The discount rate reflects the investor's required rate of return to account for risk and the time value of money when valuing future cash flows. The capitalization rate, or cap rate, is used to estimate the value of an income-producing property by dividing its net operating income by the current market value or purchase price. Understanding the difference between the discount rate and capitalization rate is crucial for accurate financial analysis and investment decisions in real estate and pet-related business ventures.

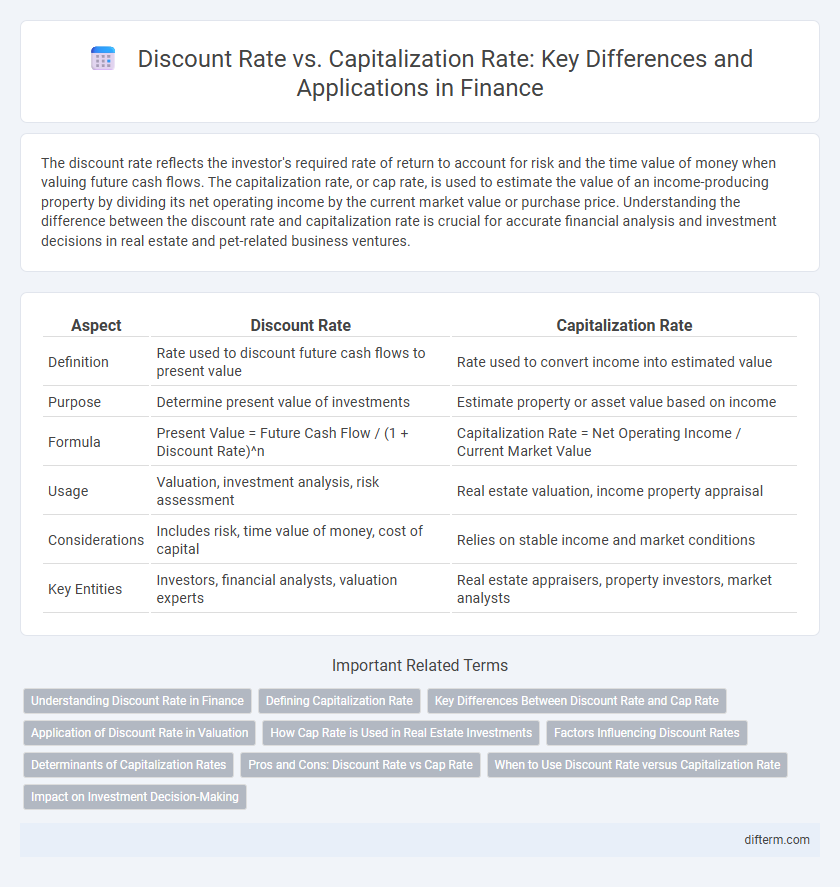

Table of Comparison

| Aspect | Discount Rate | Capitalization Rate |

|---|---|---|

| Definition | Rate used to discount future cash flows to present value | Rate used to convert income into estimated value |

| Purpose | Determine present value of investments | Estimate property or asset value based on income |

| Formula | Present Value = Future Cash Flow / (1 + Discount Rate)^n | Capitalization Rate = Net Operating Income / Current Market Value |

| Usage | Valuation, investment analysis, risk assessment | Real estate valuation, income property appraisal |

| Considerations | Includes risk, time value of money, cost of capital | Relies on stable income and market conditions |

| Key Entities | Investors, financial analysts, valuation experts | Real estate appraisers, property investors, market analysts |

Understanding Discount Rate in Finance

The discount rate in finance represents the interest rate used to determine the present value of future cash flows, reflecting the time value of money and investment risk. It is crucial for accurately valuing projects, securities, or assets by discounting expected returns to their present worth. This rate often incorporates market conditions, inflation expectations, and risk premiums, distinguishing it from the capitalization rate, which primarily focuses on income generation relative to property value.

