Convertible notes and SAFEs (Simple Agreements for Future Equity) are popular financing instruments for startups seeking early-stage investment without immediate valuation. Convertible notes function as debt that converts into equity during a future financing round, often including interest and maturity date terms, while SAFEs provide a simpler, equity-like agreement without accruing interest or having a maturity date. Choosing between the two depends on factors such as investor preferences, legal complexity, and the startup's fundraising timeline and goals.

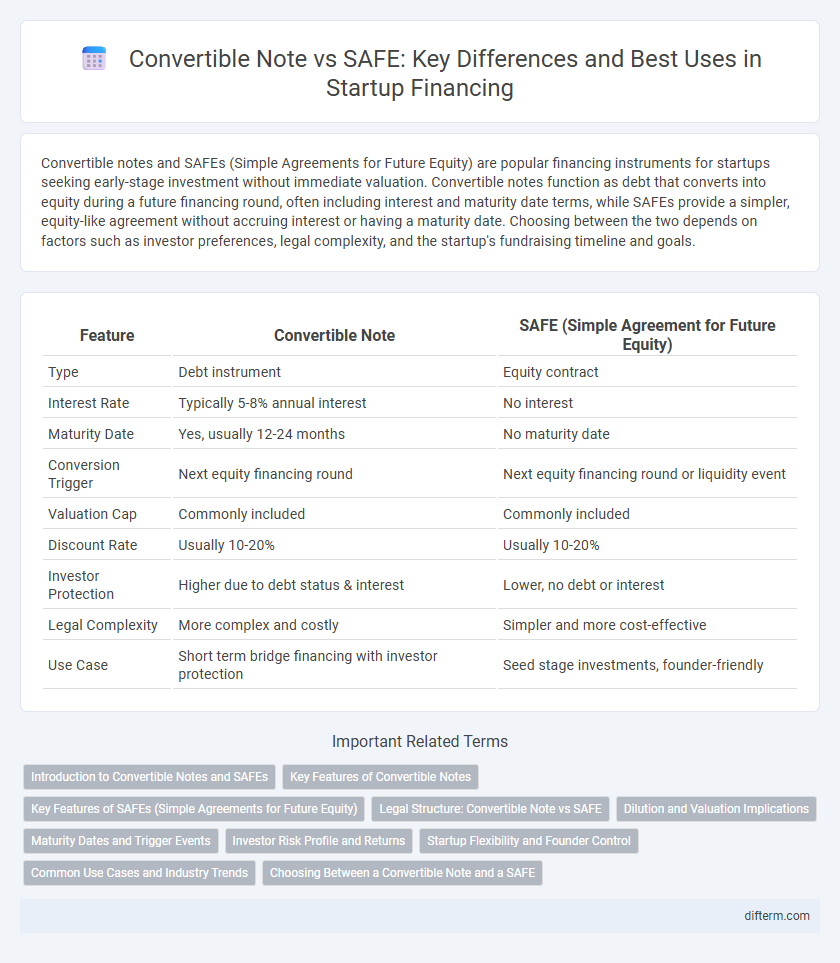

Table of Comparison

| Feature | Convertible Note | SAFE (Simple Agreement for Future Equity) |

|---|---|---|

| Type | Debt instrument | Equity contract |

| Interest Rate | Typically 5-8% annual interest | No interest |

| Maturity Date | Yes, usually 12-24 months | No maturity date |

| Conversion Trigger | Next equity financing round | Next equity financing round or liquidity event |

| Valuation Cap | Commonly included | Commonly included |

| Discount Rate | Usually 10-20% | Usually 10-20% |

| Investor Protection | Higher due to debt status & interest | Lower, no debt or interest |

| Legal Complexity | More complex and costly | Simpler and more cost-effective |

| Use Case | Short term bridge financing with investor protection | Seed stage investments, founder-friendly |

Introduction to Convertible Notes and SAFEs

Convertible notes are debt instruments that convert into equity during a future financing round, providing investors with a loan plus potential equity upside, often including interest and valuation caps. SAFEs (Simple Agreements for Future Equity) function as agreements granting rights to future equity without accruing interest or setting maturity dates, simplifying early-stage fundraising. Both instruments offer startups flexible financing solutions but differ in legal structure, risk profiles, and investor protections.

