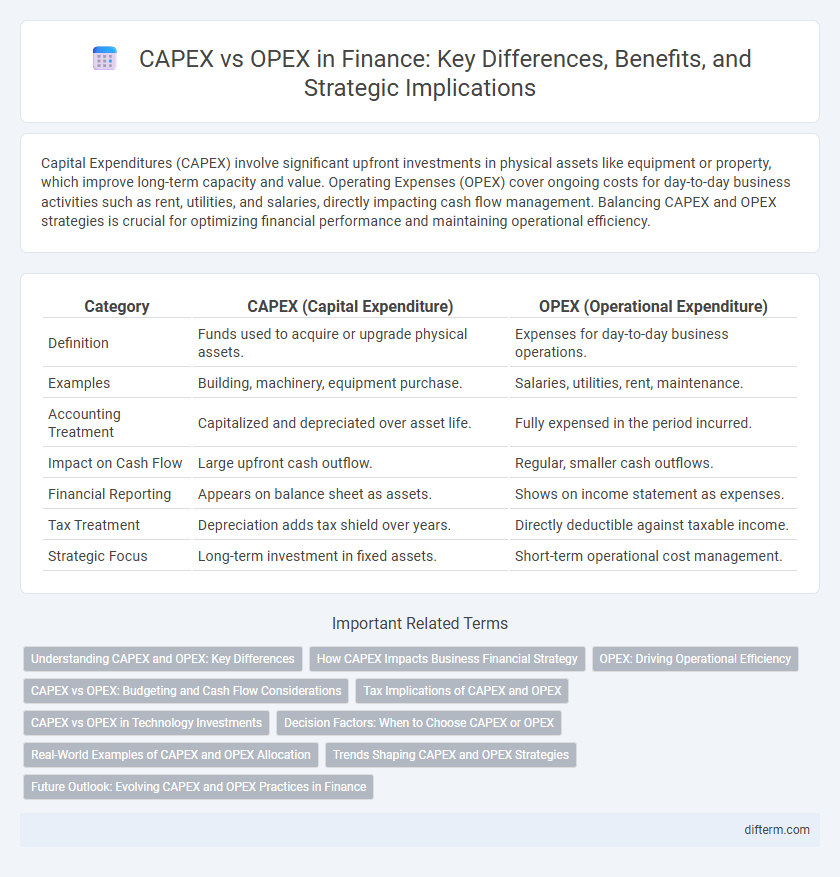

Capital Expenditures (CAPEX) involve significant upfront investments in physical assets like equipment or property, which improve long-term capacity and value. Operating Expenses (OPEX) cover ongoing costs for day-to-day business activities such as rent, utilities, and salaries, directly impacting cash flow management. Balancing CAPEX and OPEX strategies is crucial for optimizing financial performance and maintaining operational efficiency.

Table of Comparison

| Category | CAPEX (Capital Expenditure) | OPEX (Operational Expenditure) |

|---|---|---|

| Definition | Funds used to acquire or upgrade physical assets. | Expenses for day-to-day business operations. |

| Examples | Building, machinery, equipment purchase. | Salaries, utilities, rent, maintenance. |

| Accounting Treatment | Capitalized and depreciated over asset life. | Fully expensed in the period incurred. |

| Impact on Cash Flow | Large upfront cash outflow. | Regular, smaller cash outflows. |

| Financial Reporting | Appears on balance sheet as assets. | Shows on income statement as expenses. |

| Tax Treatment | Depreciation adds tax shield over years. | Directly deductible against taxable income. |

| Strategic Focus | Long-term investment in fixed assets. | Short-term operational cost management. |

Understanding CAPEX and OPEX: Key Differences

Capital Expenditures (CAPEX) refer to the funds a company invests in acquiring or upgrading physical assets such as buildings, machinery, or technology to generate long-term benefits. Operating Expenses (OPEX) are the day-to-day costs required to run business operations, including salaries, rent, and utilities, which are fully deductible in the fiscal year they occur. Understanding the distinction between CAPEX and OPEX is crucial for financial planning, budgeting, and tax optimization, as CAPEX impacts asset depreciation while OPEX directly affects net income.

