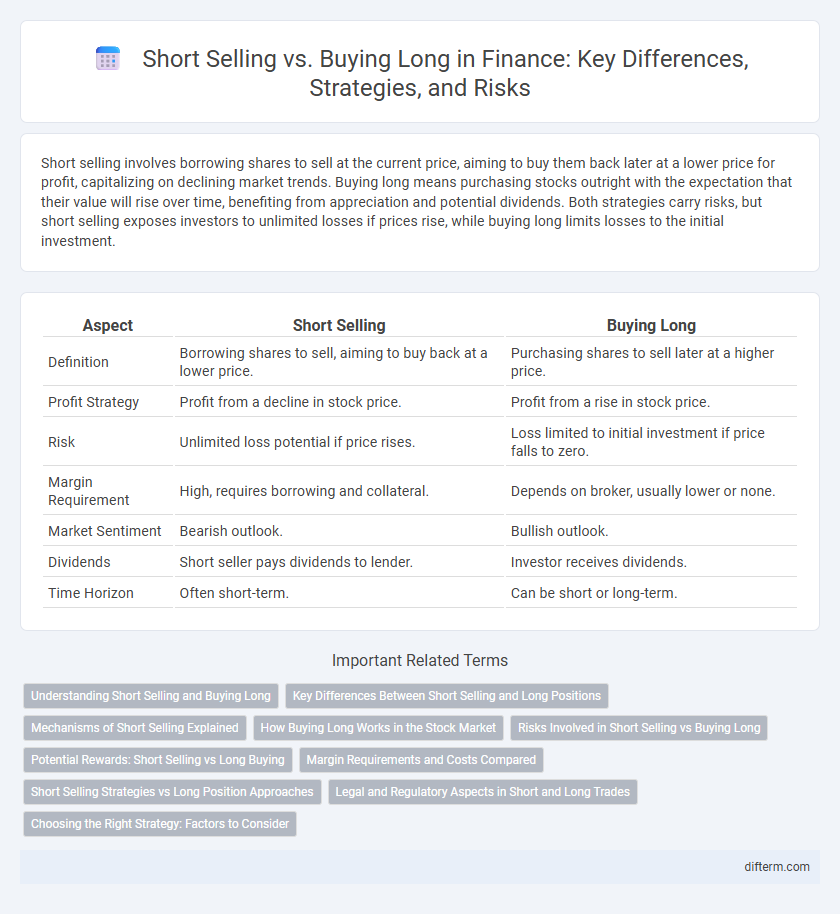

Short selling involves borrowing shares to sell at the current price, aiming to buy them back later at a lower price for profit, capitalizing on declining market trends. Buying long means purchasing stocks outright with the expectation that their value will rise over time, benefiting from appreciation and potential dividends. Both strategies carry risks, but short selling exposes investors to unlimited losses if prices rise, while buying long limits losses to the initial investment.

Table of Comparison

| Aspect | Short Selling | Buying Long |

|---|---|---|

| Definition | Borrowing shares to sell, aiming to buy back at a lower price. | Purchasing shares to sell later at a higher price. |

| Profit Strategy | Profit from a decline in stock price. | Profit from a rise in stock price. |

| Risk | Unlimited loss potential if price rises. | Loss limited to initial investment if price falls to zero. |

| Margin Requirement | High, requires borrowing and collateral. | Depends on broker, usually lower or none. |

| Market Sentiment | Bearish outlook. | Bullish outlook. |

| Dividends | Short seller pays dividends to lender. | Investor receives dividends. |

| Time Horizon | Often short-term. | Can be short or long-term. |

Understanding Short Selling and Buying Long

Short selling involves borrowing shares to sell at the current price with the expectation of repurchasing them later at a lower price, profiting from a decline in the stock's value. Buying long means purchasing shares outright, aiming to benefit from price appreciation over time. Both strategies carry distinct risk profiles, with short selling exposing investors to unlimited losses if prices rise, while buying long limits losses to the initial investment.

