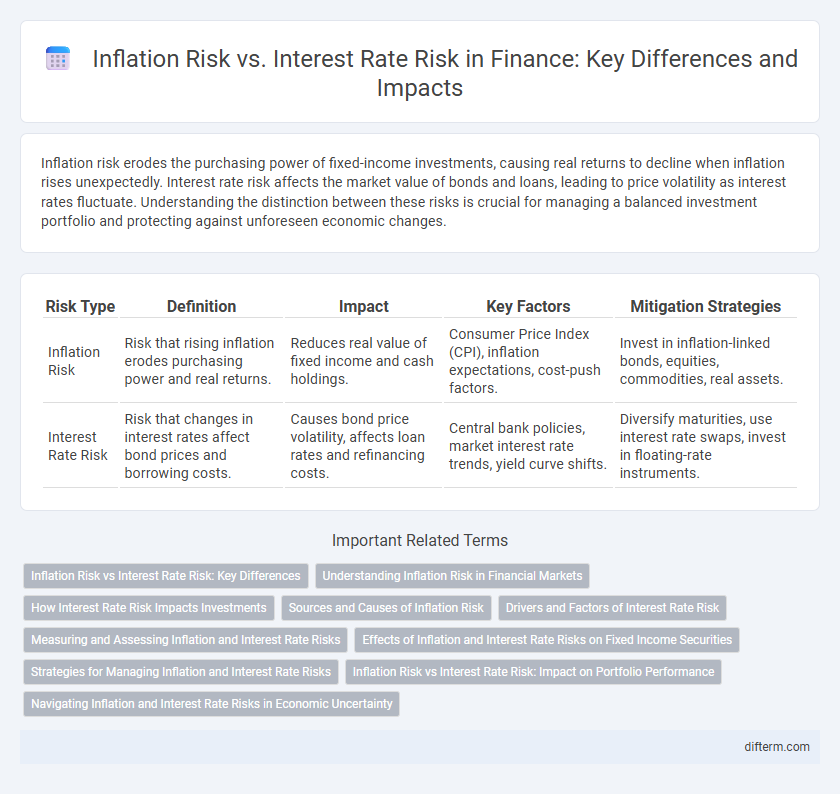

Inflation risk erodes the purchasing power of fixed-income investments, causing real returns to decline when inflation rises unexpectedly. Interest rate risk affects the market value of bonds and loans, leading to price volatility as interest rates fluctuate. Understanding the distinction between these risks is crucial for managing a balanced investment portfolio and protecting against unforeseen economic changes.

Table of Comparison

| Risk Type | Definition | Impact | Key Factors | Mitigation Strategies |

|---|---|---|---|---|

| Inflation Risk | Risk that rising inflation erodes purchasing power and real returns. | Reduces real value of fixed income and cash holdings. | Consumer Price Index (CPI), inflation expectations, cost-push factors. | Invest in inflation-linked bonds, equities, commodities, real assets. |

| Interest Rate Risk | Risk that changes in interest rates affect bond prices and borrowing costs. | Causes bond price volatility, affects loan rates and refinancing costs. | Central bank policies, market interest rate trends, yield curve shifts. | Diversify maturities, use interest rate swaps, invest in floating-rate instruments. |

Inflation Risk vs Interest Rate Risk: Key Differences

Inflation risk refers to the potential decrease in purchasing power due to rising prices, eroding the real returns on fixed-income investments. Interest rate risk involves the sensitivity of bond prices to changes in market interest rates, where rising rates typically cause bond prices to fall. Understanding these key differences helps investors strategize portfolio allocation to protect against inflation-driven losses while managing exposure to fluctuating interest rates.

Understanding Inflation Risk in Financial Markets

Inflation risk in financial markets refers to the potential erosion of purchasing power caused by rising prices, which can diminish the real returns on investments. Investors exposed to fixed-income securities, such as bonds, are particularly vulnerable since inflation reduces the real value of future interest and principal payments. Understanding inflation risk is essential for portfolio management as it influences asset allocation decisions, prompting the use of inflation-protected securities like TIPS to hedge against unexpected inflation surges.

