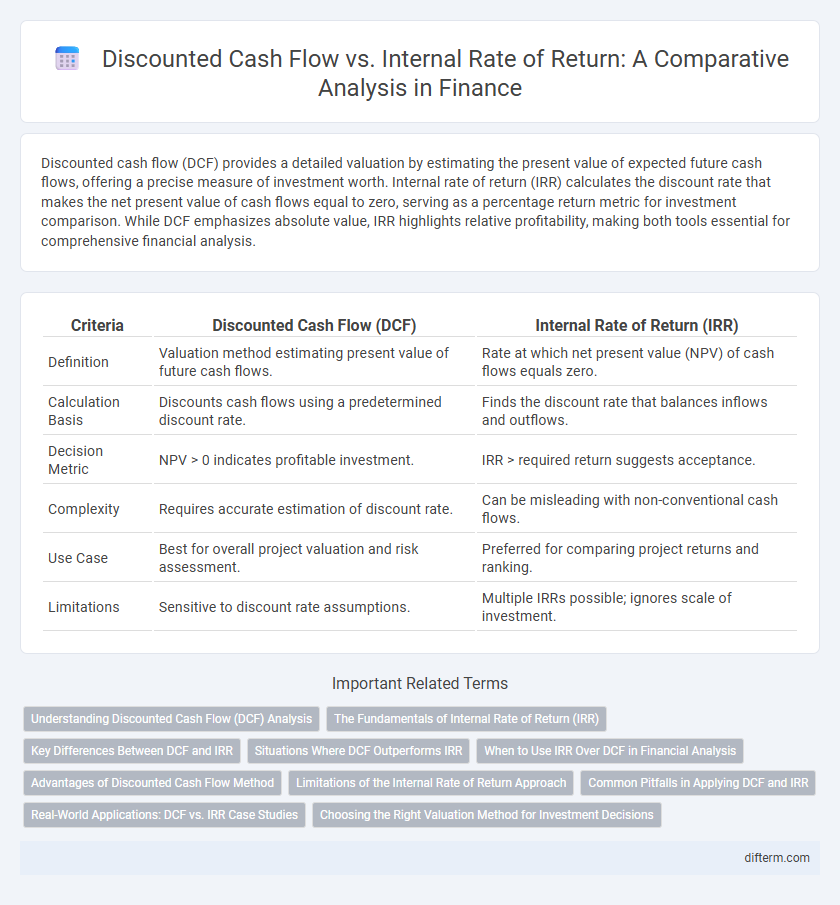

Discounted cash flow (DCF) provides a detailed valuation by estimating the present value of expected future cash flows, offering a precise measure of investment worth. Internal rate of return (IRR) calculates the discount rate that makes the net present value of cash flows equal to zero, serving as a percentage return metric for investment comparison. While DCF emphasizes absolute value, IRR highlights relative profitability, making both tools essential for comprehensive financial analysis.

Table of Comparison

| Criteria | Discounted Cash Flow (DCF) | Internal Rate of Return (IRR) |

|---|---|---|

| Definition | Valuation method estimating present value of future cash flows. | Rate at which net present value (NPV) of cash flows equals zero. |

| Calculation Basis | Discounts cash flows using a predetermined discount rate. | Finds the discount rate that balances inflows and outflows. |

| Decision Metric | NPV > 0 indicates profitable investment. | IRR > required return suggests acceptance. |

| Complexity | Requires accurate estimation of discount rate. | Can be misleading with non-conventional cash flows. |

| Use Case | Best for overall project valuation and risk assessment. | Preferred for comparing project returns and ranking. |

| Limitations | Sensitive to discount rate assumptions. | Multiple IRRs possible; ignores scale of investment. |

Understanding Discounted Cash Flow (DCF) Analysis

Discounted Cash Flow (DCF) analysis evaluates a project's value by forecasting free cash flows and discounting them to present value using a specific discount rate, typically the Weighted Average Cost of Capital (WACC). This method captures the time value of money and provides insight into the intrinsic worth beyond mere accounting profits. DCF is preferred for its ability to incorporate future growth expectations and varying cash flow patterns, making it essential for capital budgeting and investment decisions.

