A callable bond allows the issuer to redeem the bond before maturity at a predetermined price, giving them flexibility to refinance if interest rates decline. In contrast, a puttable bond grants the bondholder the right to sell the bond back to the issuer at a set price before maturity, offering protection against rising interest rates or credit risk. Investors often prefer puttable bonds for added security, while issuers favor callable bonds for managing debt cost effectively.

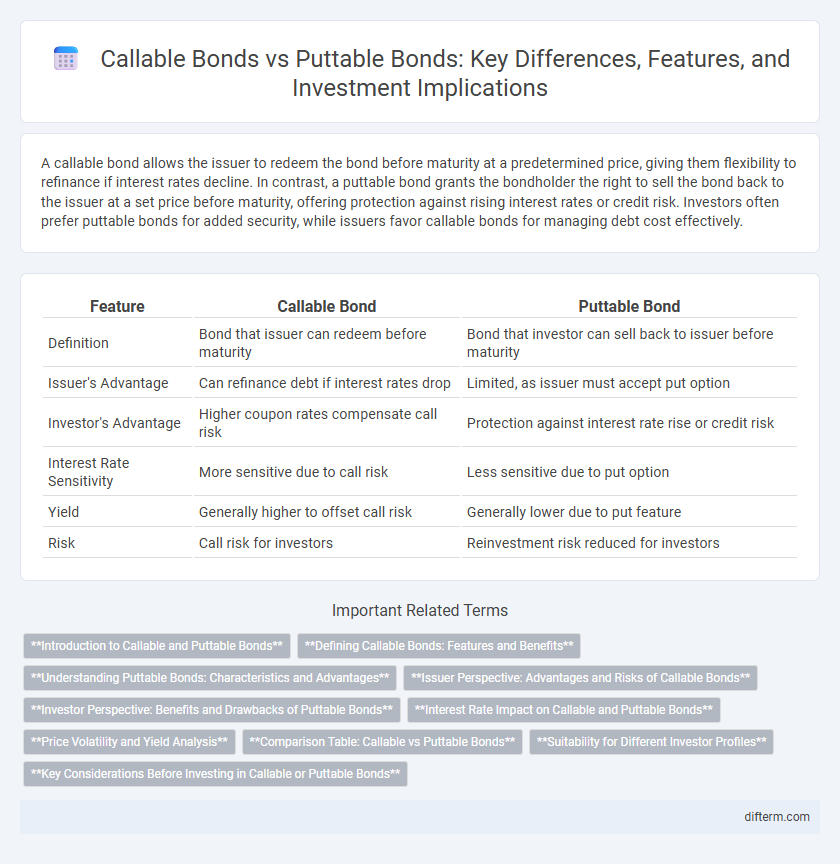

Table of Comparison

| Feature | Callable Bond | Puttable Bond |

|---|---|---|

| Definition | Bond that issuer can redeem before maturity | Bond that investor can sell back to issuer before maturity |

| Issuer's Advantage | Can refinance debt if interest rates drop | Limited, as issuer must accept put option |

| Investor's Advantage | Higher coupon rates compensate call risk | Protection against interest rate rise or credit risk |

| Interest Rate Sensitivity | More sensitive due to call risk | Less sensitive due to put option |

| Yield | Generally higher to offset call risk | Generally lower due to put feature |

| Risk | Call risk for investors | Reinvestment risk reduced for investors |

Introduction to Callable and Puttable Bonds

Callable bonds provide issuers the right to redeem the bond before maturity, typically to refinance debt when interest rates decline, offering flexibility but added risk for investors. Puttable bonds grant investors the option to sell the bond back to the issuer at specified dates, enhancing investor protection against rising interest rates or credit deterioration. Both instruments incorporate embedded options that significantly influence bond pricing, yield, and risk management strategies in fixed-income portfolios.

Defining Callable Bonds: Features and Benefits

Callable bonds are debt securities that allow the issuer to redeem the bond before its maturity date at a predetermined call price, providing flexibility to manage interest costs during declining rate environments. These bonds typically offer higher yields compared to non-callable bonds to compensate investors for the reinvestment risk associated with early redemption. Investors benefit from potential premium call prices and issuers gain from reduced interest expenses when refinancing at lower rates.

