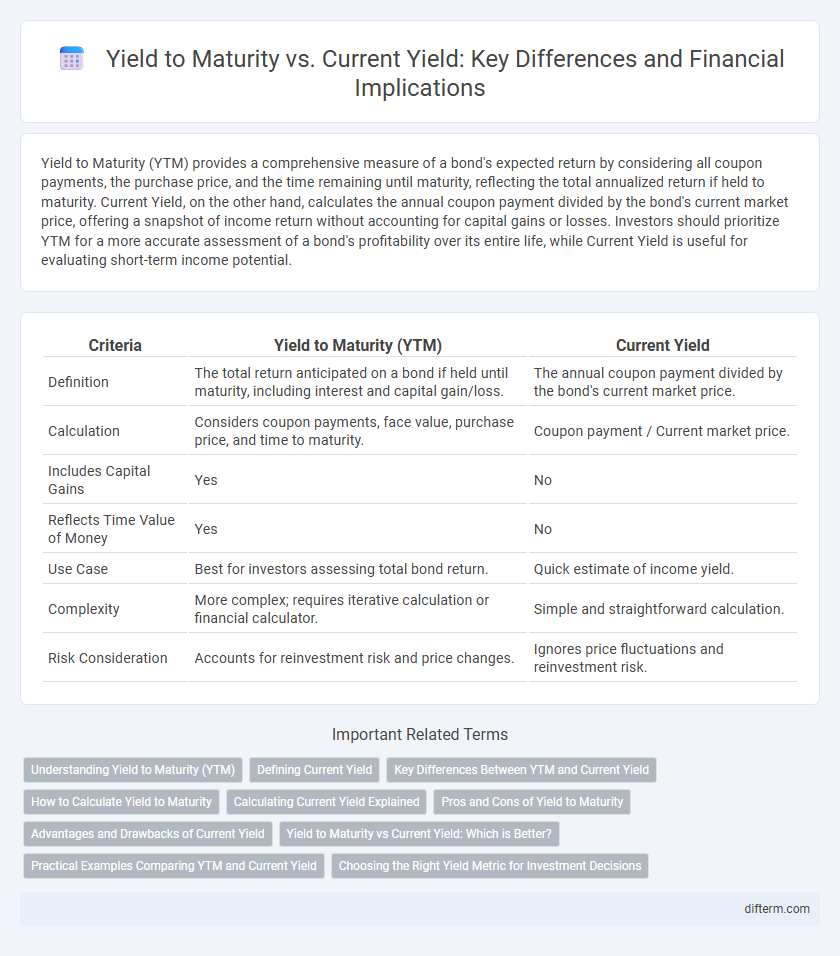

Yield to Maturity (YTM) provides a comprehensive measure of a bond's expected return by considering all coupon payments, the purchase price, and the time remaining until maturity, reflecting the total annualized return if held to maturity. Current Yield, on the other hand, calculates the annual coupon payment divided by the bond's current market price, offering a snapshot of income return without accounting for capital gains or losses. Investors should prioritize YTM for a more accurate assessment of a bond's profitability over its entire life, while Current Yield is useful for evaluating short-term income potential.

Table of Comparison

| Criteria | Yield to Maturity (YTM) | Current Yield |

|---|---|---|

| Definition | The total return anticipated on a bond if held until maturity, including interest and capital gain/loss. | The annual coupon payment divided by the bond's current market price. |

| Calculation | Considers coupon payments, face value, purchase price, and time to maturity. | Coupon payment / Current market price. |

| Includes Capital Gains | Yes | No |

| Reflects Time Value of Money | Yes | No |

| Use Case | Best for investors assessing total bond return. | Quick estimate of income yield. |

| Complexity | More complex; requires iterative calculation or financial calculator. | Simple and straightforward calculation. |

| Risk Consideration | Accounts for reinvestment risk and price changes. | Ignores price fluctuations and reinvestment risk. |

Understanding Yield to Maturity (YTM)

Yield to Maturity (YTM) represents the total return an investor expects to earn if a bond is held until it matures, incorporating all future coupon payments and the difference between the bond's current market price and its face value. YTM is expressed as an annualized rate, reflecting the compound interest earned over the bond's remaining life, making it a more comprehensive measure than Current Yield. Unlike Current Yield, which only considers the bond's annual coupon payment relative to its price, YTM accounts for reinvestment of coupons and the amortization of any premium or discount.

