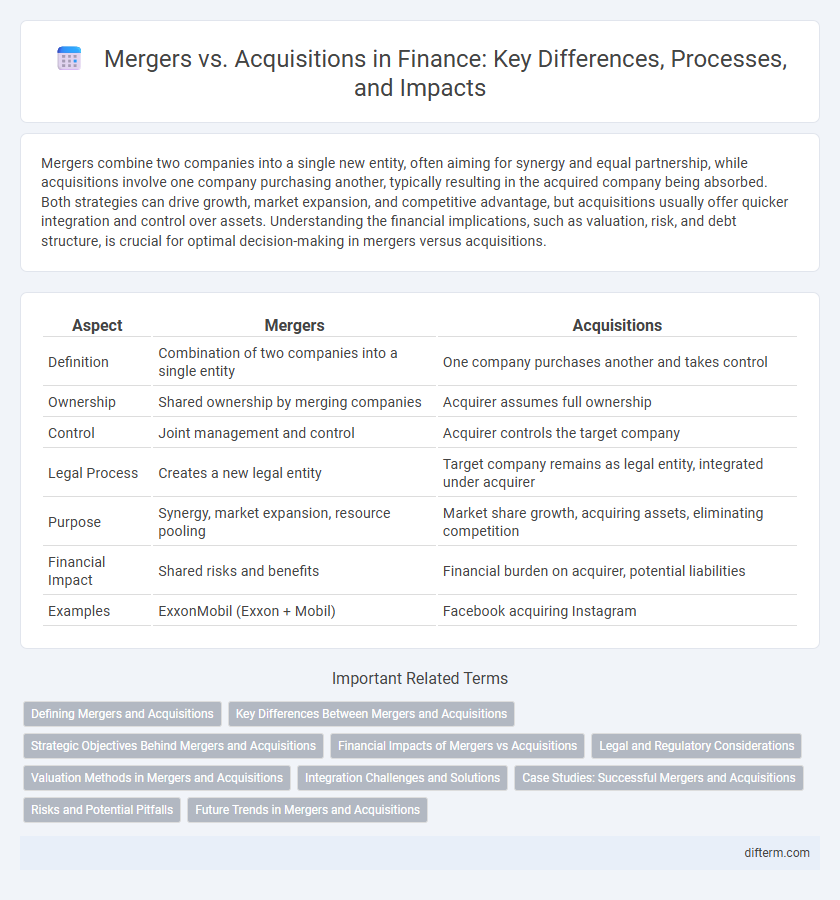

Mergers combine two companies into a single new entity, often aiming for synergy and equal partnership, while acquisitions involve one company purchasing another, typically resulting in the acquired company being absorbed. Both strategies can drive growth, market expansion, and competitive advantage, but acquisitions usually offer quicker integration and control over assets. Understanding the financial implications, such as valuation, risk, and debt structure, is crucial for optimal decision-making in mergers versus acquisitions.

Table of Comparison

| Aspect | Mergers | Acquisitions |

|---|---|---|

| Definition | Combination of two companies into a single entity | One company purchases another and takes control |

| Ownership | Shared ownership by merging companies | Acquirer assumes full ownership |

| Control | Joint management and control | Acquirer controls the target company |

| Legal Process | Creates a new legal entity | Target company remains as legal entity, integrated under acquirer |

| Purpose | Synergy, market expansion, resource pooling | Market share growth, acquiring assets, eliminating competition |

| Financial Impact | Shared risks and benefits | Financial burden on acquirer, potential liabilities |

| Examples | ExxonMobil (Exxon + Mobil) | Facebook acquiring Instagram |

Defining Mergers and Acquisitions

Mergers involve the combination of two companies to form a single new entity, often to achieve synergies in market share, resources, or technology. Acquisitions occur when one company purchases another, gaining control over its operations and assets without forming a new organization. Both strategies are critical in corporate restructuring, affecting valuations, market positioning, and shareholder value.

