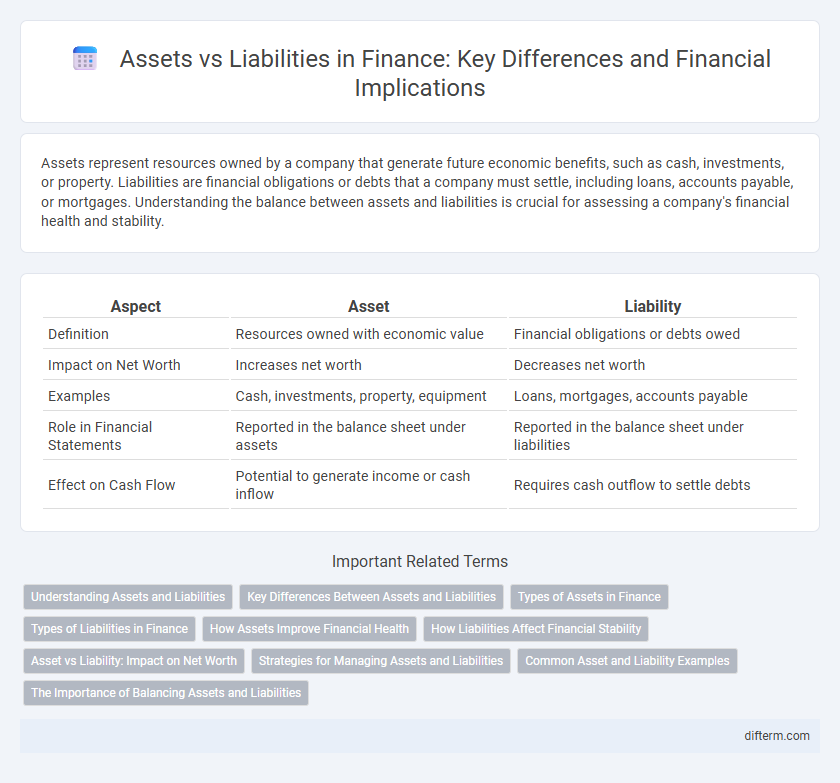

Assets represent resources owned by a company that generate future economic benefits, such as cash, investments, or property. Liabilities are financial obligations or debts that a company must settle, including loans, accounts payable, or mortgages. Understanding the balance between assets and liabilities is crucial for assessing a company's financial health and stability.

Table of Comparison

| Aspect | Asset | Liability |

|---|---|---|

| Definition | Resources owned with economic value | Financial obligations or debts owed |

| Impact on Net Worth | Increases net worth | Decreases net worth |

| Examples | Cash, investments, property, equipment | Loans, mortgages, accounts payable |

| Role in Financial Statements | Reported in the balance sheet under assets | Reported in the balance sheet under liabilities |

| Effect on Cash Flow | Potential to generate income or cash inflow | Requires cash outflow to settle debts |

Understanding Assets and Liabilities

Assets represent resources owned by an individual or company that are expected to generate future economic benefits, such as cash, investments, property, and equipment. Liabilities are financial obligations or debts owed to others, including loans, accounts payable, and mortgages, which must be settled over time. Accurate understanding of assets and liabilities is crucial for assessing financial health and making informed investment and budgeting decisions.

Key Differences Between Assets and Liabilities

Assets represent resources owned by a company that provide future economic benefits, such as cash, inventory, and property. Liabilities are obligations or debts owed to external parties, including loans, accounts payable, and mortgages. The key difference lies in assets enhancing net worth, while liabilities reduce equity and reflect financial claims against the company's resources.

Types of Assets in Finance

Assets in finance include current assets such as cash, accounts receivable, and inventory, which are expected to be converted into cash within a year. Fixed assets encompass property, plant, and equipment utilized for long-term business operations and are subject to depreciation. Intangible assets like patents, trademarks, and goodwill represent non-physical resources that provide competitive advantages and future economic benefits.

Types of Liabilities in Finance

In finance, liabilities are categorized primarily into current and long-term liabilities, where current liabilities include obligations like accounts payable, short-term loans, and accrued expenses due within one year, while long-term liabilities encompass debts such as bonds payable, mortgages, and long-term loans payable beyond one year. Understanding the types of liabilities is essential for assessing a company's financial health, liquidity, and leverage ratios, which influence creditworthiness and investment decisions. Proper classification of liabilities impacts balance sheet analysis and aids in effective financial planning and risk management strategies.

How Assets Improve Financial Health

Assets contribute to financial health by generating income, increasing net worth, and providing liquidity for future investments. Ownership of appreciating assets such as real estate and stocks enhances wealth accumulation and financial stability. High-quality assets also improve creditworthiness, enabling better borrowing terms and financial flexibility.

How Liabilities Affect Financial Stability

Liabilities represent financial obligations that reduce a company's net worth and can strain cash flow, directly impacting financial stability. Excessive liabilities increase the risk of insolvency by limiting the ability to invest in growth opportunities or meet short-term expenses. Managing liabilities effectively ensures balanced leverage, preserves creditworthiness, and maintains long-term financial health.

Asset vs Liability: Impact on Net Worth

Assets increase net worth by contributing positive value to an individual's or company's financial position, while liabilities reduce net worth by representing debts or obligations owed. The greater the total assets compared to liabilities, the higher the net worth, reflecting stronger financial health and increased borrowing power. Effective management of assets and liabilities is crucial for maximizing net worth and ensuring long-term financial stability.

Strategies for Managing Assets and Liabilities

Effective strategies for managing assets and liabilities include maintaining a balanced portfolio that aligns with cash flow needs and risk tolerance while optimizing returns. Implementing thorough risk assessment tools and regularly reviewing financial statements ensures timely adjustments to asset allocation and debt levels. Utilizing hedging techniques and leveraging liquidity management enhances financial stability and supports long-term growth objectives.

Common Asset and Liability Examples

Common asset examples include cash, accounts receivable, inventory, and property, which contribute to a company's financial strength and liquidity. Liability examples consist of accounts payable, loans, mortgages, and accrued expenses, representing obligations the company must settle in the future. Understanding the distinction between assets and liabilities is crucial for accurate balance sheet analysis and effective financial management.

The Importance of Balancing Assets and Liabilities

Balancing assets and liabilities is crucial for maintaining financial stability and ensuring sustainable growth. Proper management of assets maximizes wealth generation, while controlling liabilities reduces risk and enhances creditworthiness. A well-balanced financial structure supports liquidity, solvency, and long-term profitability.

Asset vs Liability Infographic

difterm.com

difterm.com