Hedge funds and mutual funds differ primarily in investment strategies and regulatory frameworks, with hedge funds employing aggressive techniques such as leverage and short selling to achieve higher returns. Mutual funds offer diversified portfolios managed under strict regulations, providing greater liquidity and lower risk for average investors. The choice depends on risk tolerance, investment goals, and accessibility, as hedge funds typically require higher minimum investments and are limited to accredited investors.

Table of Comparison

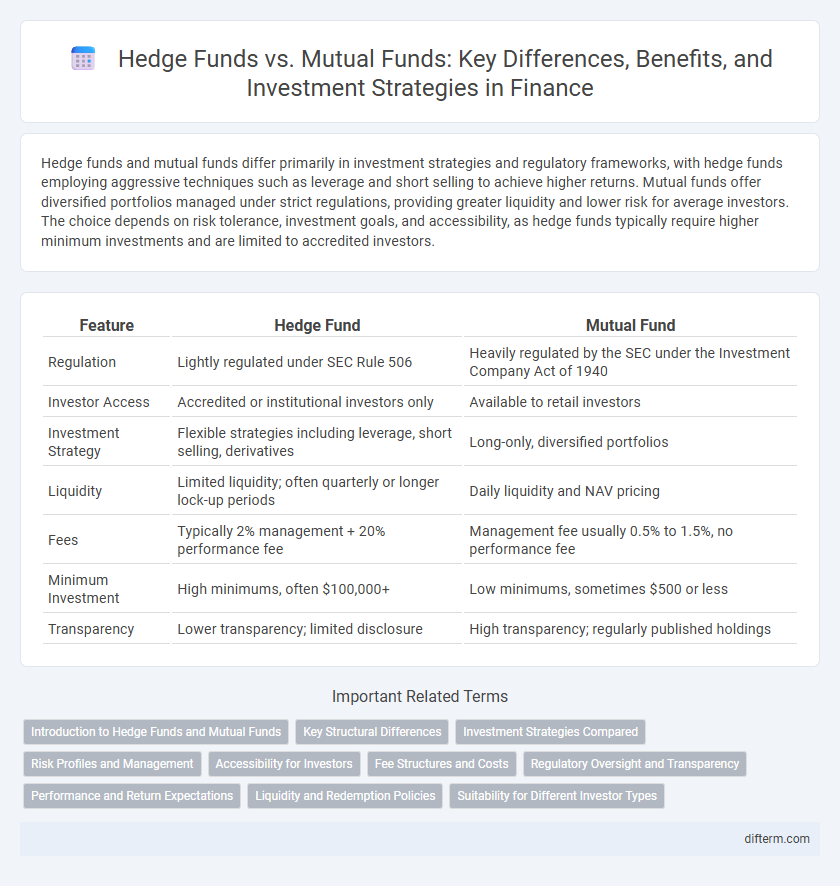

| Feature | Hedge Fund | Mutual Fund |

|---|---|---|

| Regulation | Lightly regulated under SEC Rule 506 | Heavily regulated by the SEC under the Investment Company Act of 1940 |

| Investor Access | Accredited or institutional investors only | Available to retail investors |

| Investment Strategy | Flexible strategies including leverage, short selling, derivatives | Long-only, diversified portfolios |

| Liquidity | Limited liquidity; often quarterly or longer lock-up periods | Daily liquidity and NAV pricing |

| Fees | Typically 2% management + 20% performance fee | Management fee usually 0.5% to 1.5%, no performance fee |

| Minimum Investment | High minimums, often $100,000+ | Low minimums, sometimes $500 or less |

| Transparency | Lower transparency; limited disclosure | High transparency; regularly published holdings |

Introduction to Hedge Funds and Mutual Funds

Hedge funds are private investment pools that employ diverse strategies like leverage, short selling, and derivatives to achieve high returns, typically catering to accredited investors due to their higher risk profile and regulatory exemptions. Mutual funds aggregate capital from multiple investors to invest in diversified portfolios of stocks, bonds, or other securities, offering liquidity and regulatory oversight under the Investment Company Act of 1940. While mutual funds prioritize accessibility and risk management for retail investors, hedge funds focus on absolute returns and sophisticated investment techniques for wealth preservation and growth.