Key Features of Convertible Notes

Convertible notes are debt instruments that convert into equity during a future financing round, typically offering a discount and valuation cap to incentivize early investors. They include a maturity date, interest rate, and trigger events such as Qualified Financing for conversion. Convertible notes provide downside protection through debt status while facilitating flexible valuation negotiations compared to traditional equity funding.

Key Features of SAFEs (Simple Agreements for Future Equity)

SAFEs (Simple Agreements for Future Equity) provide startups with a streamlined method to raise capital without immediate equity dilution or valuation negotiations. These agreements convert investment into equity at a later financing round, typically featuring valuation caps, discounts, or both to reward early investors. Unlike convertible notes, SAFEs do not accrue interest or have maturity dates, reducing legal complexity and administrative burdens for emerging companies.

Legal Structure: Convertible Note vs SAFE

Convertible Notes are debt instruments with a maturity date and interest rate, creating a formal loan agreement that converts into equity upon a triggering event. SAFEs (Simple Agreements for Future Equity) are not debt and lack maturity dates or interest, functioning as contracts for future equity issuance without repayment obligations. The legal structure of Convertible Notes involves lender-borrower relationships subject to debt regulations, while SAFEs represent equity commitments governed by contract law, offering simpler terms and reduced legal complexity.

Dilution and Valuation Implications

Convertible notes typically include interest rates and valuation caps, leading to potential dilution based on a discount at conversion or valuation cap triggers during subsequent funding rounds. SAFE agreements offer a simpler structure without accruing interest, converting into equity at a valuation cap or discount, which can result in less immediate dilution but more uncertainty in valuation impact. The choice between convertible notes and SAFEs significantly affects dilution outcomes, with convertible notes possibly diluting founders more aggressively due to accrued interest and early conversion mechanics, while SAFEs emphasize founder-friendly terms but may lead to larger dilution if valuations increase rapidly.

Maturity Dates and Trigger Events

Convertible notes include a defined maturity date by which repayment or conversion must occur, providing investors a clear timeline for liquidity or equity conversion. SAFE agreements lack a maturity date, allowing indefinite deferral until a trigger event such as a priced equity round or acquisition occurs. Trigger events in convertible notes often involve maturity or financing rounds, while SAFEs primarily convert during qualified financing, making SAFEs more flexible but potentially less predictable for investors.

Investor Risk Profile and Returns

Convertible Notes carry debt characteristics with fixed maturity dates and interest rates, increasing investor risk if the startup fails to convert or repay on time. SAFEs (Simple Agreements for Future Equity) eliminate repayment obligations, reducing downside risk but offering less certainty on returns due to the absence of interest and maturity dates. Investors seeking structured downside protection may prefer Convertible Notes, while those prioritizing equity upside and simplified terms often choose SAFEs.

Startup Flexibility and Founder Control

Convertible notes offer startups greater founder control by delaying valuation discussions and minimizing early equity dilution, while providing flexible repayment terms. SAFEs (Simple Agreements for Future Equity) simplify funding with fewer legal complexities but may involve less negotiation power for founders. The choice impacts startup flexibility, affecting decision-making authority and future fundraising dynamics.

Common Use Cases and Industry Trends

Convertible notes are widely used in early-stage startup financing due to their straightforward debt structure that converts to equity during subsequent funding rounds, providing investors with downside protection and potential upside. SAFEs (Simple Agreements for Future Equity) have gained popularity in the tech industry for their simplicity and cost-effectiveness, often favored by accelerators and seed-stage investors to streamline fundraising without accruing debt or interest. Market trends indicate a growing preference for SAFEs in rapid-growth sectors, while convertible notes remain relevant in industries requiring more structured investor protections and compliance with regulatory frameworks.

Choosing Between a Convertible Note and a SAFE

Choosing between a convertible note and a SAFE depends on the specific fundraising goals and risk tolerance of the startup. Convertible notes offer debt features with interest rates and maturity dates, providing investor protection but adding complexity, while SAFEs simplify the fundraising process by eliminating debt terms, converting directly into equity during a future priced round. Understanding the company's growth trajectory, valuation expectations, and investor relations is crucial to determine which instrument aligns best with long-term financing strategies.

Convertible Note vs SAFE Infographic

difterm.com

difterm.com