The Fundamentals of Internal Rate of Return (IRR)

The internal rate of return (IRR) is the discount rate that makes the net present value (NPV) of all cash flows from a project equal to zero, serving as a critical metric for evaluating investment profitability. It reflects the expected annualized rate of return, allowing investors to compare and prioritize projects based on their potential to generate positive returns. Understanding the fundamentals of IRR aids in assessing cash flow timing, risk, and capital cost, distinguishing it from discounted cash flow (DCF) analysis which focuses primarily on intrinsic project value.

Key Differences Between DCF and IRR

Discounted Cash Flow (DCF) evaluates a project's value by calculating the present value of expected future cash flows using a specific discount rate, highlighting the absolute value created. Internal Rate of Return (IRR) identifies the discount rate at which the net present value (NPV) of cash flows equals zero, emphasizing the project's profitability percentage. Unlike IRR, DCF provides a direct valuation metric, while IRR assumes reinvestment at the IRR itself, possibly leading to multiple or misleading rates for non-conventional cash flows.

Situations Where DCF Outperforms IRR

Discounted Cash Flow (DCF) outperforms Internal Rate of Return (IRR) in situations involving non-conventional cash flows or multiple sign changes, where IRR can produce multiple or misleading rates. DCF provides a clearer valuation by discounting all future cash flows with a consistent hurdle rate, reflecting the time value of money and risk more accurately. In long-term projects or investments with irregular cash flows, DCF's net present value approach offers superior decision-making insights compared to IRR.

When to Use IRR Over DCF in Financial Analysis

IRR is preferred over DCF when comparing multiple projects with different scales and timelines, as it provides a clear percentage return for easier evaluation. It is most useful for investment decisions where the cost of capital is uncertain or variable. IRR simplifies decision-making by indicating the efficiency and profitability of a project without requiring an explicit discount rate.

Advantages of Discounted Cash Flow Method

The discounted cash flow (DCF) method provides a comprehensive evaluation of a project's profitability by considering the present value of all future cash flows, enhancing accuracy in investment decisions. DCF incorporates the time value of money, allowing for a more realistic assessment of long-term financial viability compared to internal rate of return (IRR). This method is particularly advantageous in complex projects with variable cash flows or non-conventional patterns, where IRR can produce multiple or misleading results.

Limitations of the Internal Rate of Return Approach

The Internal Rate of Return (IRR) approach has limitations including its reliance on the assumption of reinvestment at the same IRR, which can be unrealistic in fluctuating market conditions. It may produce multiple IRRs for projects with non-conventional cash flows, complicating decision-making. Compared to Discounted Cash Flow (DCF), IRR lacks sensitivity to the scale and timing of cash flows, potentially leading to misleading investment evaluations.

Common Pitfalls in Applying DCF and IRR

Discounted cash flow (DCF) analysis often suffers from overly optimistic cash flow projections and the misuse of discount rates, leading to inaccurate valuations. Internal rate of return (IRR) calculations can be misleading due to multiple IRRs in non-conventional cash flows and the reinvestment rate assumption that may not hold. Both methods require careful scrutiny of input assumptions and scenario analysis to avoid common pitfalls in investment decision-making.

Real-World Applications: DCF vs. IRR Case Studies

Discounted Cash Flow (DCF) provides a detailed valuation by projecting future cash flows and discounting them to present value, widely used in capital budgeting and investment analysis. Internal Rate of Return (IRR) offers a percentage return metric, facilitating quick comparison between competing projects in corporate finance and private equity. Real-world case studies show that combining DCF's intrinsic value estimation with IRR's rate of return insights leads to more informed financial decisions and risk assessments.

Choosing the Right Valuation Method for Investment Decisions

Discounted Cash Flow (DCF) provides a precise valuation by estimating the present value of future cash flows using a specific discount rate, making it ideal for long-term investment decisions with stable cash flow projections. Internal Rate of Return (IRR) calculates the discount rate that sets the net present value to zero, offering a clear metric for comparing the profitability of multiple investments but can be misleading for projects with non-conventional cash flows or multiple IRRs. Choosing between DCF and IRR depends on project complexity, cash flow patterns, and the need for detailed cash flow analysis versus a straightforward profitability percentage.

Discounted cash flow vs internal rate of return Infographic

difterm.com

difterm.com