Direct listing offers companies an alternative to traditional IPOs by allowing existing shares to be sold directly on a public exchange without underwriters, reducing costs and avoiding dilution. IPOs typically involve issuing new shares, underwriter support, and roadshows to price and market the offering, which can increase capital raised but also lead to higher fees and regulatory scrutiny. Choosing between direct listing and IPO depends on a company's need for capital, desire for price discovery, and goals for shareholder liquidity.

Table of Comparison

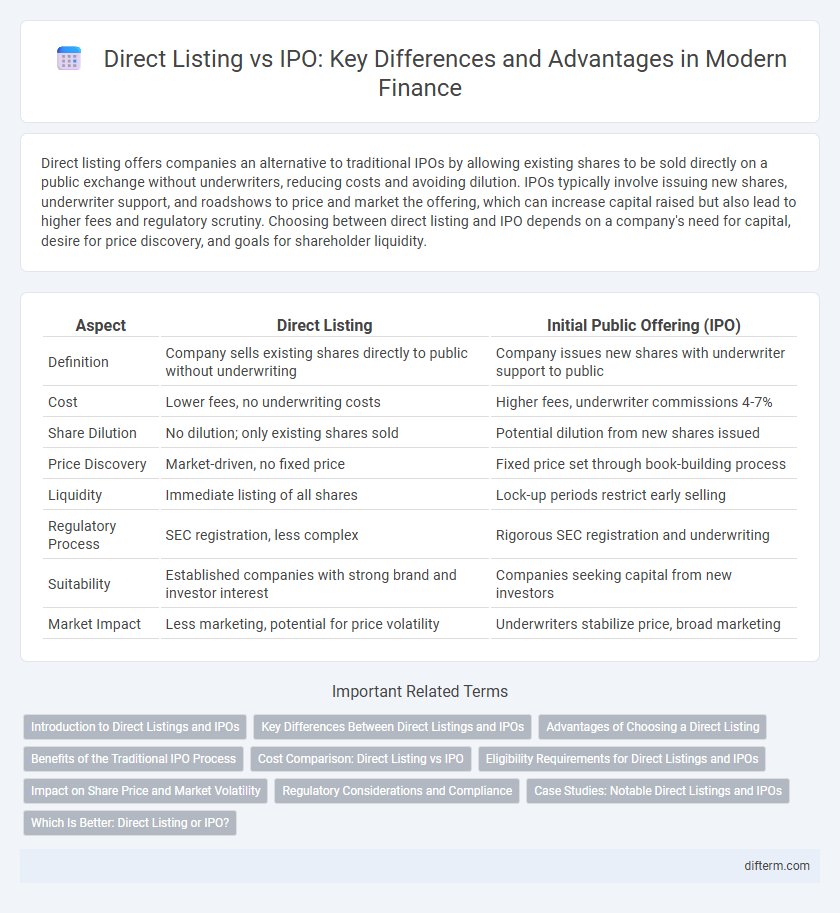

| Aspect | Direct Listing | Initial Public Offering (IPO) |

|---|---|---|

| Definition | Company sells existing shares directly to public without underwriting | Company issues new shares with underwriter support to public |

| Cost | Lower fees, no underwriting costs | Higher fees, underwriter commissions 4-7% |

| Share Dilution | No dilution; only existing shares sold | Potential dilution from new shares issued |

| Price Discovery | Market-driven, no fixed price | Fixed price set through book-building process |

| Liquidity | Immediate listing of all shares | Lock-up periods restrict early selling |

| Regulatory Process | SEC registration, less complex | Rigorous SEC registration and underwriting |

| Suitability | Established companies with strong brand and investor interest | Companies seeking capital from new investors |

| Market Impact | Less marketing, potential for price volatility | Underwriters stabilize price, broad marketing |

Introduction to Direct Listings and IPOs

Direct listings enable companies to sell existing shares directly on public markets without issuing new stock, avoiding underwriting fees and dilution. Initial Public Offerings (IPOs) involve issuing new shares through underwriters to raise fresh capital, often accompanied by extensive marketing and regulatory processes. Choosing between direct listings and IPOs depends on a company's capital needs, market conditions, and shareholder objectives.

