Bundled trusts consolidate multiple mortgages into a single investment vehicle, providing investors with diversified exposure to real estate loans. Securitized assets transform pooled financial obligations such as loans or receivables into tradable securities, often backed by underlying cash flows. Understanding the distinction enhances portfolio management by balancing risk, liquidity, and income predictability.

Table of Comparison

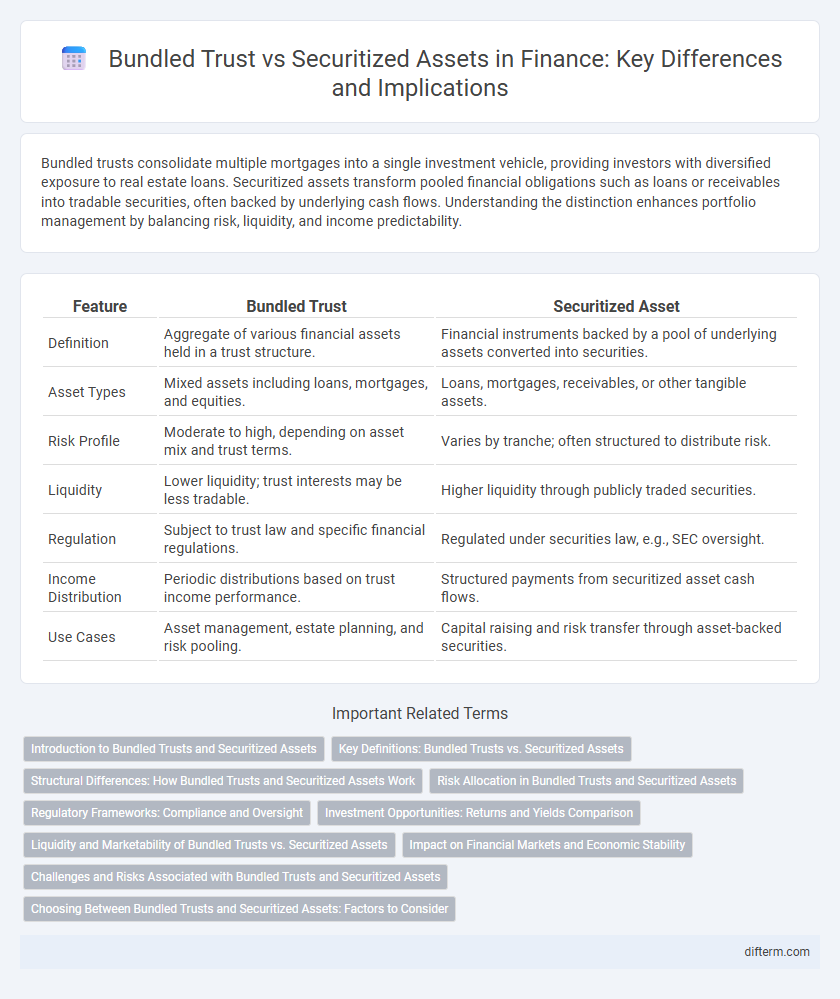

| Feature | Bundled Trust | Securitized Asset |

|---|---|---|

| Definition | Aggregate of various financial assets held in a trust structure. | Financial instruments backed by a pool of underlying assets converted into securities. |

| Asset Types | Mixed assets including loans, mortgages, and equities. | Loans, mortgages, receivables, or other tangible assets. |

| Risk Profile | Moderate to high, depending on asset mix and trust terms. | Varies by tranche; often structured to distribute risk. |

| Liquidity | Lower liquidity; trust interests may be less tradable. | Higher liquidity through publicly traded securities. |

| Regulation | Subject to trust law and specific financial regulations. | Regulated under securities law, e.g., SEC oversight. |

| Income Distribution | Periodic distributions based on trust income performance. | Structured payments from securitized asset cash flows. |

| Use Cases | Asset management, estate planning, and risk pooling. | Capital raising and risk transfer through asset-backed securities. |

Introduction to Bundled Trusts and Securitized Assets

Bundled trusts aggregate multiple financial assets into a single investment vehicle, providing diversified exposure and risk management for investors. Securitized assets involve pooling various debt obligations, such as mortgages or loans, and issuing tradable securities backed by these cash flows. Both structures enhance liquidity and access to capital markets while offering distinct mechanisms for risk distribution and investor returns.

