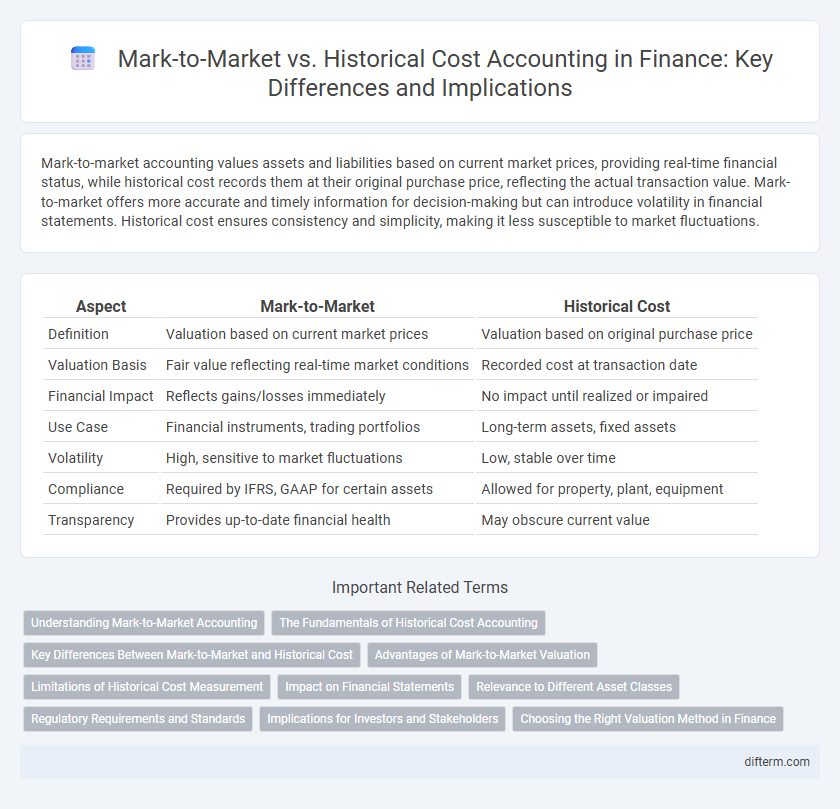

Mark-to-market accounting values assets and liabilities based on current market prices, providing real-time financial status, while historical cost records them at their original purchase price, reflecting the actual transaction value. Mark-to-market offers more accurate and timely information for decision-making but can introduce volatility in financial statements. Historical cost ensures consistency and simplicity, making it less susceptible to market fluctuations.

Table of Comparison

| Aspect | Mark-to-Market | Historical Cost |

|---|---|---|

| Definition | Valuation based on current market prices | Valuation based on original purchase price |

| Valuation Basis | Fair value reflecting real-time market conditions | Recorded cost at transaction date |

| Financial Impact | Reflects gains/losses immediately | No impact until realized or impaired |

| Use Case | Financial instruments, trading portfolios | Long-term assets, fixed assets |

| Volatility | High, sensitive to market fluctuations | Low, stable over time |

| Compliance | Required by IFRS, GAAP for certain assets | Allowed for property, plant, equipment |

| Transparency | Provides up-to-date financial health | May obscure current value |

Understanding Mark-to-Market Accounting

Mark-to-market accounting records assets and liabilities at their current market value, reflecting real-time financial conditions and providing a more accurate snapshot of a company's financial health. Unlike historical cost accounting, which values assets based on their original purchase price, mark-to-market adjusts values regularly to account for market fluctuations. This method enhances transparency and is crucial for financial institutions managing volatile assets like derivatives and securities.

The Fundamentals of Historical Cost Accounting

Historical cost accounting records assets and liabilities based on their original purchase price, providing a reliable and verifiable basis for financial reporting. This method emphasizes consistency and objectivity, minimizing the impact of market fluctuations on financial statements. It is fundamental for long-term valuation but may understate or overstate asset values during periods of significant market volatility.

Key Differences Between Mark-to-Market and Historical Cost

Mark-to-market accounting values assets and liabilities at current market prices, reflecting real-time financial conditions and providing more accurate and timely information for investors. Historical cost accounting records assets and liabilities based on their original purchase prices, offering simplicity and reliability but potentially misrepresenting current value due to market fluctuations. The key differences lie in valuation timing, relevance to decision-making, and impact on financial statement volatility and transparency.

Advantages of Mark-to-Market Valuation

Mark-to-market valuation provides real-time accuracy by reflecting current market prices, enabling more transparent and timely financial reporting. It enhances risk management by capturing market fluctuations promptly, allowing investors and companies to make informed decisions based on up-to-date asset values. This method reduces the risk of undervaluation or overvaluation associated with historical cost accounting, improving the relevance and reliability of financial statements.

Limitations of Historical Cost Measurement

Historical cost measurement often fails to reflect the current market value of assets, leading to distorted financial statements during periods of significant price volatility. It ignores inflation and changes in market conditions, which can result in understated asset values and delayed recognition of losses or gains. This limitation reduces the relevance and reliability of financial information for investors and decision-makers.

Impact on Financial Statements

Mark-to-market accounting reflects current market values on financial statements, providing real-time asset and liability valuations that increase transparency but introduce volatility in earnings. Historical cost accounting records assets and liabilities at their original purchase price, resulting in more stable financial statements but potentially less relevant information during market fluctuations. The choice between these methods significantly impacts reported profits, asset valuation, and investor decision-making processes.

Relevance to Different Asset Classes

Mark-to-market valuation provides real-time asset prices that enhance relevance for volatile securities like equities and derivatives by reflecting current market conditions. Historical cost remains more pertinent for fixed assets or bonds due to its stability and reduced sensitivity to short-term fluctuations. Different asset classes benefit from tailored accounting methods that align with their liquidity, volatility, and market transparency.

Regulatory Requirements and Standards

Mark-to-market accounting complies with regulatory frameworks such as IFRS 13 and US GAAP ASC 820, requiring assets and liabilities to be measured at fair value for accurate financial reporting and risk assessment. Historical cost accounting, governed by standards like IFRS IAS 16 and US GAAP ASC 360, records assets at original purchase price, emphasizing reliability and consistency in regulatory filings. Regulators prioritize mark-to-market for financial instruments due to its relevance in reflecting current market conditions, while historical cost remains prevalent for tangible fixed assets to ensure stability in balance sheets.

Implications for Investors and Stakeholders

Mark-to-market accounting provides real-time valuation of assets, enhancing transparency and allowing investors to assess current market risks more accurately, while historical cost accounting records assets at original purchase price, potentially obscuring true value during market fluctuations. Investors benefit from mark-to-market as it reflects current financial conditions, aiding in timely decision-making, whereas stakeholders relying on historical cost data may experience delayed recognition of asset depreciation or appreciation. Consequently, mark-to-market offers a more dynamic risk assessment, influencing investment strategies and stakeholder confidence in financial reporting.

Choosing the Right Valuation Method in Finance

Selecting the appropriate valuation method between mark-to-market and historical cost hinges on the financial instrument's liquidity and market volatility. Mark-to-market provides real-time asset valuation reflecting current market conditions, essential for trading portfolios and risk management. Historical cost remains suitable for long-term holdings where market prices are less relevant, ensuring stability and simplicity in financial reporting.

Mark-to-market vs Historical cost Infographic

difterm.com

difterm.com