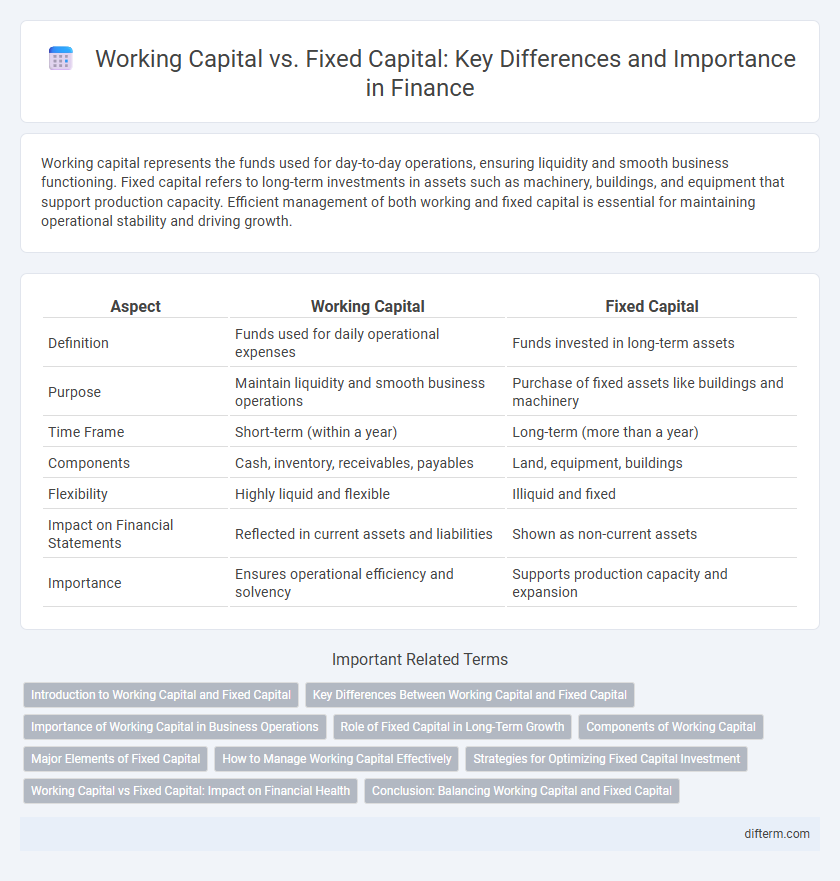

Working capital represents the funds used for day-to-day operations, ensuring liquidity and smooth business functioning. Fixed capital refers to long-term investments in assets such as machinery, buildings, and equipment that support production capacity. Efficient management of both working and fixed capital is essential for maintaining operational stability and driving growth.

Table of Comparison

| Aspect | Working Capital | Fixed Capital |

|---|---|---|

| Definition | Funds used for daily operational expenses | Funds invested in long-term assets |

| Purpose | Maintain liquidity and smooth business operations | Purchase of fixed assets like buildings and machinery |

| Time Frame | Short-term (within a year) | Long-term (more than a year) |

| Components | Cash, inventory, receivables, payables | Land, equipment, buildings |

| Flexibility | Highly liquid and flexible | Illiquid and fixed |

| Impact on Financial Statements | Reflected in current assets and liabilities | Shown as non-current assets |

| Importance | Ensures operational efficiency and solvency | Supports production capacity and expansion |

Introduction to Working Capital and Fixed Capital

Working capital represents the funds required for day-to-day business operations such as inventory, accounts receivable, and short-term liabilities, ensuring liquidity and smooth functioning. Fixed capital involves long-term investments in physical assets like machinery, buildings, and equipment that support production and growth over time. Both types of capital are essential for maintaining operational efficiency and achieving sustainable financial stability.

Key Differences Between Working Capital and Fixed Capital

Working capital refers to the liquidity available for daily operations, covering short-term assets and liabilities, while fixed capital involves long-term investments in physical assets like machinery and buildings. Working capital fluctuates regularly, reflecting the company's operational cycle, whereas fixed capital remains relatively stable due to its role in supporting production capacity over time. The key distinction lies in their purpose: working capital ensures smooth business operations and short-term financial health, while fixed capital underpins long-term growth and asset acquisition.

Importance of Working Capital in Business Operations

Working capital is critical for maintaining smooth day-to-day business operations by ensuring sufficient liquidity to meet short-term obligations and operational expenses. Effective management of working capital enhances cash flow, supports inventory management, and reduces the risk of insolvency, directly impacting the overall financial health of the business. Unlike fixed capital, which involves long-term investments in assets, working capital drives operational efficiency and business continuity.

Role of Fixed Capital in Long-Term Growth

Fixed capital plays a crucial role in long-term growth by funding investments in physical assets such as machinery, buildings, and infrastructure, which enhance production capacity and operational efficiency over time. Unlike working capital, which supports day-to-day operations, fixed capital establishes the foundation for sustained expansion and competitive advantage in the finance sector. Strategic allocation of fixed capital enables firms to leverage economies of scale, drive innovation, and achieve stable profitability in the long run.

Components of Working Capital

Working capital consists primarily of current assets such as cash, accounts receivable, and inventory, minus current liabilities including accounts payable and short-term debt, enabling day-to-day operational liquidity. These components are essential for managing the company's short-term financial health and ensuring smooth business operations. Efficient management of working capital directly impacts a firm's ability to meet immediate expenses and optimize operational efficiency.

Major Elements of Fixed Capital

Major elements of fixed capital include land, buildings, machinery, and equipment, which are essential for long-term operational capacity and production. These assets are not easily liquidated and represent significant investment that supports the company's infrastructure and production capabilities. Fixed capital differs from working capital as it pertains to tangible assets used over multiple accounting periods rather than short-term operational expenses.

How to Manage Working Capital Effectively

Effective management of working capital involves maintaining an optimal balance between current assets and current liabilities to ensure liquidity and operational efficiency. Key strategies include accurate cash flow forecasting, speeding up accounts receivable collections, managing inventory levels precisely, and negotiating favorable credit terms with suppliers. Regular monitoring and analysis of working capital ratios, such as the current ratio and quick ratio, help identify potential liquidity issues before they impact the business.

Strategies for Optimizing Fixed Capital Investment

Optimizing fixed capital investment involves balancing asset acquisition with maintaining liquidity and operational efficiency to maximize return on investment. Strategic approaches include regular asset performance evaluations, adopting cost-effective technologies, and scheduling phased capital expenditures to align with market demand. Firms increase capital efficiency by leveraging predictive analytics and asset management software to reduce idle capacity and extend asset lifespan.

Working Capital vs Fixed Capital: Impact on Financial Health

Working capital represents the liquidity available for day-to-day operations, directly influencing the company's ability to meet short-term obligations and maintain smooth business functioning. Fixed capital involves long-term investments in assets such as machinery, buildings, and equipment, essential for sustaining production capacity and growth. Efficient management of working capital alongside strategic allocation of fixed capital enhances overall financial health by balancing operational liquidity with long-term stability and expansion potential.

Conclusion: Balancing Working Capital and Fixed Capital

Balancing working capital and fixed capital is essential for maintaining a company's liquidity while ensuring long-term asset investment. Efficient management of working capital supports daily operations and cash flow, while adequate fixed capital funds infrastructure and growth initiatives. Striking the right balance optimizes financial stability and operational efficiency, driving sustainable business success.

Working Capital vs Fixed Capital Infographic

difterm.com

difterm.com