Defining Capitalization Rate

The capitalization rate, or cap rate, is a key metric in real estate finance representing the ratio of a property's net operating income (NOI) to its current market value. It serves as an indicator of the expected rate of return on an investment property, helping investors assess risk and compare potential acquisitions. Unlike the discount rate, which accounts for the time value of money and risk over multiple periods, the cap rate is a snapshot measure based on present income and value.

Key Differences Between Discount Rate and Cap Rate

The discount rate reflects the investor's required rate of return, incorporating the time value of money and risk factors, used to calculate the present value of future cash flows. The capitalization rate (cap rate) measures the expected return on an investment property based on its net operating income relative to current market value or purchase price, representing the income-generating potential. Key differences include that the discount rate accounts for the entire investment horizon and risk profile, while the cap rate is a snapshot metric focused on current income without explicitly considering future cash flow variability or discounting.

Application of Discount Rate in Valuation

The discount rate is crucial in valuation as it reflects the investor's required rate of return, incorporating risk and time value of money to determine the present value of future cash flows. It is applied to discount projected income streams or cash flows to estimate an asset's intrinsic value accurately. Using the discount rate ensures more precise financial decision-making compared to capitalization rate, which assumes a constant income without accounting for growth or risk variations.

How Cap Rate is Used in Real Estate Investments

Capitalization rate (cap rate) is a key metric in real estate investments used to estimate the return on an income-generating property by dividing the net operating income (NOI) by the current market value or purchase price. Investors apply the cap rate to compare properties, assess risk, and determine property value relative to expected income streams. Unlike the discount rate, which incorporates required rate of return and risk adjustments for future cash flows, the cap rate provides a straightforward snapshot of current yield without factoring in financing or growth assumptions.

Factors Influencing Discount Rates

Discount rates are influenced by factors such as the risk-free rate, market risk premium, and specific project risk, reflecting the overall cost of capital and investor expectations. Inflation rates, liquidity, and economic conditions also play significant roles in determining the appropriate discount rate for investment valuation. In contrast, capitalization rates primarily focus on income stability and market comparables, making discount rates more sensitive to broader financial and economic variables.

Determinants of Capitalization Rates

Capitalization rates are primarily determined by factors such as property type, location, market conditions, and risk perception associated with the investment. Higher perceived risk or lower property desirability typically results in higher capitalization rates, reflecting greater expected returns for investors. Economic indicators, interest rates, and comparable property sales also critically influence the calculation of capitalization rates in real estate finance.

Pros and Cons: Discount Rate vs Cap Rate

The discount rate reflects the investor's required rate of return accounting for risk and time value, making it ideal for present value calculations but sensitive to assumptions and fluctuations. The capitalization rate, derived from net operating income divided by property value, offers a straightforward snapshot for property valuation but may oversimplify risk and ignore future income growth. While the discount rate provides a comprehensive measure for long-term investment decisions, the cap rate serves as a quicker, market-based indicator useful for comparing similar properties.

When to Use Discount Rate versus Capitalization Rate

Use the discount rate when evaluating the present value of future cash flows, especially in discounted cash flow (DCF) analysis for investments with varying cash flow patterns over time. The capitalization rate is appropriate for estimating value based on a single year's net operating income divided by the property's current market value, commonly applied in stable, income-producing real estate assets. Selecting between the two depends on the investment's cash flow stability and the analysis objective: use discount rates for multi-period valuation and capitalization rates for quick, single-period yield estimates.

Impact on Investment Decision-Making

Discount rate directly influences the present value of future cash flows, affecting investment valuations and risk assessments in financial decision-making. Capitalization rate, derived from net operating income relative to asset value, gauges property investment returns and market comparisons. Understanding the distinction between discount rate and capitalization rate enables investors to accurately assess risk-adjusted returns and make informed financing choices.

Discount Rate vs Capitalization Rate Infographic

difterm.com

difterm.com