Understanding Puttable Bonds: Characteristics and Advantages

Puttable bonds grant investors the right to sell the bond back to the issuer at a predetermined price before maturity, offering protection against interest rate rises and market volatility. These bonds typically feature lower yields than non-puttable bonds due to the embedded investor option that reduces downside risk. The key advantages of puttable bonds include enhanced liquidity and risk management, making them attractive during uncertain economic conditions.

Issuer Perspective: Advantages and Risks of Callable Bonds

Callable bonds provide issuers with the advantage of refinancing debt at lower interest rates when market conditions improve, reducing overall borrowing costs. The issuer faces the risk of having to pay a premium to call the bond before maturity, which can increase financing expenses if interest rates do not decline as anticipated. This option enhances financial flexibility but may lead to investor demand for higher yields to compensate for call risk.

Investor Perspective: Benefits and Drawbacks of Puttable Bonds

Puttable bonds offer investors the valuable option to sell the bond back to the issuer before maturity, providing protection against interest rate increases and issuer credit deterioration. This feature enhances liquidity and reduces downside risk, making puttable bonds attractive in volatile markets. However, the embedded put option often results in lower yields compared to non-puttable or callable bonds, representing a trade-off between flexibility and income potential.

Interest Rate Impact on Callable and Puttable Bonds

Interest rate fluctuations directly affect callable and puttable bonds differently due to embedded options. Callable bonds typically decline in value when interest rates fall because issuers are more likely to call the bonds to refinance at lower rates, limiting price appreciation. Puttable bonds gain value when interest rates rise, as investors can sell the bond back to the issuer at par, reducing interest rate risk and enhancing price stability in volatile markets.

Price Volatility and Yield Analysis

Callable bonds generally exhibit higher price volatility due to the issuer's right to redeem the bond before maturity, which caps price appreciation when interest rates decline. Puttable bonds tend to have lower price volatility as investors can sell the bond back to the issuer, providing a floor on price declines when interest rates rise. Yield analysis shows callable bonds often offer higher yields to compensate for reinvestment risk, whereas puttable bonds typically have lower yields reflecting the added protection for investors.

Comparison Table: Callable vs Puttable Bonds

Callable bonds allow issuers to redeem the bond before maturity, enabling refinancing at lower interest rates, while puttable bonds grant investors the right to sell the bond back to the issuer before maturity, offering downside protection. Callable bonds generally carry higher yields due to call risk, whereas puttable bonds tend to have lower yields reflecting the embedded put option's value. Credit risk, interest rate risk, and optionality structure differ significantly, affecting pricing, investor strategy, and risk management in fixed-income portfolios.

Suitability for Different Investor Profiles

Callable bonds suit issuers aiming to refinance debt when interest rates drop, making them ideal for investors seeking higher yields but willing to accept call risk, typically more experienced or risk-tolerant investors. Puttable bonds cater to conservative investors prioritizing downside protection and flexibility, allowing bondholders to sell back before maturity, thus appealing to those with lower risk tolerance or approaching retirement. Suitability hinges on investor goals: growth and yield-seeking investors favor callable bonds, while risk-averse investors appreciate the safety features of puttable bonds.

Key Considerations Before Investing in Callable or Puttable Bonds

Investors must evaluate interest rate risk, as callable bonds expose holders to reinvestment risk if issuers call the bond when rates decline, while puttable bonds offer protection by allowing early sale back to the issuer during rising rates. Credit risk assessment is crucial since callable bonds may be issued by companies with moderate credit ratings seeking flexibility, whereas puttable bonds often provide investors with a safety net against default. Liquidity and yield differentials between callable and puttable bonds also impact investment decisions, with callable bonds typically offering higher yields to compensate for call risk and puttable bonds trading at premium prices due to embedded investor-friendly options.

Callable Bond vs Puttable Bond Infographic

difterm.com

difterm.com