Key Differences Between Mergers and Acquisitions

Mergers involve the combination of two companies to form a new entity, typically characterized by mutual agreement and shared ownership, whereas acquisitions occur when one company takes over another, resulting in the acquired firm becoming part of the acquiring company's assets. Key differences include the nature of ownership transfer, with mergers often leading to joint control and acquisitions resulting in one company's dominance. Financial structuring also varies, as mergers usually involve stock exchanges between equals, while acquisitions can be financed through cash, stock, or debt, impacting valuation and integration strategies.

Strategic Objectives Behind Mergers and Acquisitions

Mergers and acquisitions aim to achieve strategic objectives such as market expansion, diversification, and synergies in operational efficiencies. Companies pursue these transactions to gain competitive advantages, enhance shareholder value, and access new technologies or customer bases. Strategic alignment in mergers and acquisitions often drives increased economies of scale and accelerated growth trajectories.

Financial Impacts of Mergers vs Acquisitions

Mergers typically result in extensive financial restructuring, with combined revenues and cost synergies driving improved profitability and shareholder value over time. Acquisitions often involve significant upfront expenses and integration costs, but they can rapidly increase market share and generate immediate cash flow benefits. Both strategies impact balance sheets, earnings per share, and debt levels differently, requiring detailed financial analysis to assess long-term fiscal health and risk profiles.

Legal and Regulatory Considerations

Mergers and acquisitions require navigating complex legal frameworks including antitrust laws, securities regulations, and corporate governance standards to ensure compliance. Regulatory bodies such as the SEC in the United States and the CMA in the UK enforce disclosure requirements and review transactions for potential monopoly risks. Proper due diligence and legal counsel are essential to address contractual obligations, intellectual property rights, and post-transaction integration challenges.

Valuation Methods in Mergers and Acquisitions

Valuation methods in mergers and acquisitions primarily include discounted cash flow (DCF), comparable company analysis, and precedent transactions, each offering unique insights into the target company's worth. DCF assesses intrinsic value by projecting future cash flows and discounting them to present value, while comparable company analysis evaluates market value based on similar firms' trading multiples. Precedent transactions provide context by analyzing prices paid in recent similar acquisitions, helping stakeholders determine fair value and negotiate deal terms.

Integration Challenges and Solutions

Mergers and acquisitions often face significant integration challenges, including cultural clashes, system incompatibilities, and misaligned operational processes that can hinder synergies and value creation. Successful integration requires comprehensive due diligence, clear communication strategies, and the implementation of unified IT platforms to streamline workflows. Leveraging change management frameworks and appointing dedicated integration teams are crucial solutions to align objectives and ensure a smooth transition post-merger or acquisition.

Case Studies: Successful Mergers and Acquisitions

Successful mergers and acquisitions often hinge on strategic alignment and thorough due diligence, as demonstrated by the Disney-Pixar merger, which combined creative strengths to dominate the animation market. The acquisition of LinkedIn by Microsoft exemplifies how integrating complementary technologies can expand user reach and drive revenue growth. These case studies highlight the importance of cultural fit and a clear vision in realizing synergies and long-term value.

Risks and Potential Pitfalls

Mergers often carry integration risks, including cultural clashes and operational disruptions that can undermine projected synergies. Acquisitions pose challenges like overvaluation, hidden liabilities, and regulatory hurdles that may lead to financial losses or deal cancellations. Both transactions require thorough due diligence to mitigate risks such as market uncertainty, employee turnover, and post-deal performance shortfalls.

Future Trends in Mergers and Acquisitions

Future trends in mergers and acquisitions emphasize increased reliance on artificial intelligence and data analytics to identify optimal targets and streamline due diligence. Cross-border deals are expected to rise, driven by globalization and the pursuit of emerging market growth opportunities. Environmental, social, and governance (ESG) criteria will play a critical role in deal valuation and integration strategies.

Mergers vs Acquisitions Infographic

difterm.com

difterm.com