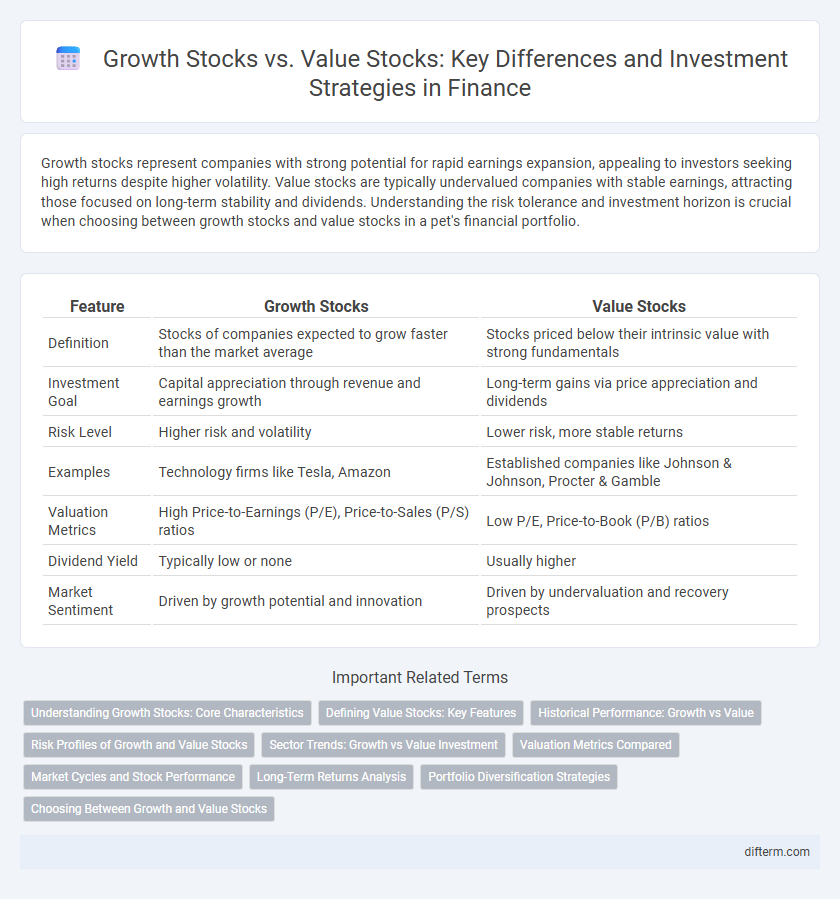

Growth stocks represent companies with strong potential for rapid earnings expansion, appealing to investors seeking high returns despite higher volatility. Value stocks are typically undervalued companies with stable earnings, attracting those focused on long-term stability and dividends. Understanding the risk tolerance and investment horizon is crucial when choosing between growth stocks and value stocks in a pet's financial portfolio.

Table of Comparison

| Feature | Growth Stocks | Value Stocks |

|---|---|---|

| Definition | Stocks of companies expected to grow faster than the market average | Stocks priced below their intrinsic value with strong fundamentals |

| Investment Goal | Capital appreciation through revenue and earnings growth | Long-term gains via price appreciation and dividends |

| Risk Level | Higher risk and volatility | Lower risk, more stable returns |

| Examples | Technology firms like Tesla, Amazon | Established companies like Johnson & Johnson, Procter & Gamble |

| Valuation Metrics | High Price-to-Earnings (P/E), Price-to-Sales (P/S) ratios | Low P/E, Price-to-Book (P/B) ratios |

| Dividend Yield | Typically low or none | Usually higher |

| Market Sentiment | Driven by growth potential and innovation | Driven by undervaluation and recovery prospects |

Understanding Growth Stocks: Core Characteristics

Growth stocks typically represent companies with above-average revenue and earnings growth, often reinvesting profits to fuel expansion rather than paying dividends. These stocks are characterized by high price-to-earnings (P/E) ratios and strong future earnings potential driven by innovation or market disruption. Investors attracted to growth stocks often seek capital appreciation through exposure to rapidly scaling industries like technology and healthcare.