Defining Current Yield

Current yield measures the annual income (interest or dividends) earned from a bond or investment divided by its current market price, expressed as a percentage. It provides investors with a snapshot of the income generated relative to the price paid, ignoring capital gains or losses. Unlike yield to maturity, current yield does not account for the total return if the bond is held until maturity or reinvestment of coupon payments.

Key Differences Between YTM and Current Yield

Yield to Maturity (YTM) represents the total return an investor can expect to earn if a bond is held until maturity, factoring in all coupon payments and the difference between the purchase price and face value. Current Yield measures the annual coupon payment divided by the bond's current market price, reflecting only the income component without accounting for capital gains or losses. The key differences highlight that YTM provides a comprehensive measure of bond profitability, incorporating time value of money and reinvestment assumptions, whereas Current Yield offers a snapshot of income yield based solely on the bond's current price and interest payments.

How to Calculate Yield to Maturity

Yield to Maturity (YTM) is calculated by solving the equation that equates the present value of all future bond cash flows, including interest payments and the face value at maturity, to the bond's current market price. This involves finding the discount rate (YTM) that satisfies the formula: Price = [Coupon Payment / (1 + YTM)^t] + [Face Value / (1 + YTM)^n], where t represents each period until maturity and n is the total number of periods. Since no closed-form solution exists for YTM, it is often computed using iterative methods or financial calculators.

Calculating Current Yield Explained

Current Yield is calculated by dividing the annual coupon payment by the bond's current market price, expressed as a percentage. This metric provides insight into the income return relative to the bond's price but does not account for capital gains or losses upon maturity. Yield to Maturity, by contrast, incorporates the total expected return, including interest payments and the difference between purchase price and par value, offering a more comprehensive measure of bond profitability.

Pros and Cons of Yield to Maturity

Yield to Maturity (YTM) provides a comprehensive measure of a bond's total return by calculating the annualized rate assuming the bond is held until maturity, capturing interest payments and capital gains or losses. YTM's advantage lies in its accuracy and inclusion of reinvestment risk, while its complexity and reliance on constant reinvestment rates can be drawbacks compared to the simpler Current Yield, which only considers annual coupon payments relative to the bond's price. Investors seeking a precise assessment of long-term profitability prefer YTM despite its assumptions, whereas those wanting quick income insights might favor Current Yield.

Advantages and Drawbacks of Current Yield

Current yield provides a simple measure of the annual income generated by a bond relative to its market price, making it easy for investors to quickly assess income potential. However, it does not account for capital gains or losses that occur if the bond is held to maturity, thus overlooking the total return captured by Yield to Maturity (YTM). Additionally, current yield ignores the time value of money and reinvestment risk, limiting its usefulness for comprehensive bond evaluation.

Yield to Maturity vs Current Yield: Which is Better?

Yield to Maturity (YTM) provides a comprehensive measure of a bond's return by accounting for all coupon payments, the purchase price, and the time to maturity, while Current Yield only reflects the annual coupon payment divided by the bond's current price. YTM is generally considered better for investors seeking a true representation of potential earnings and total return over the bond's life. Current Yield can be misleading during price fluctuations, making YTM the preferred metric for informed investment decisions.

Practical Examples Comparing YTM and Current Yield

Yield to Maturity (YTM) represents the total return an investor can expect if a bond is held until maturity, incorporating all coupon payments and the difference between the purchase price and face value. Current Yield, on the other hand, measures the annual coupon payment divided by the bond's current market price, providing a snapshot of income but ignoring capital gains or losses. For example, a bond with a $1,000 face value, a 5% coupon, purchased at $950 would have a Current Yield of approximately 5.26%, while its YTM, accounting for the discount, would be higher, reflecting the total earned return.

Choosing the Right Yield Metric for Investment Decisions

Yield to Maturity (YTM) provides a comprehensive measure of a bond's total return if held until maturity, incorporating all coupon payments and capital gains or losses. Current Yield focuses solely on the annual coupon payment divided by the bond's current market price, offering a snapshot of income relative to price but ignoring reinvestment and maturity value. Investors prioritizing long-term returns should rely on YTM for informed decisions, while those emphasizing immediate income may consider Current Yield as a supplementary metric.

Yield to Maturity vs Current Yield Infographic

difterm.com

difterm.com