Key Structural Differences

Hedge funds typically operate as private investment limited partnerships with fewer regulatory constraints, allowing greater flexibility in investment strategies, including leverage, short selling, and derivatives. Mutual funds are publicly offered investment vehicles regulated by the SEC, adhering to strict disclosure and diversification requirements, which limit risk but also restrict aggressive investment tactics. The investor base in hedge funds usually consists of accredited or institutional investors, whereas mutual funds cater to the general public, emphasizing liquidity and transparency.

Investment Strategies Compared

Hedge funds employ aggressive investment strategies, including leverage, short selling, and derivatives, aiming for high returns regardless of market conditions. Mutual funds primarily rely on long-only, diversified portfolios managed to achieve steady growth and income, adhering to regulatory constraints. The flexibility of hedge funds allows dynamic asset allocation and risk management, contrasting with the more conservative and transparent approach of mutual funds.

Risk Profiles and Management

Hedge funds typically employ aggressive investment strategies with higher risk profiles, using leverage, derivatives, and short-selling to achieve substantial returns. Mutual funds generally focus on diversified, regulated portfolios with lower risk, prioritizing capital preservation and steady growth for average investors. Risk management in hedge funds involves dynamic, active approaches tailored to market conditions, while mutual funds rely on regulatory guidelines and broad diversification to mitigate risk.

Accessibility for Investors

Hedge funds typically require high minimum investments, often ranging from $100,000 to $1 million, limiting accessibility to accredited or institutional investors. Mutual funds offer lower minimum investment thresholds, sometimes as low as $500, making them accessible to a broader range of individual investors. This accessibility distinction significantly impacts investor diversification options and portfolio strategies.

Fee Structures and Costs

Hedge funds typically charge a management fee of around 2% of assets under management (AUM) and a performance fee of 20% on profits, reflecting their active management and higher risk strategies. Mutual funds generally impose an expense ratio averaging 0.5% to 1.5%, which covers operational costs but lacks performance-based fees. The higher fees in hedge funds often correlate with exclusive investment opportunities and potential for outsized returns, whereas mutual funds cater to broader investor access with lower costs and regulatory oversight.

Regulatory Oversight and Transparency

Hedge funds face less regulatory oversight compared to mutual funds, allowing for greater investment flexibility but reduced transparency for investors. Mutual funds are subject to strict regulations by the Securities and Exchange Commission (SEC), ensuring regular disclosures and transparency in holdings and fees. This regulatory framework in mutual funds aims to protect retail investors by providing clearer insights into fund operations and risks.

Performance and Return Expectations

Hedge funds typically pursue higher performance and aggressive return expectations through alternative investment strategies, derivative use, and leverage compared to mutual funds, which generally focus on diversified portfolios with moderate risk and steady returns. Mutual funds aim for consistent growth by investing primarily in stocks and bonds, offering more predictable performance aligned with market indices. Performance volatility in hedge funds is higher, potentially yielding outsized returns but with increased risk, whereas mutual funds provide stability suitable for risk-averse investors.

Liquidity and Redemption Policies

Hedge funds typically impose strict liquidity constraints, including lock-up periods and limited redemption windows, to manage investments in less liquid assets. Mutual funds offer higher liquidity, allowing investors to redeem shares daily at the net asset value (NAV). Redemption policies in hedge funds are often structured to prevent sudden large withdrawals, contrasting with mutual funds' more flexible and frequent redemption options.

Suitability for Different Investor Types

Hedge funds typically suit high-net-worth individuals and institutional investors seeking aggressive growth and higher risk exposure through strategies such as leverage, short selling, and derivatives. Mutual funds appeal to retail investors and those prioritizing liquidity and diversification with regulated portfolios offering moderate risk and professional management. Understanding an investor's risk tolerance, investment horizon, and regulatory requirements is essential when choosing between hedge funds and mutual funds.

Hedge Fund vs Mutual Fund Infographic

difterm.com

difterm.com