Yield to Maturity (YTM) represents the total return expected on a bond if held until maturity, reflecting current market conditions and interest rates. The coupon rate is the fixed annual interest paid by the bond issuer based on the bond's face value. When the YTM exceeds the coupon rate, the bond typically sells at a discount, whereas if the YTM is lower than the coupon rate, the bond usually trades at a premium.

Table of Comparison

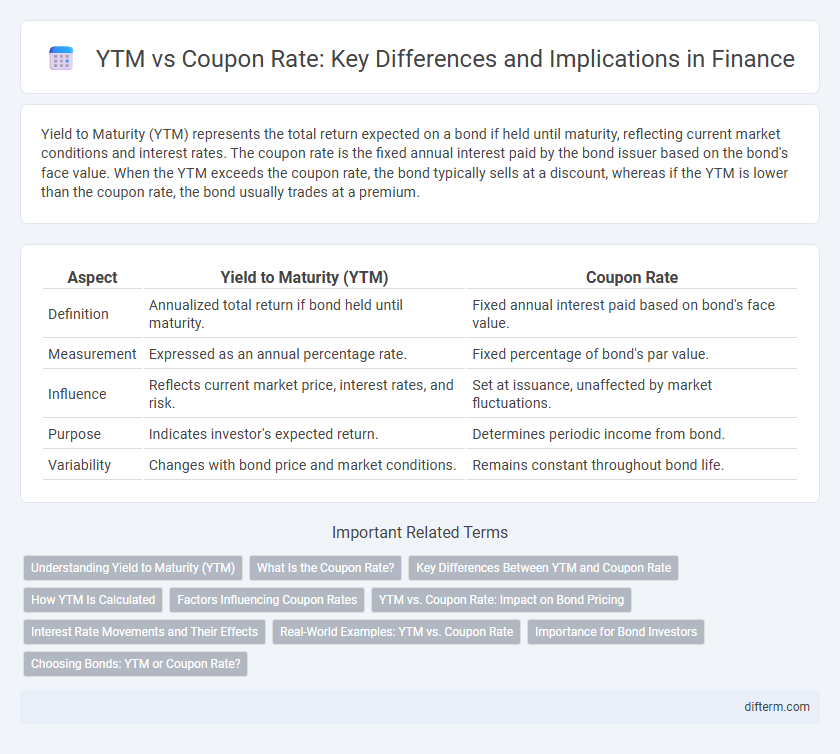

| Aspect | Yield to Maturity (YTM) | Coupon Rate |

|---|---|---|

| Definition | Annualized total return if bond held until maturity. | Fixed annual interest paid based on bond's face value. |

| Measurement | Expressed as an annual percentage rate. | Fixed percentage of bond's par value. |

| Influence | Reflects current market price, interest rates, and risk. | Set at issuance, unaffected by market fluctuations. |

| Purpose | Indicates investor's expected return. | Determines periodic income from bond. |

| Variability | Changes with bond price and market conditions. | Remains constant throughout bond life. |

Understanding Yield to Maturity (YTM)

Yield to Maturity (YTM) represents the total return an investor can expect if a bond is held until it matures, incorporating both the bond's current market price and all future coupon payments. Unlike the coupon rate, which is fixed and represents the bond's annual interest payment based on its face value, YTM adjusts for the bond's price fluctuations and time value of money. Understanding YTM is crucial for assessing a bond's true profitability, especially when trading below or above its par value.

What Is the Coupon Rate?

The coupon rate is the fixed annual interest percentage paid by a bond issuer to bondholders based on the bond's face value. It determines the regular income investors receive and remains constant throughout the bond's life, unlike the yield to maturity (YTM) which fluctuates with market prices. Understanding the coupon rate is crucial for assessing the bond's income stream relative to current market yields.

Key Differences Between YTM and Coupon Rate

Yield to Maturity (YTM) represents the total return anticipated on a bond if held until maturity, factoring in all cash flows and current market price, while the Coupon Rate is the fixed annual interest paid based on the bond's face value. YTM fluctuates with market conditions and reflects the bond's true earning potential, whereas the Coupon Rate remains constant throughout the bond's life. Understanding the divergence between YTM and Coupon Rate helps investors assess whether a bond is trading at a premium, discount, or par value.

How YTM Is Calculated

Yield to Maturity (YTM) is calculated by solving the equation that equates the present value of all future cash flows from the bond, including coupon payments and the face value repayment, to the bond's current market price. This involves discounting each cash flow by the YTM rate, typically requiring iterative numerical methods or financial calculators due to the complexity of the formula. The Coupon Rate, by contrast, is simply the annual interest payment divided by the bond's face value and does not account for market price or time value of money.

Factors Influencing Coupon Rates

Coupon rates are primarily influenced by prevailing interest rates, issuer credit quality, and bond maturity, which directly affect investor demand and risk perception. Higher credit risk or longer maturities typically result in elevated coupon rates to compensate investors for increased risk or time exposure. Market interest rate fluctuations also dictate coupon rate settings, aligning bond yields with comparable securities to remain competitive.

YTM vs. Coupon Rate: Impact on Bond Pricing

Yield to Maturity (YTM) versus Coupon Rate significantly influences bond pricing, with YTM reflecting the bond's total expected return if held to maturity, while the Coupon Rate represents the fixed annual interest payment. When YTM exceeds the Coupon Rate, bonds trade at a discount below par value, signaling higher market interest rates or credit risk. Conversely, if the Coupon Rate exceeds YTM, bonds trade at a premium, indicating favorable yields relative to prevailing market conditions.

Interest Rate Movements and Their Effects

Yield to Maturity (YTM) fluctuates with market interest rate movements, directly impacting bond pricing, while the coupon rate remains fixed at issuance. When interest rates rise, YTM increases, causing bond prices to fall below par value, whereas falling interest rates lower YTM and push bond prices above par. Understanding the inverse relationship between interest rates and bond prices is essential for evaluating the relative value and return expectations of fixed-income securities.

Real-World Examples: YTM vs. Coupon Rate

Yields to Maturity (YTM) and coupon rates often diverge in real-world bond markets due to fluctuating interest rates and credit risk perceptions. For example, a corporate bond with a 5% coupon rate may have a YTM of 4.5% if it sells at a premium, reflecting market demand and lower perceived risk. Conversely, a government bond issued at a 3% coupon might trade at a discount, pushing the YTM above the coupon rate to attract investors amid rising rates.

Importance for Bond Investors

Yield to maturity (YTM) provides bond investors with a comprehensive measure of the total return expected if the bond is held until maturity, incorporating all coupon payments and capital gains or losses. The coupon rate indicates the fixed annual interest paid on the bond's face value but does not account for market price fluctuations or reinvestment risk. Understanding the difference between YTM and the coupon rate is crucial for investors to accurately assess bond valuation, compare investment opportunities, and make informed portfolio decisions.

Choosing Bonds: YTM or Coupon Rate?

When choosing bonds, Yield to Maturity (YTM) offers a comprehensive measure of expected return, incorporating current price, coupon payments, and time to maturity, making it a more accurate indicator than the coupon rate. The coupon rate only reflects the fixed interest payment relative to the bond's face value and ignores price fluctuations and reinvestment of coupons. Investors prioritizing total investment return should rely on YTM for a precise comparison between bonds.

YTM vs Coupon Rate Infographic

difterm.com

difterm.com