How Interest Rate Risk Impacts Investments

Interest rate risk significantly influences investment returns by causing fluctuations in bond prices, with rising rates typically leading to falling bond values. This risk affects fixed-income securities more acutely, as investors demand higher yields to compensate for increasing rates, which reduces the market value of existing bonds. Understanding the sensitivity of various asset classes to interest rate changes is crucial for portfolio management and mitigating potential losses.

Sources and Causes of Inflation Risk

Inflation risk primarily stems from rising consumer prices due to increased demand, supply chain disruptions, or expansive monetary policies leading to currency devaluation. Persistent inflation erodes the purchasing power of fixed income returns, impacting bondholders and savers. Central banks monitor inflation indicators closely to adjust interest rates, indirectly linking inflation risk to interest rate risk but stemming from distinct economic pressures such as wage growth or commodity price shocks.

Drivers and Factors of Interest Rate Risk

Interest rate risk arises primarily from fluctuations in benchmark rates such as the Federal Funds Rate, influenced by central bank monetary policies and economic indicators like inflation and employment data. Changes in interest rates affect bond prices, loan costs, and investment yields, driven by factors including the maturity of financial instruments, duration, and market expectations of future rate movements. Key drivers also encompass credit risk perceptions and liquidity conditions, which can amplify sensitivity to interest rate shifts in financial markets.

Measuring and Assessing Inflation and Interest Rate Risks

Measuring inflation risk involves analyzing Consumer Price Index (CPI) trends and forecasting price level changes to estimate the erosion of purchasing power over time. Interest rate risk assessment requires evaluating bond duration and convexity to determine sensitivity to fluctuations in market interest rates and their impact on portfolio value. Advanced models such as the Fisher equation link nominal interest rates to real rates and expected inflation, aiding in comprehensive risk measurement.

Effects of Inflation and Interest Rate Risks on Fixed Income Securities

Inflation risk erodes the real returns of fixed income securities by decreasing the purchasing power of future interest payments and principal repayments. Interest rate risk affects the market value of these securities, as rising rates cause bond prices to fall, impacting investors holding fixed coupons. Both risks reduce the attractiveness of fixed income investments, making portfolio diversification and inflation-protected securities essential for managing exposure.

Strategies for Managing Inflation and Interest Rate Risks

Managing inflation and interest rate risks requires diversified investment strategies such as allocating assets to inflation-protected securities like TIPS and short-duration bonds to reduce exposure to rate fluctuations. Utilizing floating rate instruments and maintaining a balanced portfolio with real assets, including commodities and real estate, can mitigate the adverse effects of rising inflation and interest rates. Hedging techniques like interest rate swaps and options further safeguard portfolios against unexpected monetary policy shifts and market volatility.

Inflation Risk vs Interest Rate Risk: Impact on Portfolio Performance

Inflation risk erodes the real value of investment returns by reducing purchasing power, negatively impacting fixed-income assets and cash holdings in a portfolio. Interest rate risk affects the market value of bonds and other interest-sensitive securities, with rising rates typically causing prices to fall and reducing overall portfolio value. Balancing exposure to both risks is crucial for maintaining stable portfolio performance, particularly in volatile economic environments.

Navigating Inflation and Interest Rate Risks in Economic Uncertainty

Inflation risk erodes purchasing power by increasing the cost of goods and services, while interest rate risk impacts bond prices and borrowing costs, creating volatility in investment portfolios. Investors must evaluate the trade-offs between fixed-income securities, which are sensitive to rising rates, and inflation-protected assets like Treasury Inflation-Protected Securities (TIPS). Diversification strategies that include a mix of equities, real assets, and inflation-indexed bonds can help mitigate the combined threats of inflation and fluctuating interest rates during periods of economic uncertainty.

Inflation risk vs Interest rate risk Infographic

difterm.com

difterm.com