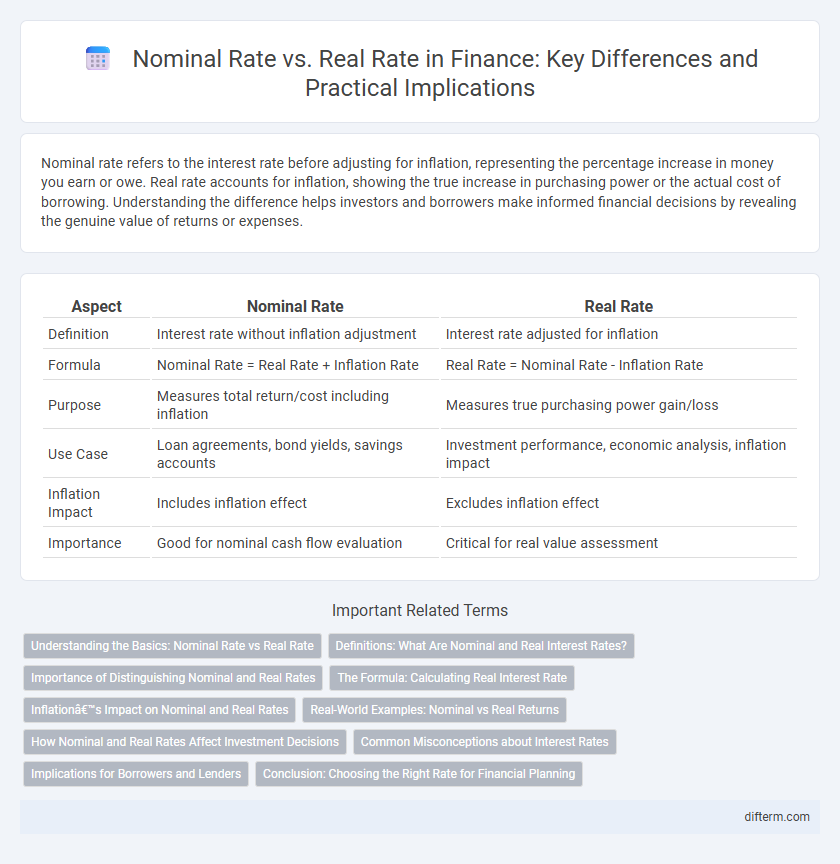

Nominal rate refers to the interest rate before adjusting for inflation, representing the percentage increase in money you earn or owe. Real rate accounts for inflation, showing the true increase in purchasing power or the actual cost of borrowing. Understanding the difference helps investors and borrowers make informed financial decisions by revealing the genuine value of returns or expenses.

Table of Comparison

| Aspect | Nominal Rate | Real Rate |

|---|---|---|

| Definition | Interest rate without inflation adjustment | Interest rate adjusted for inflation |

| Formula | Nominal Rate = Real Rate + Inflation Rate | Real Rate = Nominal Rate - Inflation Rate |

| Purpose | Measures total return/cost including inflation | Measures true purchasing power gain/loss |

| Use Case | Loan agreements, bond yields, savings accounts | Investment performance, economic analysis, inflation impact |

| Inflation Impact | Includes inflation effect | Excludes inflation effect |

| Importance | Good for nominal cash flow evaluation | Critical for real value assessment |

Understanding the Basics: Nominal Rate vs Real Rate

Nominal rate refers to the interest rate before adjusting for inflation, representing the stated percentage return on an investment or loan. Real rate adjusts the nominal rate by subtracting the inflation rate, reflecting the true purchasing power gain or loss. Understanding the distinction between nominal and real rates is essential for accurately assessing investment performance and making informed financial decisions.

Definitions: What Are Nominal and Real Interest Rates?

Nominal interest rate refers to the percentage increase in money you pay or earn on a loan or investment without adjusting for inflation. Real interest rate accounts for inflation by subtracting the inflation rate from the nominal rate, revealing the true purchasing power of the interest earned or paid. Understanding the difference between nominal and real rates is crucial for accurate assessment of investment returns and loan costs over time.

Importance of Distinguishing Nominal and Real Rates

Understanding the distinction between nominal and real interest rates is crucial for accurate financial decision-making and investment analysis. Nominal rates reflect the stated interest without adjusting for inflation, while real rates provide the inflation-adjusted return, offering a true measure of purchasing power. Ignoring this difference can lead to miscalculations in evaluating investment performance, loan costs, and the true profitability of financial assets.

The Formula: Calculating Real Interest Rate

The formula for calculating the real interest rate is derived by adjusting the nominal rate to account for inflation, expressed as Real Interest Rate = [(1 + Nominal Rate) / (1 + Inflation Rate)] - 1. This calculation ensures investors understand the true growth of their purchasing power by reflecting inflation's impact. Accurately applying this formula is crucial for comparing investment returns and making informed financial decisions.

Inflation’s Impact on Nominal and Real Rates

Inflation directly reduces the purchasing power of nominal interest rates, causing the real rate of return to decline when inflation rises. The nominal rate represents the stated interest without adjustment, while the real rate reflects the nominal rate adjusted for inflation, providing a more accurate measure of true investment yield. Investors must consider inflation's impact to evaluate the effective profitability of financial instruments accurately.

Real-World Examples: Nominal vs Real Returns

Investors often face the difference between nominal and real rates when evaluating returns on assets such as stocks or bonds. For example, if a stock yields a nominal return of 8% while inflation is 3%, the real return, which adjusts for purchasing power, is approximately 5%. Understanding this distinction helps investors assess the true growth of their investment portfolio over time.

How Nominal and Real Rates Affect Investment Decisions

Nominal rates represent the stated interest rate without adjusting for inflation, while real rates reflect the true purchasing power by accounting for inflation. Investors rely on real rates to assess the genuine return on investments, influencing asset allocation and risk tolerance. Understanding the difference between nominal and real rates helps in making informed decisions about bonds, stocks, and other financial instruments.

Common Misconceptions about Interest Rates

Nominal interest rates often mislead investors by ignoring inflation's impact, causing an overestimation of actual returns. Real interest rates, adjusted for inflation, provide a more accurate measure of purchasing power changes over time. Misunderstanding the difference between nominal and real rates can result in poor financial decisions, such as underestimating the cost of borrowing or overstating investment profitability.

Implications for Borrowers and Lenders

Nominal rates represent the stated interest without adjusting for inflation, affecting borrowers by determining the immediate cost of debt, whereas real rates reflect the true purchasing power impact, crucial for lenders seeking to preserve investment value. Borrowers face higher actual costs if inflation is lower than expected, while lenders benefit when real rates exceed nominal rates due to increased returns in inflation-adjusted terms. Understanding the divergence between nominal and real rates helps both parties make informed decisions about loan agreements and investment risks.

Conclusion: Choosing the Right Rate for Financial Planning

Selecting the appropriate interest rate for financial planning hinges on your investment goals and inflation expectations. The nominal rate reflects the stated interest without adjusting for inflation, while the real rate accounts for inflation's impact on purchasing power. Prioritizing the real rate ensures more accurate projections of investment returns and helps preserve long-term wealth.

Nominal Rate vs Real Rate Infographic

difterm.com

difterm.com