Key Differences Between Direct Listings and IPOs

Direct listings allow companies to sell existing shares directly to the public without issuing new shares, avoiding underwriter fees and stock dilution; IPOs involve issuing new shares with underwriters facilitating price discovery and ensuring capital raise. IPOs provide a more structured pricing process and marketing support, often leading to higher initial valuations, whereas direct listings offer greater market-driven transparency but with potential price volatility. Companies opting for direct listings maintain full control over the offering timeline and avoid lock-up periods common in IPOs, impacting liquidity and shareholder turnout.

Advantages of Choosing a Direct Listing

Direct listing offers companies immediate access to public markets without diluting existing shareholder equity or incurring underwriting fees typically associated with an IPO. It enhances price discovery by allowing market supply and demand to establish the stock price organically. Companies benefit from increased liquidity and broader shareholder participation while bypassing lock-up periods that restrict insider selling.

Benefits of the Traditional IPO Process

The traditional IPO process provides companies with extensive underwriting support, ensuring accurate pricing and allocation of shares through established investment banks. It enhances market confidence by offering increased regulatory scrutiny and transparency, which often leads to greater investor protection and stability. Furthermore, the structured roadshow during an IPO generates significant media coverage and investor awareness, facilitating broader market acceptance and liquidity.

Cost Comparison: Direct Listing vs IPO

Direct listings generally incur lower costs than traditional IPOs due to the absence of underwriter fees, which can range from 5% to 7% of the capital raised in IPOs. Companies opting for a direct listing primarily pay for legal, accounting, and exchange fees, significantly reducing overall expenses compared to IPO underwriting and marketing costs. This cost efficiency makes direct listings an attractive alternative for firms seeking to minimize capital outlay while accessing public markets.

Eligibility Requirements for Direct Listings and IPOs

Direct listings typically require companies to be publicly traded or listed on an approved exchange, with no specific minimum financial thresholds, making them accessible to well-established private companies seeking liquidity without raising new capital. Initial Public Offerings (IPOs) often mandate stringent eligibility criteria, including minimum revenue benchmarks, profitability records, and comprehensive regulatory filings such as SEC registration statements. While IPOs involve underwriters and roadshows to meet investor demands, direct listings streamline the process more for companies prioritizing existing shareholder liquidity over fresh capital infusion.

Impact on Share Price and Market Volatility

Direct listings often lead to more immediate price discovery and can reduce underpricing compared to IPOs, where the initial offering price is typically set by underwriters. IPOs may experience higher market volatility on the first trading day due to demand imbalances and allocation strategies. Direct listings, lacking a traditional underwriting process, tend to generate more transparent market-driven pricing but can result in unpredictable share price fluctuations initially.

Regulatory Considerations and Compliance

Direct listings eliminate the underwriting process, reducing regulatory scrutiny related to securities registration compared to traditional IPOs, where the SEC closely reviews prospectuses and pricing. Companies pursuing IPOs must adhere to extensive disclosure requirements, including audited financial statements and risk factors, ensuring comprehensive compliance with SEC regulations under the Securities Act of 1933. In contrast, direct listings demand adherence to exchange-specific listing rules and ongoing reporting obligations but bypass several regulatory steps, potentially accelerating market entry while maintaining compliance with the Securities Exchange Act of 1934.

Case Studies: Notable Direct Listings and IPOs

Notable direct listings like Spotify and Slack demonstrated cost efficiency and immediate liquidity by bypassing traditional underwriting fees, while high-profile IPOs such as Facebook and Airbnb highlighted the benefits of extensive capital raising and market visibility. Spotify's 2018 direct listing avoided dilution and provided transparent price discovery, contrasting with Facebook's 2012 IPO, which raised $16 billion but faced initial price volatility. Airbnb's 2020 IPO underscored the advantages of investor confidence and substantial fundraising during uncertain market conditions compared to Slack's more controlled market entry via direct listing.

Which Is Better: Direct Listing or IPO?

Direct listing offers companies a cost-effective alternative to IPOs by eliminating underwriters and allowing existing shareholders to sell shares directly to the public, enhancing liquidity and price discovery. IPOs provide established pricing mechanisms, capital infusion through new share issuance, and broader market exposure, benefiting firms seeking substantial fundraising and structured investor outreach. The choice depends on a company's capital needs, desire for market validation, and shareholder structure, with direct listings favoring mature firms with strong brand recognition and IPOs suiting growth-stage companies aiming for significant capital raises.

Direct Listing vs IPO Infographic

difterm.com

difterm.com