Collateral involves pledging specific assets as security for a loan, allowing lenders to seize these assets if the borrower defaults. A guarantor, on the other hand, is a third party who agrees to repay the loan if the primary borrower fails to meet obligations. Understanding the distinction between collateral and guarantors helps lenders assess risk and borrowers secure financing more effectively.

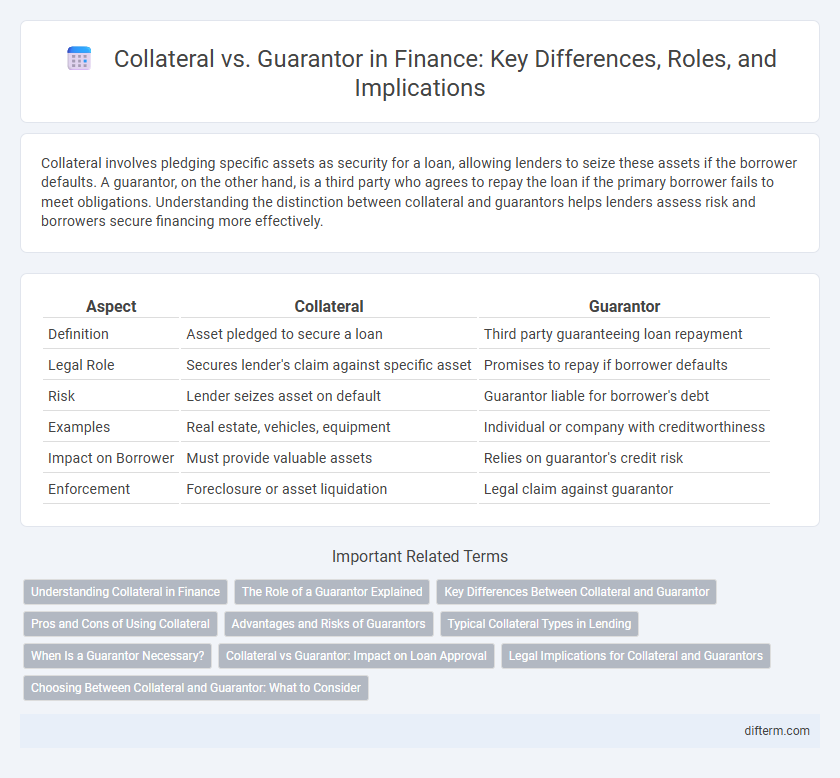

Table of Comparison

| Aspect | Collateral | Guarantor |

|---|---|---|

| Definition | Asset pledged to secure a loan | Third party guaranteeing loan repayment |

| Legal Role | Secures lender's claim against specific asset | Promises to repay if borrower defaults |

| Risk | Lender seizes asset on default | Guarantor liable for borrower's debt |

| Examples | Real estate, vehicles, equipment | Individual or company with creditworthiness |

| Impact on Borrower | Must provide valuable assets | Relies on guarantor's credit risk |

| Enforcement | Foreclosure or asset liquidation | Legal claim against guarantor |

Understanding Collateral in Finance

Collateral in finance refers to an asset pledged by a borrower to secure a loan, reducing the lender's risk by providing a tangible resource that can be liquidated if the borrower defaults. Common types of collateral include real estate, vehicles, inventory, and accounts receivable, each serving as a financial backstop for loan repayment. Unlike a guarantor who promises to repay a loan if the borrower defaults, collateral directly ties the loan to a specific asset's value, influencing loan terms, interest rates, and approval chances.

The Role of a Guarantor Explained

A guarantor provides a third-party promise to repay a loan if the primary borrower defaults, enhancing the lender's security without requiring immediately accessible assets. Unlike collateral, which involves pledging specific assets as security, a guarantor relies on their creditworthiness and financial standing to back the loan. The role of a guarantor is crucial in credit agreements where borrowers lack sufficient collateral but possess a trusted individual or entity willing to assume repayment responsibility.

Key Differences Between Collateral and Guarantor

Collateral refers to an asset pledged by a borrower to secure a loan, reducing the lender's risk by providing a tangible fallback in case of default. A guarantor, in contrast, is a third party who promises to fulfill the borrower's debt obligations if the borrower fails to repay, offering a personal financial guarantee rather than an asset. The essential difference lies in collateral involving physical or financial assets, whereas a guarantor relies on personal creditworthiness and legal commitment.

Pros and Cons of Using Collateral

Using collateral in financing secures a loan by pledging assets, which often results in lower interest rates and increased lender confidence. However, it exposes borrowers to the risk of asset forfeiture if they default, potentially causing significant financial loss. Unlike guarantors, collateral does not rely on a third party, but limits loan accessibility to those with valuable assets.

Advantages and Risks of Guarantors

Guarantors provide a backup payment source, enhancing loan approval chances and potentially securing better interest rates by mitigating lender risk. They do not require asset liquidation like collateral, offering flexibility to borrowers who may lack tangible assets. However, guarantors assume significant liability, risking credit damage and financial strain if the primary borrower defaults.

Typical Collateral Types in Lending

Typical collateral types in lending include real estate, vehicles, equipment, inventory, and accounts receivable, which borrowers pledge to secure loans and reduce lender risk. Real estate is the most common collateral due to its stable value and long-term appreciation potential. Equipment and inventory serve as effective collateral in business lending, providing tangible assets that lenders can liquidate if borrowers default.

When Is a Guarantor Necessary?

A guarantor becomes necessary when a borrower lacks sufficient credit history or financial stability to secure a loan independently. In such cases, the guarantor provides a secondary promise to repay the debt if the primary borrower defaults, reducing risk for the lender. Unlike collateral, which involves tangible assets, a guarantor's obligation is personal and legal, often requiring thorough credit evaluation.

Collateral vs Guarantor: Impact on Loan Approval

Collateral provides tangible assets that lenders can seize if a borrower defaults, directly reducing the lender's risk and often accelerating loan approval. Guarantors, by contrast, offer a promise to repay if the borrower fails, impacting approval through enhanced credit assurance but lacking immediate asset liquidation options. Loan approval processes weigh collateral's asset value more heavily due to its direct security, while guarantor reliability affects approval based on personal creditworthiness and financial capacity.

Legal Implications for Collateral and Guarantors

Collateral involves specific assets pledged to secure a loan, granting creditors legal rights to seize the asset upon borrower default, ensuring direct recovery of the owed amount. Guarantors legally commit to fulfill the borrower's debt obligation if the primary debtor fails, creating a secondary liability but not involving seizure of specific assets unless further legal action is taken. The legal implications for collateral emphasize asset control and liquidation rights, whereas guarantors face personal financial liability and potential credit impact without immediate asset forfeiture.

Choosing Between Collateral and Guarantor: What to Consider

Choosing between collateral and a guarantor involves assessing risk tolerance, asset availability, and borrower credibility. Collateral requires tangible assets that lenders can seize in default, offering direct security but limiting borrowing flexibility. Guarantors leverage personal or corporate credit strength to back loans, enabling access without upfront assets but increasing dependency on third-party reliability.

Collateral vs Guarantor Infographic

difterm.com

difterm.com