High-yield bonds offer higher interest rates due to increased credit risk compared to investment-grade bonds, which are issued by more financially stable companies with lower default risk. Investors seeking greater returns may prefer high-yield bonds despite their volatility, while conservative investors often choose investment-grade bonds for capital preservation and steady income. Understanding the risk-return tradeoff is essential when selecting between these two bond categories for portfolio diversification.

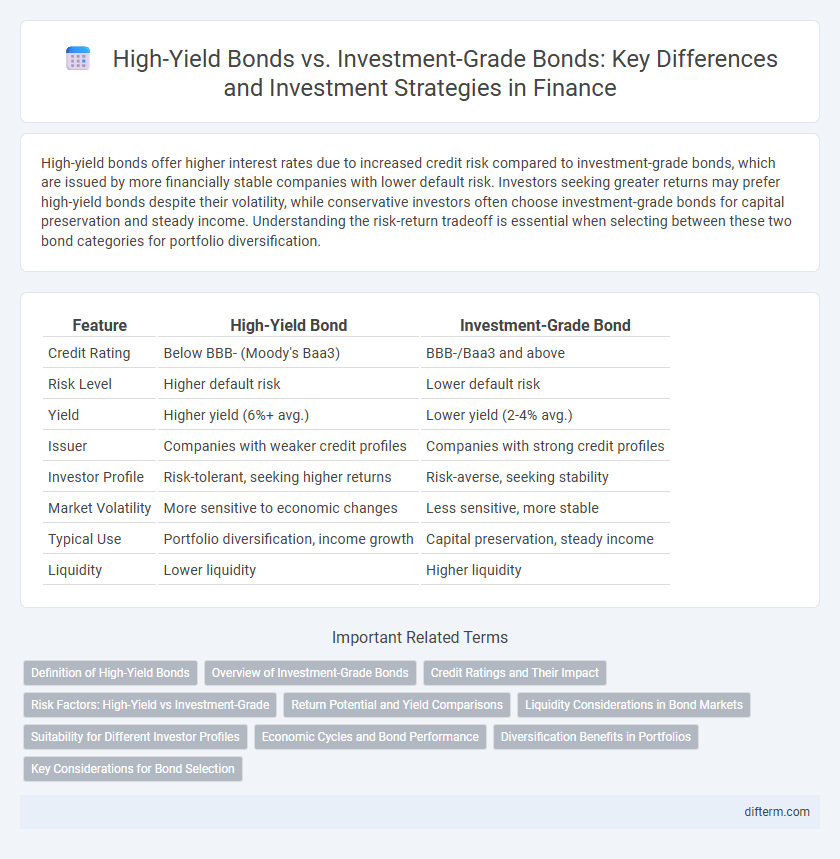

Table of Comparison

| Feature | High-Yield Bond | Investment-Grade Bond |

|---|---|---|

| Credit Rating | Below BBB- (Moody's Baa3) | BBB-/Baa3 and above |

| Risk Level | Higher default risk | Lower default risk |

| Yield | Higher yield (6%+ avg.) | Lower yield (2-4% avg.) |

| Issuer | Companies with weaker credit profiles | Companies with strong credit profiles |

| Investor Profile | Risk-tolerant, seeking higher returns | Risk-averse, seeking stability |

| Market Volatility | More sensitive to economic changes | Less sensitive, more stable |

| Typical Use | Portfolio diversification, income growth | Capital preservation, steady income |

| Liquidity | Lower liquidity | Higher liquidity |

Definition of High-Yield Bonds

High-yield bonds, also known as junk bonds, are debt securities issued by companies with lower credit ratings, typically below BBB- by Standard & Poor's or Baa3 by Moody's, reflecting higher default risk. These bonds offer significantly higher interest rates compared to investment-grade bonds to compensate investors for the increased credit risk. High-yield bonds play a crucial role in corporate finance by providing capital to companies that may not qualify for investment-grade ratings.

