Cross currency transactions involve exchanging two foreign currencies without converting through the base currency, often used to bypass fluctuations and additional costs. Base currency refers to the primary currency in a financial instrument or portfolio against which all other currencies are measured or compared. Understanding the distinction between cross currency and base currency is crucial for accurate hedging, risk management, and optimizing international investment strategies.

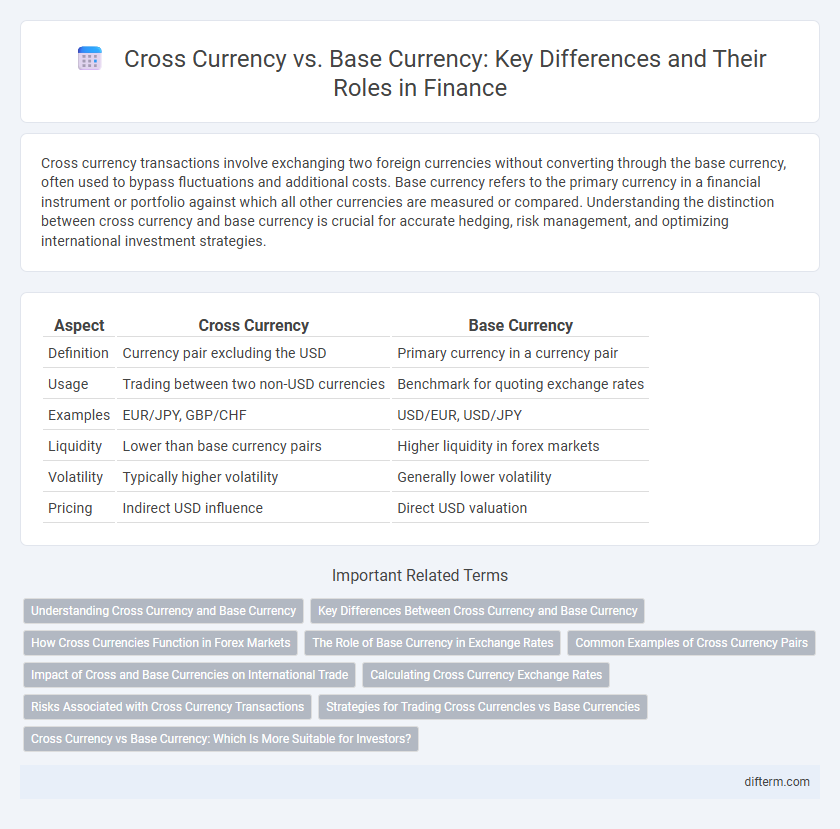

Table of Comparison

| Aspect | Cross Currency | Base Currency |

|---|---|---|

| Definition | Currency pair excluding the USD | Primary currency in a currency pair |

| Usage | Trading between two non-USD currencies | Benchmark for quoting exchange rates |

| Examples | EUR/JPY, GBP/CHF | USD/EUR, USD/JPY |

| Liquidity | Lower than base currency pairs | Higher liquidity in forex markets |

| Volatility | Typically higher volatility | Generally lower volatility |

| Pricing | Indirect USD influence | Direct USD valuation |

Understanding Cross Currency and Base Currency

Cross currency refers to a currency pair that does not involve the US dollar as either the base or quote currency, such as EUR/JPY or GBP/CHF. Base currency is the first currency listed in a currency pair and serves as the reference point for valuing the second currency, or quote currency. Understanding the relationship between cross currency pairs and base currency is crucial for managing foreign exchange risk and executing international financial transactions effectively.

Key Differences Between Cross Currency and Base Currency

Cross currency refers to a currency pair that does not include the base currency of the trading platform or country, typically used in international finance to facilitate direct exchange rates between two non-domestic currencies. Base currency is the primary currency against which exchange rates are quoted and serves as the foundation for pricing and trading in the forex market. Key differences include the role in trade; the base currency acts as a benchmark for valuation, while cross currency pairs bypass the base currency to provide direct exchange rates between two foreign currencies.

How Cross Currencies Function in Forex Markets

Cross currencies involve trading currency pairs that do not include the US dollar, such as EUR/GBP or AUD/JPY, allowing investors to directly exchange two foreign currencies. These pairs function by determining exchange rates based on relative supply and demand influenced by economic indicators, interest rates, and geopolitical events of both involved countries. Forex markets facilitate efficient liquidity and price discovery for cross currencies through electronic trading platforms, enabling diverse hedging and speculative strategies beyond base currency reliance.

The Role of Base Currency in Exchange Rates

The base currency serves as the reference point in exchange rates, determining the value of the cross currency in foreign exchange markets. It is essential for quoting currency pairs, where the exchange rate expresses how much of the counter currency is needed to purchase one unit of the base currency. Understanding the base currency's role enables more accurate financial analysis and effective risk management in international trade and investment.

Common Examples of Cross Currency Pairs

Common examples of cross currency pairs include EUR/JPY, GBP/CHF, and AUD/CAD, which do not involve the US dollar as the base or quote currency. These pairs are frequently traded to diversify portfolios and take advantage of currency movements between major economies other than the USD. Cross currency pairs often exhibit unique volatility patterns and spreads compared to base currency pairs involving the US dollar.

Impact of Cross and Base Currencies on International Trade

Cross currencies significantly influence international trade by enabling direct exchange between two non-USD currencies, reducing dependence on the US dollar and lowering transaction costs. Base currencies, often the US dollar or euro, serve as a primary reference, stabilizing trade contracts and pricing but can introduce exposure to currency fluctuations and geopolitical risks. Efficient management of cross and base currency risks is essential for multinational corporations to optimize currency conversion, minimize exchange rate volatility, and enhance global trade profitability.

Calculating Cross Currency Exchange Rates

Calculating cross currency exchange rates involves determining the value of one currency relative to another by using their individual exchange rates against a common base currency, typically the US dollar. The formula requires dividing the exchange rate of currency A against the base currency by the exchange rate of currency B against the same base currency, enabling accurate conversion between two foreign currencies without direct market quotes. This method is essential for businesses and investors managing multinational transactions and currency risk exposure in the forex market.

Risks Associated with Cross Currency Transactions

Cross currency transactions expose businesses to exchange rate risk due to fluctuations between the two foreign currencies involved, which can lead to unpredictable transaction costs and profit margins. Unlike base currency transactions, cross currency deals lack direct hedging instruments, increasing the complexity of managing currency risk and potential liquidity issues. Market volatility and geopolitical events further amplify the risk, necessitating robust risk management strategies such as forward contracts or options to mitigate potential financial losses.

Strategies for Trading Cross CurrencIes vs Base Currencies

Trading cross currencies involves leveraging opportunities in pairs without the US dollar, enhancing diversification beyond the base currency typically anchored to the USD. Strategies focus on exploiting interest rate differentials and geopolitical events impacting two foreign economies directly, requiring advanced analysis of relative economic indicators. Base currency trading prioritizes liquidity and global economic trends, often employing carry trade techniques and momentum indicators tied to the USD's influence in forex markets.

Cross Currency vs Base Currency: Which Is More Suitable for Investors?

Cross currency transactions involve exchanging one foreign currency for another without using the domestic base currency, offering investors opportunities to diversify currency exposure and hedge against base currency depreciation. Base currency trading centers on the investor's primary currency, providing simpler risk management and lower transaction costs but potentially limiting global diversification. Investors seeking broader market access and enhanced hedging strategies may prefer cross currency trades, while those prioritizing stability and reduced complexity often favor base currency transactions.

Cross Currency vs Base Currency Infographic

difterm.com

difterm.com