Key Differences Between Short Selling and Long Positions

Short selling involves borrowing shares to sell at the current price with the expectation of repurchasing them at a lower price, profiting from a decline in the asset's value. Buying long means purchasing shares outright, anticipating their price will rise over time, yielding profits upon sale. Key differences include risk exposure--short selling carries unlimited loss potential while long positions have limited downside--and regulatory constraints, as short selling often requires margin accounts and adherence to specific rules.

Mechanisms of Short Selling Explained

Short selling involves borrowing shares from a broker to sell them at the current market price, aiming to repurchase them later at a lower price to return to the lender, profiting from the price difference. This mechanism requires a margin account and exposes traders to unlimited risk if the asset price rises. In contrast, buying long means purchasing securities outright with the expectation that their value will increase, limiting the risk to the initial investment amount.

How Buying Long Works in the Stock Market

Buying long in the stock market involves purchasing shares with the expectation that their value will increase over time, allowing investors to profit from capital appreciation and potential dividends. This strategy benefits from upward market trends and relies on fundamental analysis of company performance, economic conditions, and industry growth. Unlike short selling, buying long does not expose investors to unlimited losses, making it a traditional approach for wealth accumulation in financial markets.

Risks Involved in Short Selling vs Buying Long

Short selling carries the risk of unlimited losses since the stock price can rise indefinitely, whereas buying long limits losses to the initial investment. Margin requirements and the possibility of a margin call add to the financial risks of short selling. In contrast, long positions benefit from potential dividends and price appreciation, but are still exposed to market downturns.

Potential Rewards: Short Selling vs Long Buying

Short selling offers the potential for significant profits in declining markets by capitalizing on price drops, while buying long positions allows investors to benefit from asset appreciation and dividends. Risk-adjusted returns vary, as short selling involves unlimited loss potential versus long buying's limited downside to the invested capital. Successful short selling requires precise market timing and risk management, contrasting with long buying's advantage of compounding gains over time.

Margin Requirements and Costs Compared

Short selling requires higher margin requirements compared to buying long due to the increased risk of unlimited losses, often demanding 150% of the short sale value as collateral. Costs associated with short selling include paying borrowing fees on the borrowed securities and potential margin calls, while buying long typically involves only the initial purchase price and standard brokerage commissions. Understanding these margin and cost differences is crucial for effective risk management and capital allocation in trading strategies.

Short Selling Strategies vs Long Position Approaches

Short selling strategies involve borrowing shares to sell at the current price, aiming to repurchase them at a lower price to profit from declining markets, while long position approaches focus on purchasing assets expecting their value to appreciate over time. Effective short selling requires precise timing and risk management due to potential unlimited losses, whereas long positions benefit from dividends and capital growth with limited downside risk to the initial investment. Traders often use technical analysis and market sentiment indicators to optimize short selling, whereas fundamental analysis typically guides long-term investment decisions.

Legal and Regulatory Aspects in Short and Long Trades

Short selling faces stricter regulatory scrutiny due to its potential market risks, requiring compliance with rules such as the SEC's Regulation SHO, which mandates locate and close-out requirements to prevent naked short selling. Long buying, being a straightforward purchase of securities, encounters fewer legal constraints and is mainly subject to standard trading regulations and disclosure requirements. Both strategies must adhere to insider trading laws and reporting standards, but short selling involves additional margin requirements and borrowing obligations regulated by financial authorities.

Choosing the Right Strategy: Factors to Consider

Evaluating market conditions, risk tolerance, and investment goals are crucial when choosing between short selling and buying long; short selling suits bearish markets and experienced traders comfortable with higher risk, while buying long aligns with bullish scenarios and long-term growth strategies. Liquidity, stock volatility, and borrowing costs must also be considered as they directly impact the profitability and feasibility of short selling. Investors should incorporate technical analysis, fundamental research, and timing to optimize decision-making and maximize returns based on their strategy choice.

Short selling vs Buying long Infographic

difterm.com

difterm.com