How CAPEX Impacts Business Financial Strategy

CAPEX influences business financial strategy by requiring significant upfront investment in assets that drive long-term growth and operational capacity. This allocation affects cash flow management, as capital expenditures reduce immediate liquidity but can lead to depreciation benefits and tax advantages over time. Strategic CAPEX planning enables businesses to optimize asset utilization, enhance competitive positioning, and support sustainable financial performance.

OPEX: Driving Operational Efficiency

OPEX, or operational expenditures, focus on day-to-day expenses essential for maintaining business functions, directly impacting cash flow and profitability. Prioritizing OPEX management enhances operational efficiency by optimizing resource allocation, reducing waste, and enabling agile responses to market changes. Effective control of OPEX supports sustained business growth and improved financial performance through streamlined processes and cost containment strategies.

CAPEX vs OPEX: Budgeting and Cash Flow Considerations

CAPEX (Capital Expenditures) involves significant upfront investments in fixed assets, impacting long-term budgeting and requiring substantial initial cash outflows. OPEX (Operational Expenditures) covers day-to-day expenses like salaries and utilities, offering more flexibility in budgeting and smoother cash flow management. Businesses prioritize CAPEX for asset acquisition and expansion, while OPEX facilitates operational agility and short-term financial control.

Tax Implications of CAPEX and OPEX

Capital expenditures (CAPEX) are typically capitalized and depreciated over the asset's useful life, allowing businesses to spread tax deductions across multiple years, which can enhance long-term tax planning. Operating expenses (OPEX) are fully deductible in the year they are incurred, providing immediate tax benefits that improve cash flow and reduce taxable income more rapidly. Understanding these differing tax implications helps companies optimize financial strategies by balancing upfront tax savings against sustained depreciation advantages.

CAPEX vs OPEX in Technology Investments

Capital expenditures (CAPEX) in technology investments involve significant upfront costs for acquiring hardware, software, or infrastructure, providing long-term assets that depreciate over time. Operating expenditures (OPEX) cover ongoing expenses such as cloud services, subscriptions, maintenance, and support, offering flexibility and scalability with a pay-as-you-go model. Organizations strategically balance CAPEX and OPEX to optimize cash flow, reduce risk, and enhance technological agility in rapidly evolving markets.

Decision Factors: When to Choose CAPEX or OPEX

Choosing between CAPEX and OPEX depends on factors such as budget constraints, tax implications, and the desired flexibility of financial management. CAPEX is optimal for long-term investments like infrastructure or equipment, providing asset ownership and depreciation benefits. OPEX suits operational expenses requiring flexibility, including subscription services or maintenance, enhancing cash flow management and scalability.

Real-World Examples of CAPEX and OPEX Allocation

In the finance sector, CAPEX (Capital Expenditures) typically involves large investments in physical assets such as purchasing new manufacturing equipment or upgrading office buildings, which are capitalized and depreciated over time. OPEX (Operational Expenditures) covers day-to-day expenses like employee salaries, utility bills, and routine maintenance, impacting the profit and loss statement immediately. For instance, a technology company may allocate CAPEX to acquire servers and data centers, while budgeting OPEX for cloud service subscriptions and IT support.

Trends Shaping CAPEX and OPEX Strategies

Emerging trends in CAPEX and OPEX strategies reveal a shift towards scalable cloud solutions and automation technologies that reduce upfront capital investments while optimizing operational expenses. Companies increasingly prioritize agile budgeting frameworks, leveraging real-time data analytics to balance long-term asset acquisition with flexible operational spending. Sustainability initiatives and digital transformation drive CAPEX toward energy-efficient infrastructure, whereas OPEX focuses on subscription-based services and managed IT solutions to enhance cost predictability and business agility.

Future Outlook: Evolving CAPEX and OPEX Practices in Finance

Finance is witnessing a strategic shift as companies increasingly adopt hybrid models that balance CAPEX and OPEX to optimize resource allocation and enhance agility. Emerging technologies like cloud computing and AI are driving a preference for OPEX, enabling scalable spending aligned with operational needs. Forecasts suggest this evolution will improve financial flexibility, risk management, and investment efficiency in corporate finance strategies.

CAPEX vs OPEX Infographic

difterm.com

difterm.com