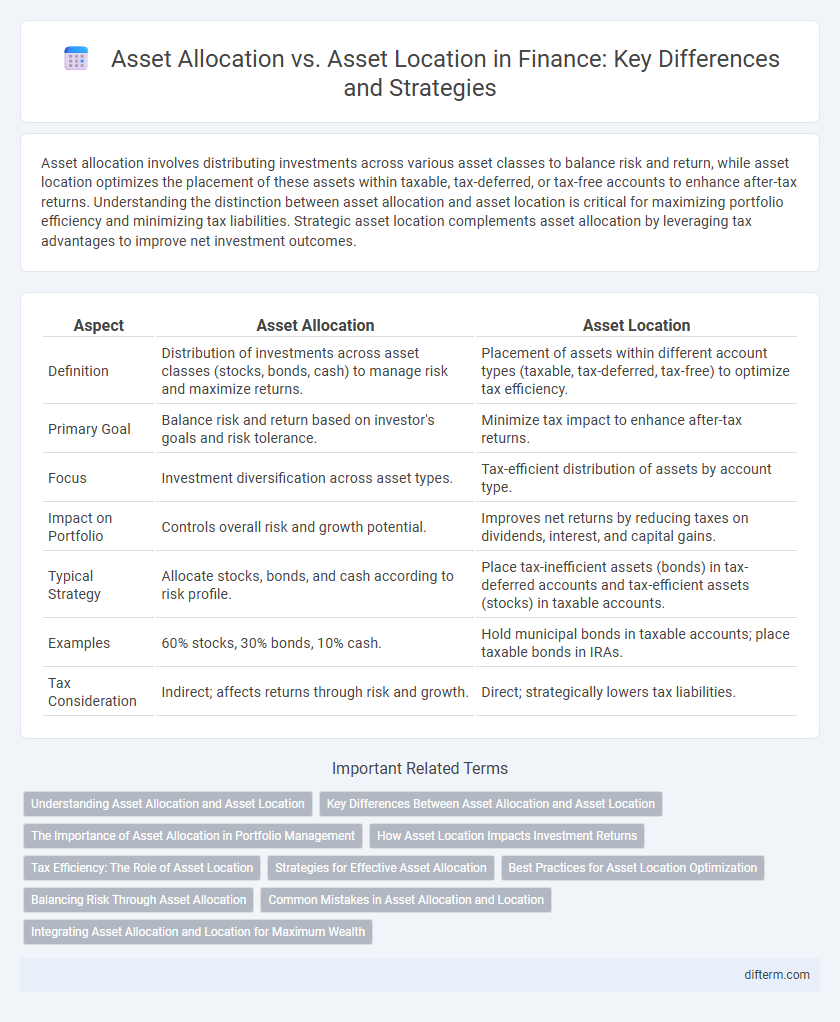

Asset allocation involves distributing investments across various asset classes to balance risk and return, while asset location optimizes the placement of these assets within taxable, tax-deferred, or tax-free accounts to enhance after-tax returns. Understanding the distinction between asset allocation and asset location is critical for maximizing portfolio efficiency and minimizing tax liabilities. Strategic asset location complements asset allocation by leveraging tax advantages to improve net investment outcomes.

Table of Comparison

| Aspect | Asset Allocation | Asset Location |

|---|---|---|

| Definition | Distribution of investments across asset classes (stocks, bonds, cash) to manage risk and maximize returns. | Placement of assets within different account types (taxable, tax-deferred, tax-free) to optimize tax efficiency. |

| Primary Goal | Balance risk and return based on investor's goals and risk tolerance. | Minimize tax impact to enhance after-tax returns. |

| Focus | Investment diversification across asset types. | Tax-efficient distribution of assets by account type. |

| Impact on Portfolio | Controls overall risk and growth potential. | Improves net returns by reducing taxes on dividends, interest, and capital gains. |

| Typical Strategy | Allocate stocks, bonds, and cash according to risk profile. | Place tax-inefficient assets (bonds) in tax-deferred accounts and tax-efficient assets (stocks) in taxable accounts. |

| Examples | 60% stocks, 30% bonds, 10% cash. | Hold municipal bonds in taxable accounts; place taxable bonds in IRAs. |

| Tax Consideration | Indirect; affects returns through risk and growth. | Direct; strategically lowers tax liabilities. |

Understanding Asset Allocation and Asset Location

Asset allocation involves strategically distributing investments across various asset classes such as stocks, bonds, and cash to balance risk and return according to an investor's goals. Asset location focuses on placing those investments within the most tax-efficient accounts, like tax-deferred IRAs or taxable brokerage accounts, to maximize after-tax returns. Understanding the distinction between asset allocation and asset location helps optimize portfolio performance by aligning investment risk with tax advantages.