Overview of Investment-Grade Bonds

Investment-grade bonds are debt securities rated BBB- or higher by major credit rating agencies such as S&P, Moody's, and Fitch, indicating a low risk of default and stable financial performance. These bonds typically offer lower yields compared to high-yield bonds but provide greater capital preservation and appeal to conservative investors seeking steady income streams. Issued by corporations, municipalities, and governments with strong credit profiles, investment-grade bonds play a crucial role in diversified fixed-income portfolios by balancing risk and return.

Credit Ratings and Their Impact

High-yield bonds, rated below BBB- by credit rating agencies like S&P and Moody's, carry higher default risk but offer greater interest returns compared to investment-grade bonds, which have ratings of BBB-/Baa3 and above indicating lower credit risk. Credit ratings impact investor perception, influencing bond yields, with lower-rated high-yield bonds demanding higher yields to compensate for increased risk. The rating gap affects portfolio strategies, where investment-grade bonds provide stability and lower risk, while high-yield bonds present opportunities for enhanced income through higher risk exposure.

Risk Factors: High-Yield vs Investment-Grade

High-yield bonds carry significantly higher credit risk due to issuers' lower credit ratings, increasing the likelihood of default compared to investment-grade bonds, which come from more financially stable companies. Investment-grade bonds typically offer lower yields but provide greater protection against credit events, reflecting their stronger issuer creditworthiness and lower default rates. The risk premium demanded by investors for high-yield bonds compensates for volatility, economic sensitivity, and a greater probability of issuer distress.

Return Potential and Yield Comparisons

High-yield bonds offer substantially higher returns compared to investment-grade bonds, reflecting their increased credit risk and lower credit ratings from agencies like Moody's and S&P. Investment-grade bonds provide lower yields but greater stability due to higher credit ratings (BBB- or above), making them suitable for conservative investors seeking steady income. Yield comparisons consistently show high-yield bonds outperforming in total return, especially during strong economic cycles, but this comes with greater default risk and price volatility.

Liquidity Considerations in Bond Markets

High-yield bonds often exhibit lower liquidity compared to investment-grade bonds, leading to wider bid-ask spreads and higher trading costs. Institutional investors typically prefer investment-grade bonds due to their more active secondary markets, enabling quicker transactions and better price transparency. Liquidity differences significantly impact portfolio management strategies and risk assessments in fixed-income markets.

Suitability for Different Investor Profiles

High-yield bonds, characterized by higher default risk and elevated coupon rates, are suitable for aggressive investors seeking higher returns and willing to tolerate greater credit risk. Investment-grade bonds offer lower yields but provide greater capital preservation and income stability, aligning well with conservative investors prioritizing safety and predictable cash flows. Portfolio diversification strategies often combine both bond types to balance risk and reward based on individual risk tolerance and investment objectives.

Economic Cycles and Bond Performance

High-yield bonds typically outperform investment-grade bonds during economic expansions due to higher risk tolerance and increased corporate earnings driving spreads tighter. Investment-grade bonds demonstrate greater stability and lower default rates in economic downturns, offering safer returns as credit risk rises. Bond performance across economic cycles depends on credit quality sensitivity, with high-yield bonds exhibiting amplified gains and losses relative to the more resilient investment-grade sector.

Diversification Benefits in Portfolios

High-yield bonds offer higher returns with increased credit risk, providing diversification benefits by reducing correlation with investment-grade bonds in portfolios. Investment-grade bonds add stability and lower default risk, balancing the overall risk profile when combined with high-yield bonds. Including both types enhances portfolio resilience through varied credit risk exposure and improved risk-adjusted returns.

Key Considerations for Bond Selection

High-yield bonds offer higher interest rates due to increased credit risk compared to investment-grade bonds, which have lower default risk and more stable returns. Investors must evaluate their risk tolerance, investment horizon, and income requirements when selecting between these bonds. Portfolio diversification and economic outlook also play crucial roles in balancing potential yield against credit quality.

High-yield bond vs Investment-grade bond Infographic

difterm.com

difterm.com