Defining Value Stocks: Key Features

Value stocks are shares of companies trading at prices considered below their intrinsic worth, often characterized by low price-to-earnings (P/E) ratios and high dividend yields. These stocks typically belong to established firms with stable earnings, strong balance sheets, and consistent cash flow, reflecting market undervaluation or temporary challenges. Investors target value stocks for potential long-term capital appreciation coupled with income generation, benefiting from market corrections and company fundamentals.

Historical Performance: Growth vs Value

Growth stocks have historically outperformed value stocks during bull markets due to their significant earnings potential and investor optimism. Conversely, value stocks tend to provide more consistent returns and outperform growth stocks during market downturns or economic recoveries, as they are typically undervalued with stable fundamentals. Over several decades, the cyclical nature of market preferences has resulted in periods where either growth or value strategies dominate in returns.

Risk Profiles of Growth and Value Stocks

Growth stocks typically exhibit higher volatility and greater risk due to their reliance on future earnings potential and market expectations, which can lead to significant price fluctuations. Value stocks tend to have lower volatility with more stable cash flows and established business models, often appealing to investors seeking income and capital preservation. The risk profile of growth stocks is generally more aggressive, while value stocks offer a more conservative investment approach, reflecting differing responses to economic cycles and market conditions.

Sector Trends: Growth vs Value Investment

Technology and healthcare sectors predominantly drive growth stocks through innovation and rapid earnings expansion, while financials and utilities often dominate value stock portfolios due to their stable cash flows and dividend yields. Sector trends reveal that growth investments excel in bull markets with high economic optimism, whereas value stocks tend to outperform during market recoveries and periods of economic stability. Understanding sector-specific dynamics is crucial for investors aiming to balance risk and returns between growth and value styles.

Valuation Metrics Compared

Growth stocks typically exhibit higher price-to-earnings (P/E) ratios reflecting expectations of rapid earnings expansion, while value stocks often trade at lower P/E ratios indicating potential undervaluation based on current fundamentals. Price-to-book (P/B) and price-to-sales (P/S) ratios also tend to be elevated for growth stocks due to anticipated future profitability, whereas value stocks show more conservative multiples suggesting stability or recovery potential. Investors analyzing these valuation metrics assess growth stocks for momentum and market optimism, contrasting with value stocks' appeal rooted in tangible asset strength and earnings resilience.

Market Cycles and Stock Performance

Growth stocks typically outperform during bullish market cycles due to strong earnings momentum and high investor optimism, while value stocks excel in bearish or recovering markets by offering stability and undervalued assets. Market cycles influence stock performance as growth stocks exhibit higher volatility, capitalizing on economic expansion, whereas value stocks provide steady dividends and resilience amid economic downturns. Investors often diversify their portfolios by balancing growth and value stocks to optimize returns across different phases of market cycles.

Long-Term Returns Analysis

Growth stocks, characterized by high earnings growth potential, often deliver substantial long-term returns driven by innovation and market expansion. Value stocks, typically undervalued with stable fundamentals, provide steady returns and dividend income, appealing during market volatility. Historical data shows growth stocks outperform value stocks in bull markets, while value stocks offer downside protection and consistent gains over extended periods.

Portfolio Diversification Strategies

Growth stocks typically exhibit higher volatility but offer substantial capital appreciation potential, making them essential for aggressive portfolio diversification strategies. Value stocks provide stability through undervalued assets with consistent dividends, balancing risk and generating income in diversified portfolios. Combining growth and value stocks enhances risk-adjusted returns by capturing multiple market cycles and economic conditions.

Choosing Between Growth and Value Stocks

Choosing between growth stocks and value stocks depends on investment goals and risk tolerance. Growth stocks, often characterized by high revenue and earnings potential, offer significant capital appreciation but come with higher volatility. Value stocks typically provide stable dividends and are priced below their intrinsic value, appealing to investors seeking income and lower risk.

Growth Stocks vs Value Stocks Infographic

difterm.com

difterm.com