Key Definitions: Bundled Trusts vs. Securitized Assets

Bundled trusts aggregate multiple mortgages into a single investment vehicle, providing diversified exposure to real estate debt, while securitized assets represent financial instruments backed by pools of underlying assets, such as loans or receivables, converted into tradable securities. Bundled trusts often maintain the underlying asset ownership structure, enhancing investor transparency, whereas securitized assets involve complex structuring and credit enhancements to optimize risk and return profiles. Understanding the distinctions in asset composition, risk dispersion, and investor rights is crucial for portfolio allocation and regulatory compliance in asset-backed finance.

Structural Differences: How Bundled Trusts and Securitized Assets Work

Bundled trusts pool multiple individual assets into a single trust structure, providing diversification and collective management, while securitized assets involve pooling financial assets into a special purpose vehicle (SPV) that issues tradable securities backed by those assets. In bundled trusts, asset ownership remains within the trust, focusing on income distribution to beneficiaries, whereas securitized assets transfer cash flows to investors through structured tranches with varying risk and return profiles. Structural differences lie in control, risk allocation, and legal frameworks, where bundled trusts prioritize beneficiary rights and securitization emphasizes investor payouts and market liquidity.

Risk Allocation in Bundled Trusts and Securitized Assets

Risk allocation in bundled trusts typically involves pooling various financial assets, where the trust structure absorbs some credit risk while investors bear market and liquidity risks. In securitized assets, risk is distributed through tranching, enabling different investor classes to assume varying levels of credit and prepayment risk based on tranche seniority. This structured approach enhances risk diversification, allowing for targeted exposure and tailored risk-return profiles for investors.

Regulatory Frameworks: Compliance and Oversight

Bundled trusts and securitized assets operate under distinct regulatory frameworks that mandate strict compliance with securities laws and investor protection standards. Bundled trusts are typically governed by trust law and financial regulatory agencies such as the SEC, emphasizing fiduciary duties and ongoing disclosure requirements. Securitized assets fall under specific securitization regulations like the Dodd-Frank Act, requiring transparency, risk retention, and adherence to structured finance supervision protocols to ensure market stability and investor confidence.

Investment Opportunities: Returns and Yields Comparison

Bundled trusts typically offer diversified exposure to a pool of underlying assets, providing steady income streams with moderate risk, while securitized assets often deliver higher yields due to their structured tranches and risk layers. Investment opportunities in bundled trusts favor conservative investors seeking predictable returns, whereas securitized assets attract those willing to assume greater risk for potentially enhanced returns. Yield performance depends on asset quality, tranche seniority, and market conditions, influencing the risk-return profile between these two financing structures.

Liquidity and Marketability of Bundled Trusts vs. Securitized Assets

Bundled trusts typically offer limited liquidity compared to securitized assets due to their structure, which involves pooling assets without creating tradable securities, restricting secondary market transactions. Securitized assets, such as mortgage-backed securities or asset-backed securities, provide enhanced marketability by transforming underlying cash flows into standardized, tradeable instruments that attract a broader range of investors. Consequently, securitized assets generally demonstrate higher liquidity, facilitating quicker asset liquidation and price discovery in active financial markets.

Impact on Financial Markets and Economic Stability

Bundled trusts consolidate multiple financial assets, enhancing liquidity and risk diversification, which can stabilize financial markets by reducing the impact of individual asset defaults. Securitized assets, structured into tradable instruments, increase market efficiency but may introduce systemic risk if underlying asset quality deteriorates, potentially triggering market volatility. The interplay between bundled trusts and securitized assets shapes credit availability and investor confidence, directly influencing economic stability and monetary policy effectiveness.

Challenges and Risks Associated with Bundled Trusts and Securitized Assets

Bundled trusts and securitized assets face significant challenges including credit risk, liquidity risk, and valuation complexities caused by pooling heterogeneous financial instruments. The risk of default is amplified when underlying assets deteriorate, affecting cash flow predictability and increasing exposure to market fluctuations. Regulatory uncertainty and transparency issues further complicate risk assessment, making these instruments vulnerable during economic downturns.

Choosing Between Bundled Trusts and Securitized Assets: Factors to Consider

When choosing between bundled trusts and securitized assets, investors must evaluate factors such as risk diversification, cash flow stability, and credit enhancements. Bundled trusts typically offer pooled asset portfolios that mitigate default risk through diversification, whereas securitized assets provide tailored tranches with varying risk-return profiles aligned with investor preferences. Assessing market liquidity, regulatory implications, and underlying asset quality is critical for optimizing portfolio performance and aligning with financial goals.

Bundled trust vs Securitized asset Infographic

difterm.com

difterm.com