Key Differences Between Asset Allocation and Asset Location

Asset allocation strategically distributes investments across various asset classes like stocks, bonds, and cash to balance risk and return, while asset location optimizes the placement of these investments across different account types such as taxable, tax-deferred, and tax-exempt accounts to minimize taxes. Key differences include asset allocation's focus on diversification to achieve portfolio goals versus asset location's emphasis on tax efficiency by leveraging differing tax treatments of accounts. Effective integration of both strategies enhances overall portfolio performance by balancing risk, return, and tax impact.

The Importance of Asset Allocation in Portfolio Management

Effective asset allocation strategically balances investments across asset classes like stocks, bonds, and real estate to optimize risk and return, aligning with an investor's financial goals and risk tolerance. This fundamental portfolio management practice enhances diversification, reduces volatility, and improves long-term performance potential. Understanding the distinction between asset allocation, which focuses on selecting asset categories, and asset location, which involves placing assets in tax-efficient accounts, is critical for maximizing investment efficiency.

How Asset Location Impacts Investment Returns

Asset location significantly impacts investment returns by optimizing tax efficiency through strategic placement of assets in taxable, tax-deferred, or tax-exempt accounts. Proper asset location reduces tax drag, enhancing after-tax returns and compounding growth over time. Studies show allocating high-growth investments like stocks in tax-advantaged accounts, while placing income-generating assets in taxable accounts, can improve portfolio performance substantially.

Tax Efficiency: The Role of Asset Location

Asset location plays a crucial role in tax efficiency by strategically placing income-generating investments like bonds in tax-advantaged accounts such as IRAs to minimize taxable income. Equities generating qualified dividends or long-term capital gains are often held in taxable accounts to benefit from lower tax rates and greater liquidity. Optimizing asset location enhances after-tax returns without altering the overall risk-return profile of the portfolio.

Strategies for Effective Asset Allocation

Effective asset allocation strategies prioritize diversifying investments across asset classes such as equities, bonds, and real estate to optimize risk-adjusted returns. Incorporating asset location involves strategically placing tax-inefficient investments in tax-advantaged accounts like IRAs or 401(k)s to enhance after-tax growth. Combining asset allocation with asset location maximizes portfolio efficiency by balancing growth potential and tax minimization.

Best Practices for Asset Location Optimization

Optimal asset location involves strategically placing investments in tax-advantaged accounts like IRAs and 401(k)s to maximize after-tax returns by minimizing tax liabilities on high-yield or tax-inefficient assets. Best practices emphasize holding tax-inefficient assets such as bonds and REITs in tax-deferred accounts, while placing tax-efficient equities and index funds in taxable accounts to leverage lower capital gains rates. Regular portfolio reviews and rebalancing ensure alignment with financial goals, tax laws, and risk tolerance, enhancing tax efficiency and long-term growth.

Balancing Risk Through Asset Allocation

Balancing risk through asset allocation involves strategically distributing investments across various asset classes such as stocks, bonds, and cash to optimize returns while minimizing exposure to market volatility. Asset location, by contrast, focuses on placing these investments in tax-efficient accounts to enhance after-tax returns without altering the overall risk profile. Effective portfolio management requires integrating both strategies to align risk tolerance, investment goals, and tax considerations for long-term financial growth.

Common Mistakes in Asset Allocation and Location

Common mistakes in asset allocation include failing to diversify across asset classes, leading to excessive risk exposure, and neglecting to adjust allocations based on changing market conditions or personal risk tolerance. In asset location, investors often err by placing high-taxable assets in taxable accounts instead of tax-advantaged accounts, which reduces after-tax returns. Proper understanding of asset allocation and asset location strategies is essential for maximizing portfolio efficiency and long-term wealth accumulation.

Integrating Asset Allocation and Location for Maximum Wealth

Integrating asset allocation and asset location strategies enhances portfolio efficiency by optimizing tax impacts and risk-adjusted returns. Placing tax-inefficient assets like bonds in tax-advantaged accounts while holding growth-oriented equities in taxable accounts maximizes after-tax wealth. Strategic coordination of these approaches aligns investment goals with tax considerations, driving long-term financial growth.

Asset allocation vs asset location Infographic

difterm.com

difterm.com